fintech

fintech

Nextbank is a fintech company that has been driving innovation in Southeast Asian banking for over five years. Their modern cloud software, which includes mobile branchless banking, business intelligence dashboards, loan origination, and credit scoring, is used by more than 50 financial institutions worldwide. Miquido has been a strategic technology partner of Nextbank since its inception in 2019. Our teams have been responsible for providing all modules of comprehensive banking software, including the credit scoring engine.

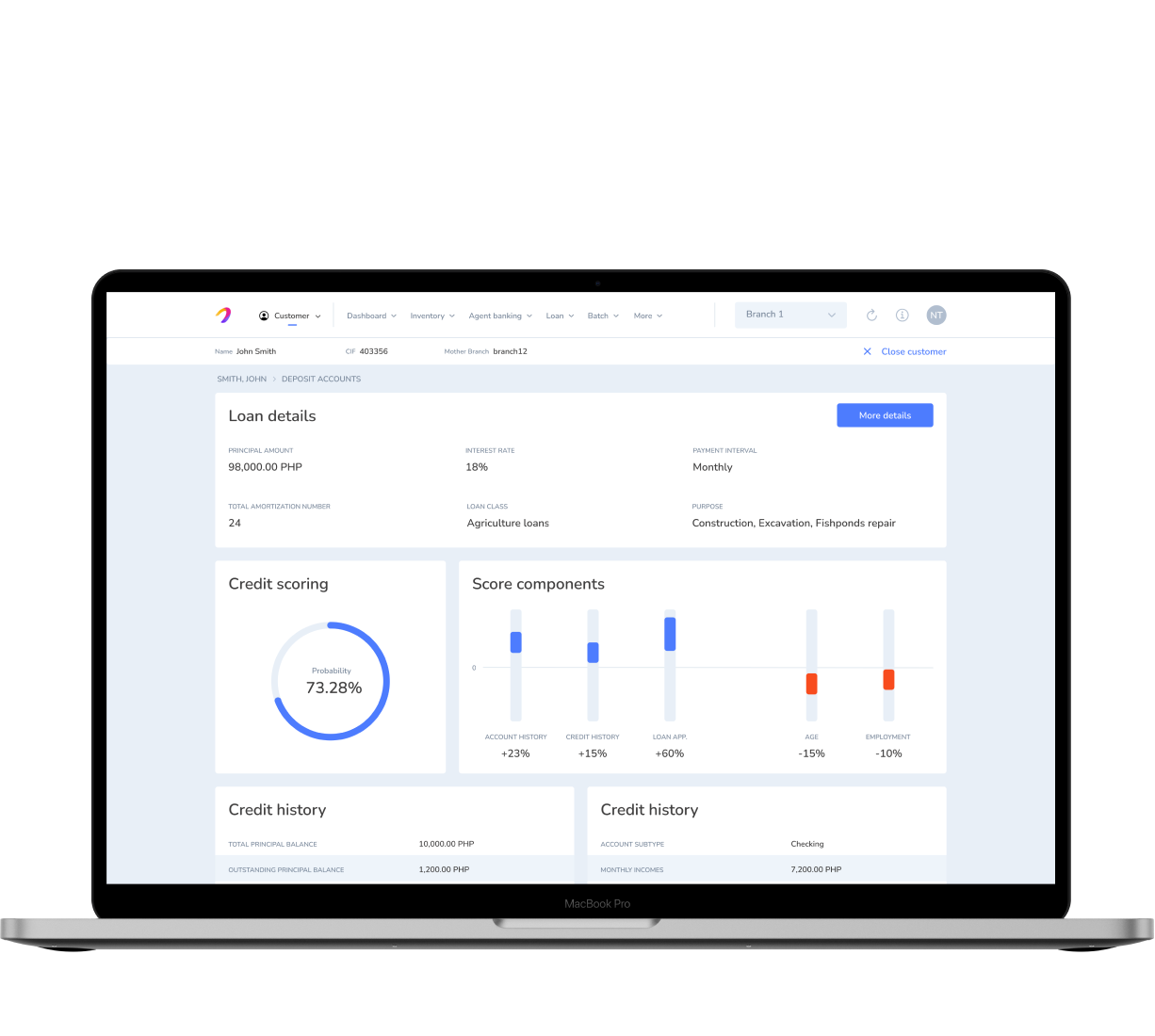

As part of our collaboration with Nextbank, we have delivered an AI-powered system that automates the assessment process for financial institutions. The main objective of this engine is to determine whether an individual is likely to repay a loan offered by a bank. The system uses artificial intelligence to analyse thousands of data points, providing an in-depth interpretation, and works proactively by searching for potential customers. The scoring engine uses AI and ML-based technology, which boasts an unprecedented 97% predictions’ accuracy – translating to the model’s capability to distinguish high-risk loans. To date, it was successfully deployed in 7 banks in Asia and has already processed 500 million loan applications.

97%

500 M+

2019

As part of its software-as-a-service offering, Nextbank needed a credit scoring module that could transform the market by addressing the limitations of the traditional loan granting process. Conventional financial institutions use scorecards, which are complex statistical models that analyse consumer payment default patterns to determine credit scores. Credit scores range from 300 (poor) to 900 (excellent), indicating an individual’s creditworthiness with three digits alone.

The founders of Nextbank recognised the limitations of traditional credit scorecards. These models use multiple factors and weights to determine a three-digit credit score without providing any explanation as to how it was calculated. This lack of transparency can result in errors while calculating the credit score, such as biases in lending practices, overemphasis on credit history, and an inability to consider individual circumstances that might have affected a person’s ability to repay a loan in the past. Therefore, developing a way to conduct more informed, comprehensive, and impartial analyses was necessary.

In traditional banking systems, there are groups of professionals who are responsible for maintaining scorecards manually per client type or product. However, conventional scorecards have limited predictive power as they operate within a restricted context. They do not consider the broader economic or market conditions that may affect an individual’s financial situation, and they are slow to adapt to changes in a borrower’s circumstances.

Manual modifications to scorecards are required for any changes in the economic situation, which makes them difficult to maintain. As a result, while these analyses can provide insights into the past, they may not always accurately predict future financial behaviour. This can lead to banks lending money to individuals who cannot repay it or denying loans without appropriate justification.

Traditional credit scoring systems are only triggered when a customer initiates the application process. This reactive approach limits their ability to proactively identify potential borrowers who may be reliable and creditworthy but have not considered applying for credit. Nextbank recognised that transforming the traditional credit scoring model into a more proactive solution could revolutionise the lending landscape. By identifying and suggesting potential clients, financial institutions could expand the pool of creditworthy individuals and create new revenue streams. A proactive system would also enable financial institutions to stay ahead of the competition by capitalising on a more comprehensive understanding of credit risk and potential profitability.

Miquido quickly recognised the potential of machine learning in credit scoring automation. The data science team collected historical data on clients’ demographics, transaction history, and credit history. Based on this data, they analyzed the characteristics that define the target population. The main challenge was to define how the bank could classify a loan as a failure. After analyzing the data and consulting with business representatives from Nextbank, the team agreed to define a failure as a loan installment that remained unpaid for 90 days after the deadline. Going forward, this was the definition that the model tried to predict.

Selecting the right tools was critical to developing an accurate and effective risk assessment model that enabled in-depth data analysis. Our data science team recommended using three machine learning models and frameworks: linear regression, lightGBM, and XGBoost. Initially, we used linear regression as a baseline to compare the results of more advanced models. Later, we switched to more complex gradient boosting models, including the lightGBM framework and XGBoost library, due to their ability to deliver higher precision.

Using linear regression allowed us to perform a detailed analysis, which helped us measure the impact of individual factors on the final score. This level of detail proved crucial in identifying and resolving problematic issues within the system, such as ambiguous loan application cases. However, lightGBM and XGBoost were essential tools for achieving high prediction accuracy and performance, which we closely monitored throughout the entire test.

Our team conducted further exploration of available data sources and refined the risk assessment model to achieve the best possible solution. Miquido utilised machine learning to improve credit scoring by incorporating more than 600 data points. This has enabled the new scoring engine to focus on credit history nuances, such as the number of active and closed loans, the cumulative amount associated with both categories and payment delays. To make the system more comprehensive, Miquido’s data science team also included demographic attributes, such as age, gender, civil status, and income type.

The project’s main objective was to streamline the manual and laborious scoring process, which previously required several teams dedicated to specific cases. By using machine learning, Miquido has ensured that Nextbank and its clients can process a large number of contextual details related to loan applications, including loan type, industry purpose, MOS (Margin of Safety) group, and loan amount, without requiring financial institution teams to be involved.

The credit scoring engine developed by Miquido has shown a remarkable ability to identify high-risk loans. To assess the performance of the models, our data science analysis team tracked key metrics commonly used in machine learning, including ROC (which measures the model’s ability to differentiate between paying and non-paying customers) and F1 Score (which provides a comprehensive assessment based on precision and recall metrics). Our solution delivered impressive results of 0.75 and 0.85 ROC and -0.69 and -0.71 F1 (for linear regression and LightGBM, respectively). In the tested sample, machine learning enabled us to predict 1,450 out of 1,500 loans accurately.

The solution developed by Nextbank is designed to minimise bias. The Miquido team trained the model on historical data regarding how certain individuals have repaid their loans instead of data on whether the bank granted the loan or not. This approach ensures that Nextbank does not perpetuate any existing prejudices that may have been present in the bank’s or its employees’ old procedures.

We have integrated 600 data points into our risk assessment engine. However, machine learning makes it possible to analyse hundreds of thousands of features. The solution delivered for Nextbank can be scaled based on the requirements of the bank or its clients, using secure algorithms to process internal or external sources. This automation speeds up risk assessment and eliminates repetitive tasks. Moreover, as the amount of data increases, the accuracy of ML-based predictions improves, allowing Nextbank clients to expand their datasets without compromising processing speed.

Deploying a credit scoring engine as an independent microservice on the cloud with a REST API provides Nextbank and its clients with a seamless integration solution. This architecture facilitates quick and efficient processing of credit applications, enabling instant calculation of loan repayment probability for each application. This high-speed implementation ensures a rapid and responsive system for evaluating credit risk.

One of the key benefits of this cloud-based credit scoring solution is its ability to automatically identify new potential borrowers. The system analyses incoming loan requests and juxtaposes it with user data, allowing financial institutions to proactively reach out to individuals who may be eligible for pre-approved loans. This not only streamlines the lending process but also enhances customer engagement by offering personalised and targeted financial products.