Cross-platform digital banking app development

Driving digital bank transformation

Introduction

Over 50 million mobile app users

Maya Bank has been a prominent player in the fintech space for years. By partnering with Miquido, they made a significant leap by transitioning into a fully-fledged digital bank. Leveraging cross-platform technology, we developed an agile, feature-rich digital banking application that empowers users with seamless financial management tools, cryptocurrency transactions, credit services, and more. This strategic collaboration allowed the client to launch a secure, scalable platform, achieving rapid market adoption and competitive advantage in the BFSI sector.

Our hybrid development approach ensured the smooth integration of new features with the client’s existing native infrastructure and third-party services. Creating a unified ecosystem accelerated time-to-market, enhanced user experience, and ensured compliance with strict financial regulations. The result? A comprehensive digital banking solution that sets a new benchmark for innovation and efficiency in the industry.

Industry

Duration

2 years

Tech stack

Frontend

React

Backend

Java, Kotlin

Mobile

Analytics & Monitoring

Google Firebase Crashlytics, Analytics

Tools

ZXing, Material Design, SkeletonView, Lottie

50M+

users worldwide

1M+

positive app store reviews

2 years

end-to-end development

Challenges

Tight timeline for a full-scale cross-platform digital bank launch

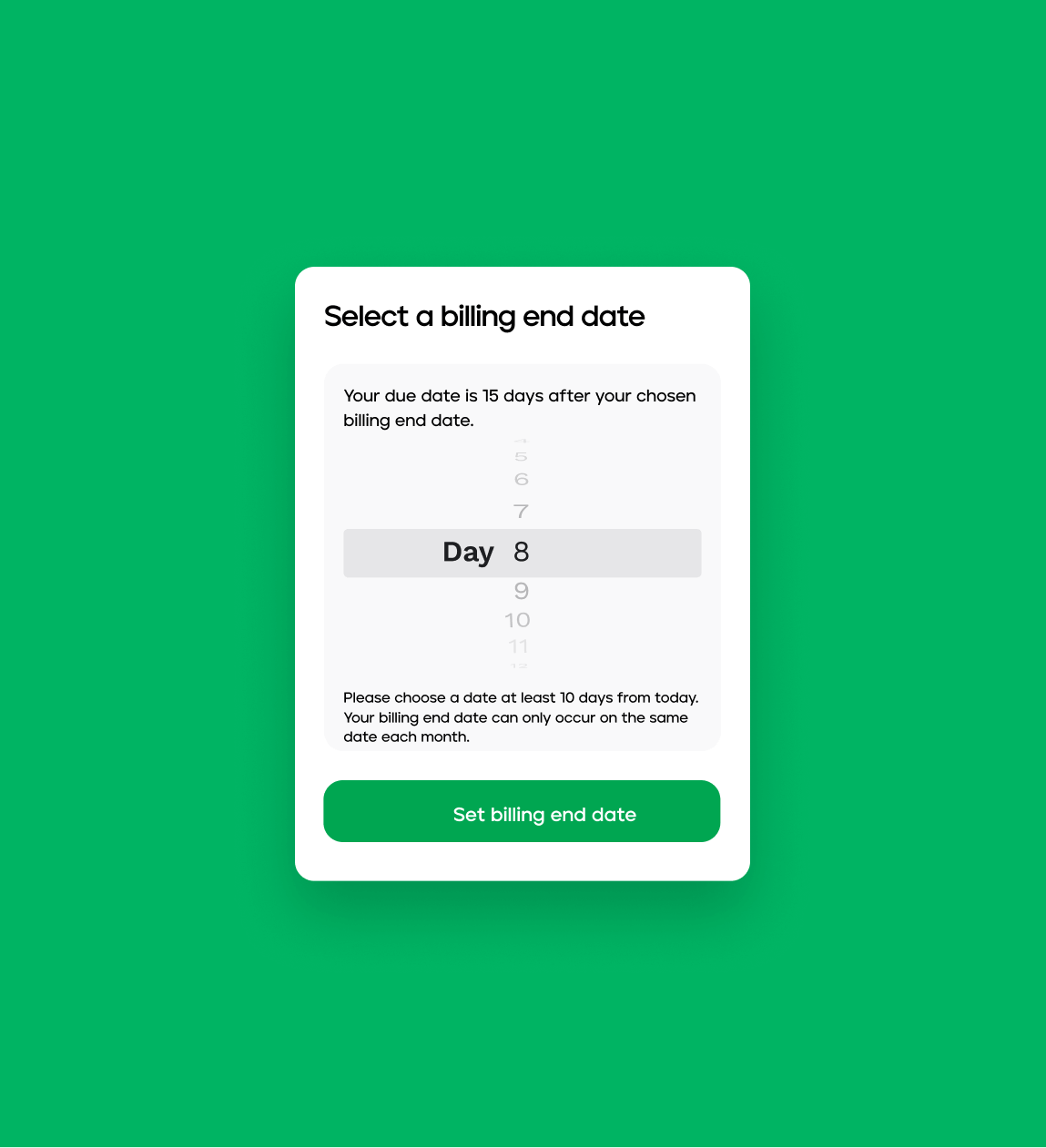

After obtaining a digital banking license, Maya Bank faced the ambitious task of launching a complete digital banking platform within three months. The challenge required rapid development, seamless integration with existing systems, and strict adherence to financial regulations. Time was of the essence, and our client’s success hinged on deploying a functional, compliant, and user-friendly solution within this compressed timeframe.

Scalability for millions of users

With a user base in the tens of millions, the digital bank needed an infrastructure capable of handling high volumes of concurrent transactions. This required a robust, scalable system ensuring fast, reliable performance without downtime. The solution also needed to cater to diverse user needs, from retail customers to businesses, while maintaining exceptional reliability and responsiveness.

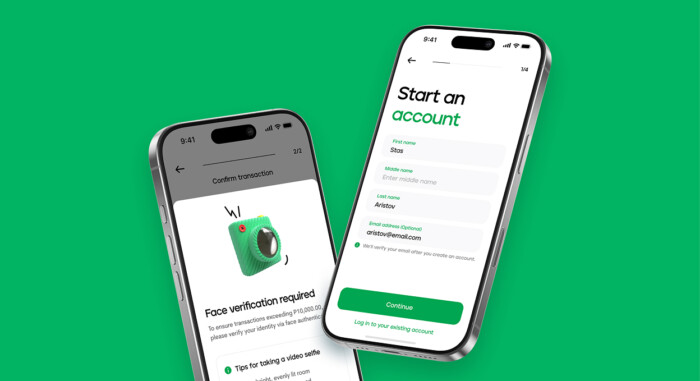

Delivering an innovative, native-like experience

In a competitive market dominated by traditional banks, Maya Bank’s app needed to offer a superior user experience. Security, speed, and innovative features were essential to attract and retain users while building trust in the platform’s ability to handle sensitive financial data. Achieving this required an agile development strategy to meet evolving user expectations and demands.

Solutions

Efficient cross-platform banking app development

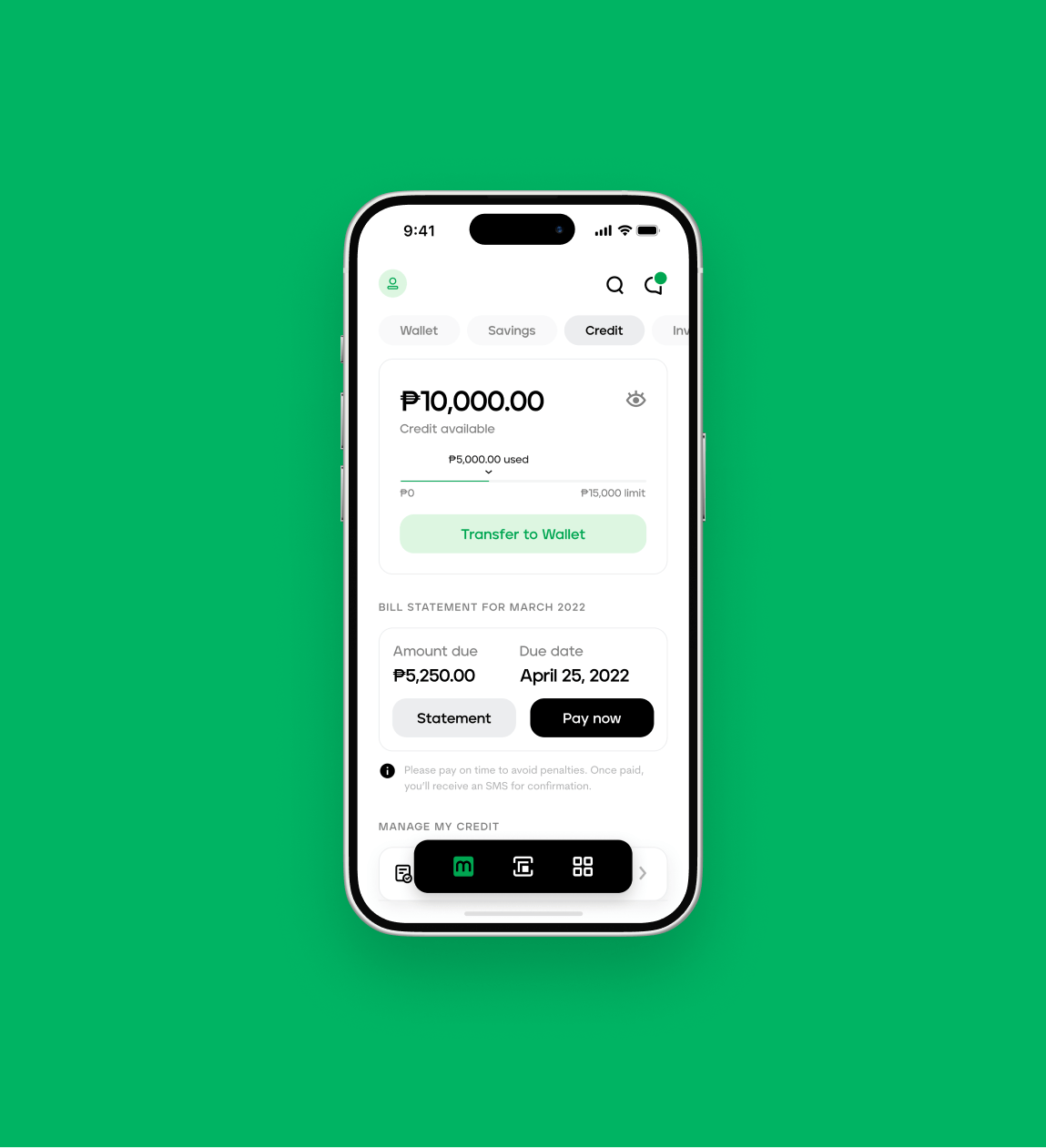

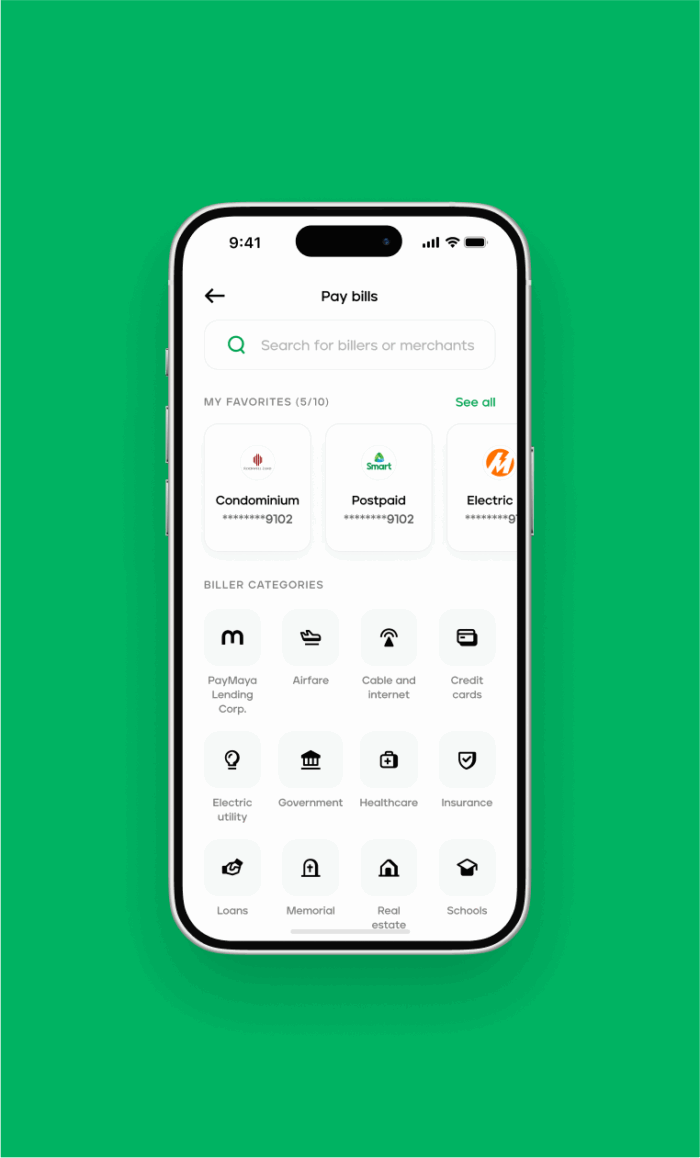

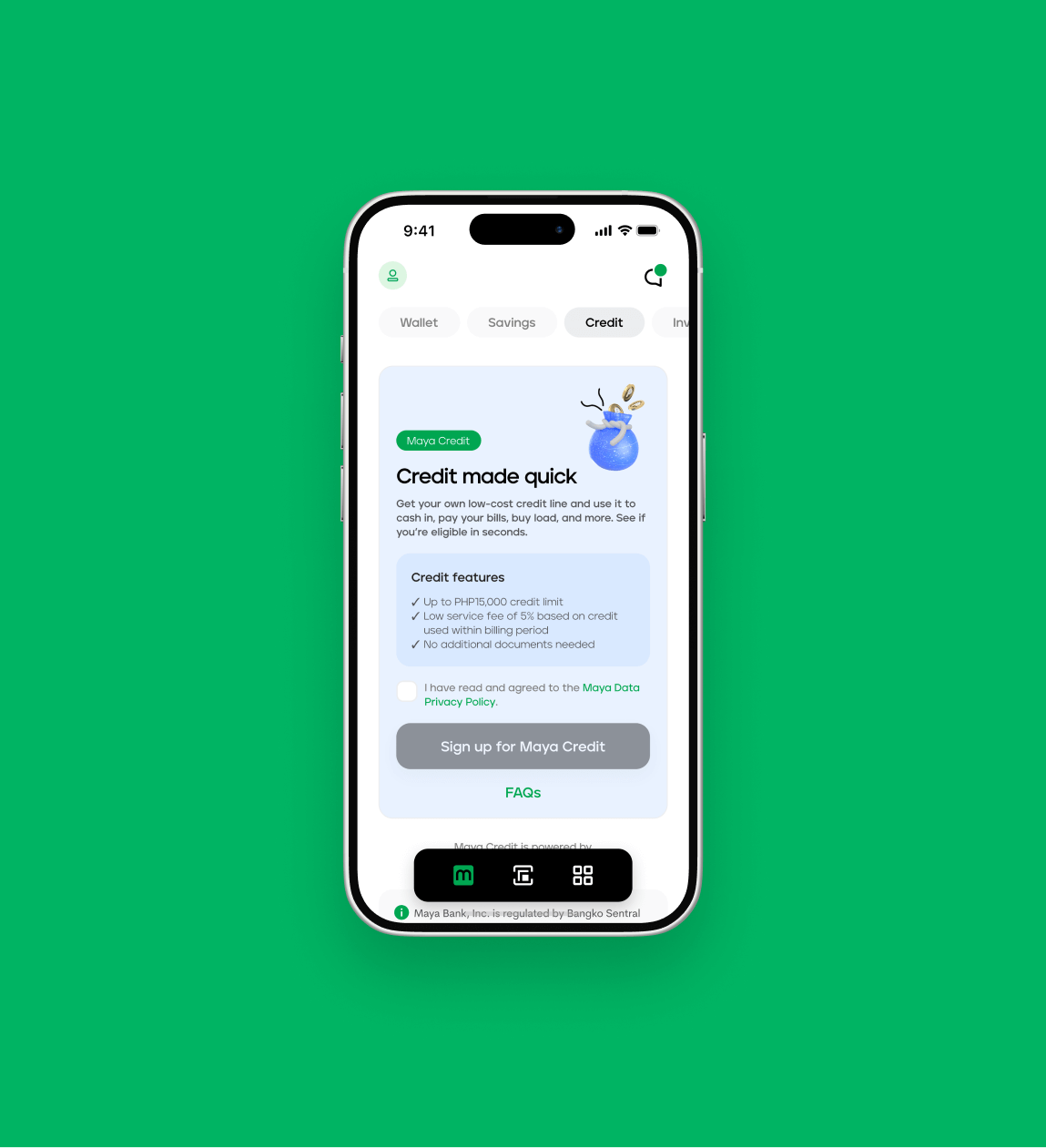

We adopted a modular, cross-platform approach to streamline development and accelerate delivery. By leveraging Flutter, we achieved up to 90% code reuse across iOS and Android, reducing engineering effort by 60%. This approach enabled rapid feature implementation and testing through tools like hot reload for instant code previews. Critical banking functionalities, such as cryptocurrency transactions, savings modules, and Buy Now Pay Later (BNPL) options, were developed and seamlessly integrated into the app’s architecture.

Backend excellence for seamless performance

To support millions of users, we built a robust backend using Node.js, designed to handle rapid transaction processing and ensure secure interactions with external services. The modular architecture enabled easy scaling and allowed for the swift rollout of updates and new features, ensuring uninterrupted operations.

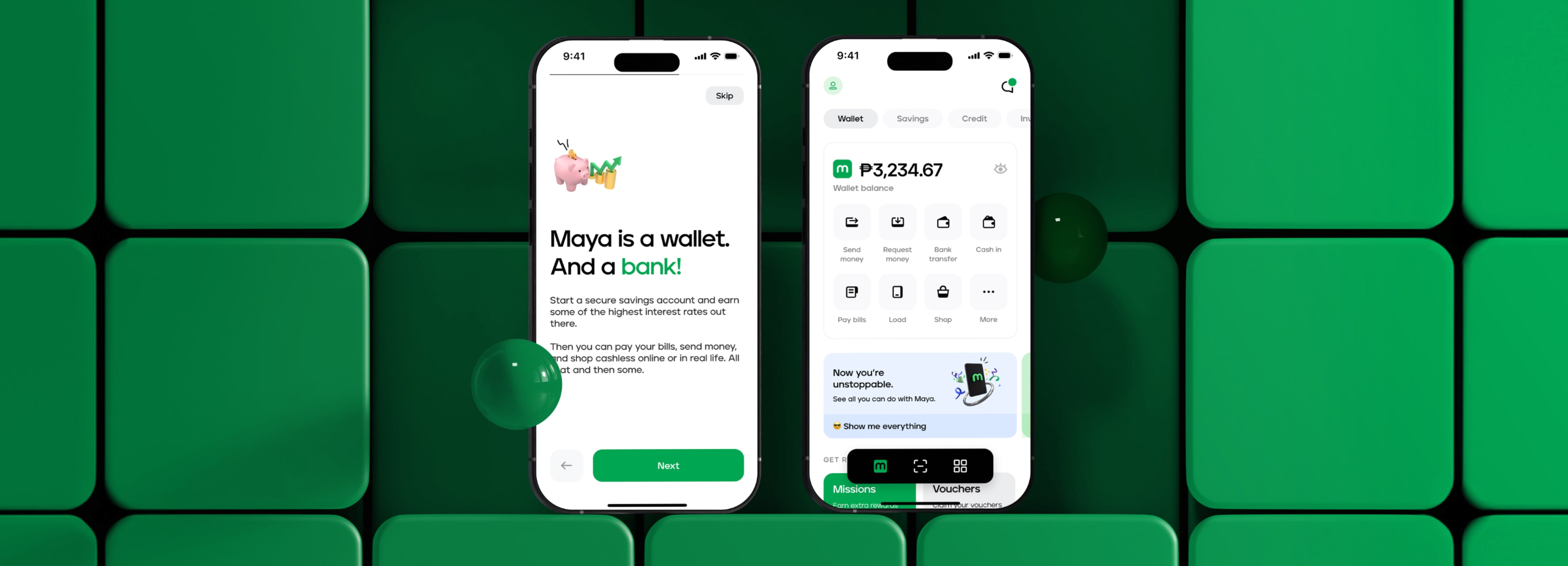

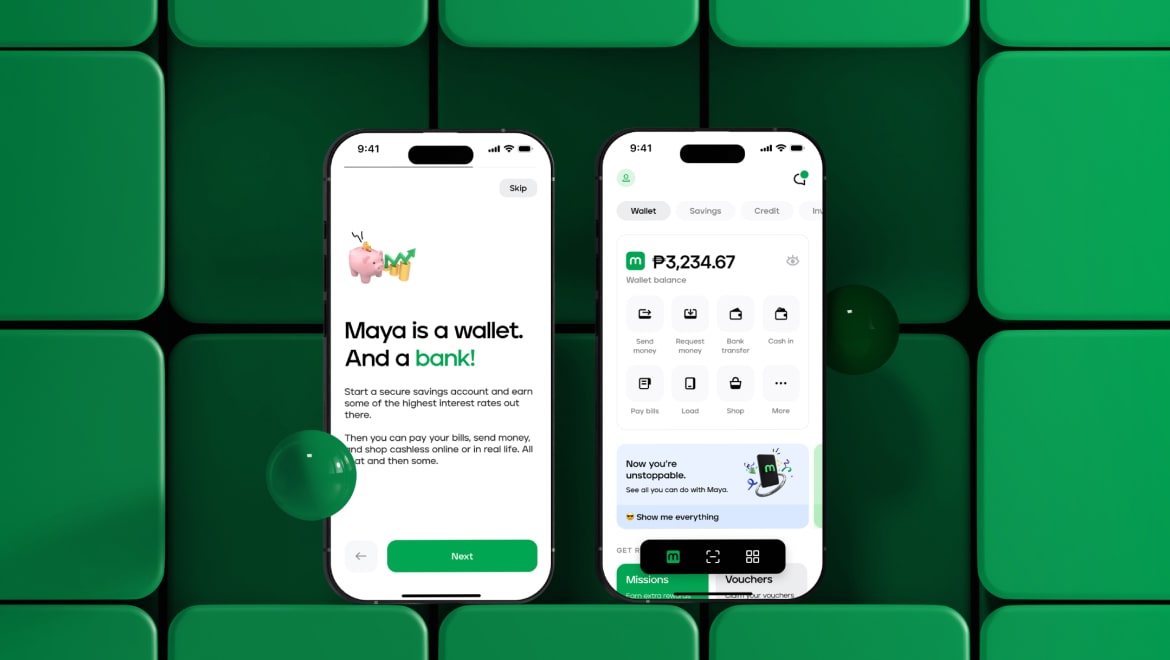

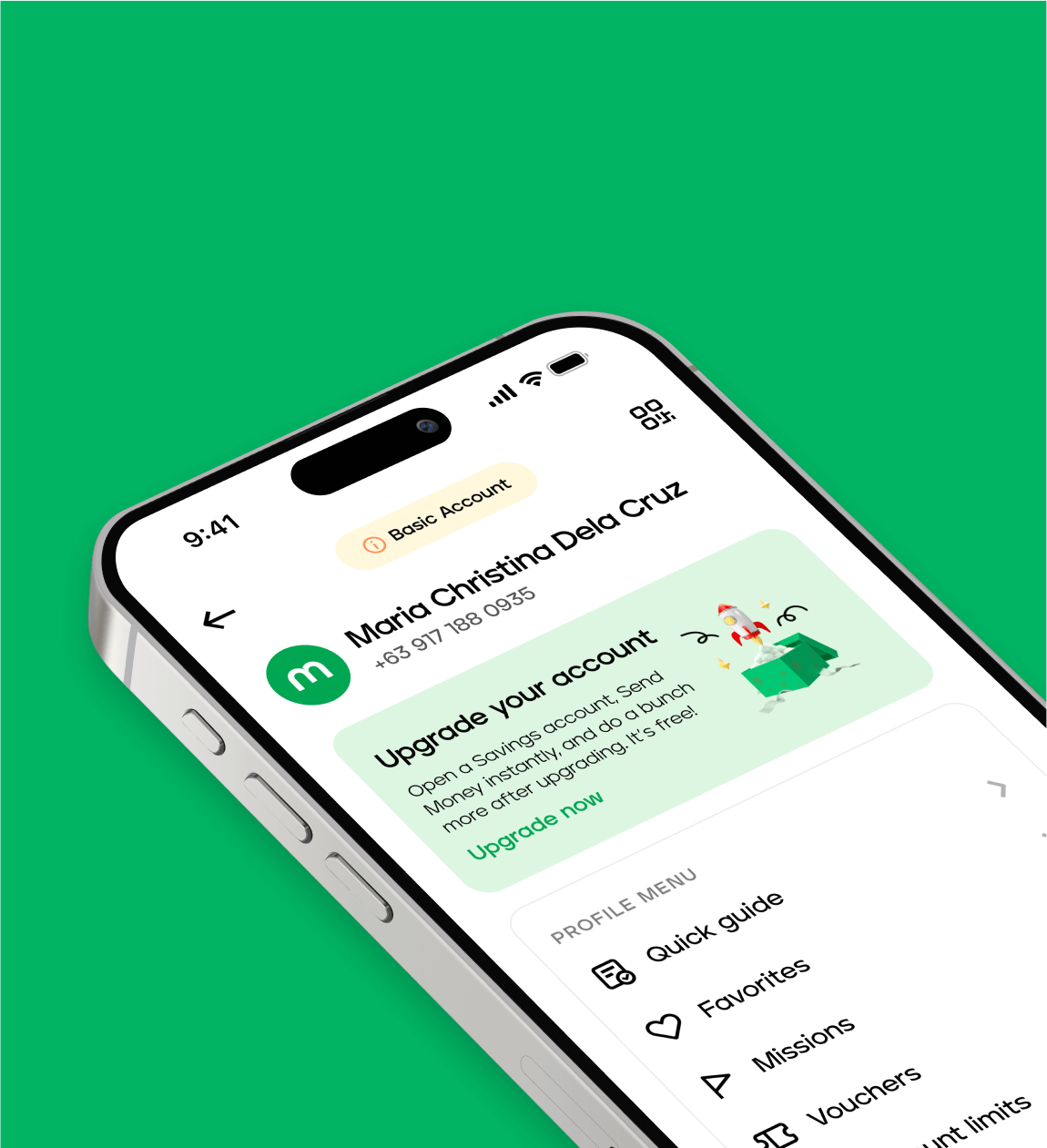

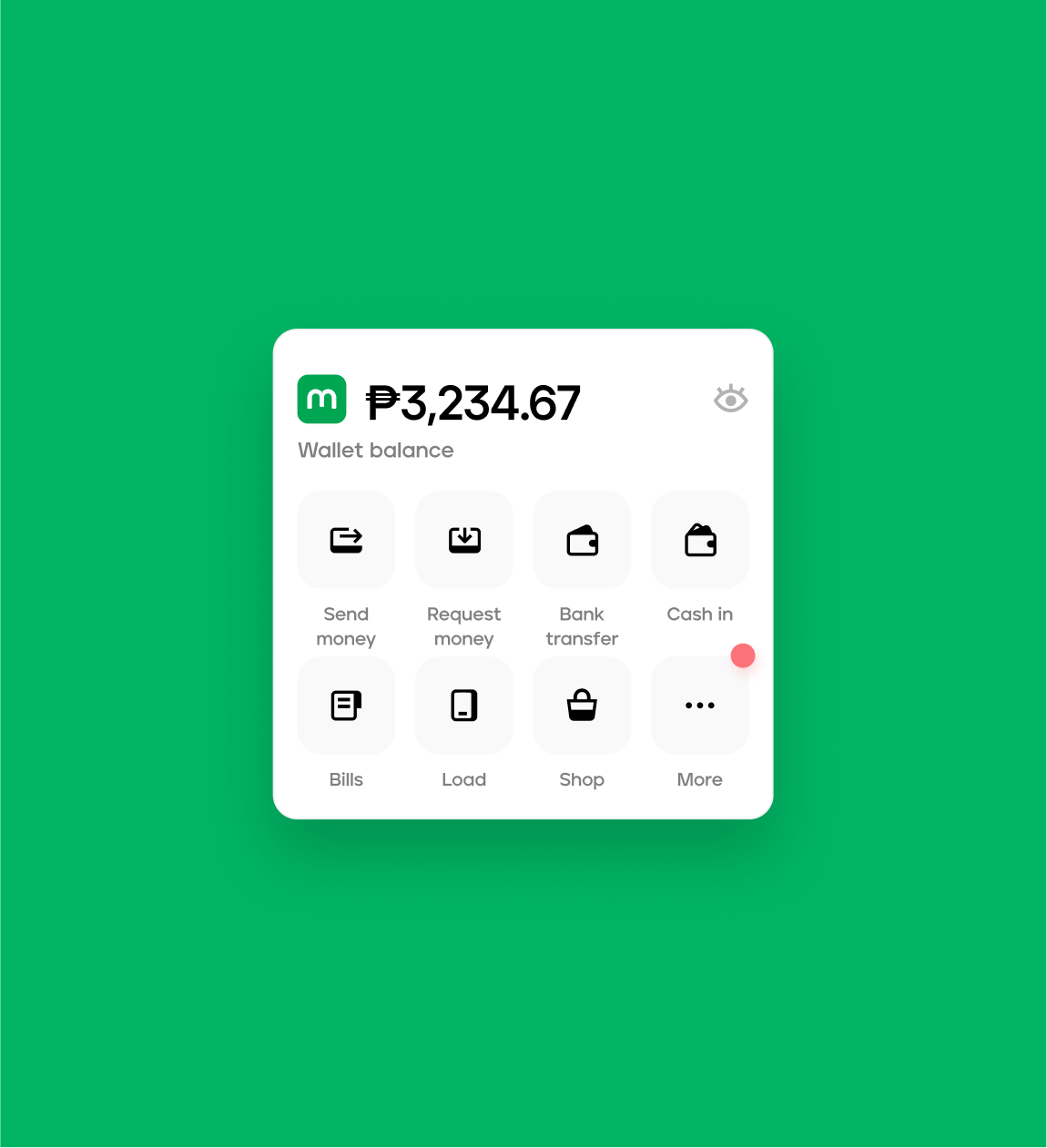

End-to-end development and UI redesign

Our team of 30+ experts managed every development stage, from mobile app creation to security audits and consulting. A key milestone was revamping the app’s UI to align with the brand’s vision, ensuring a seamless transition for existing users. The redesigned interface combined intuitiveness with the client’s new identity as a digital banking leader.

Results

Successful on-time digital bank launch

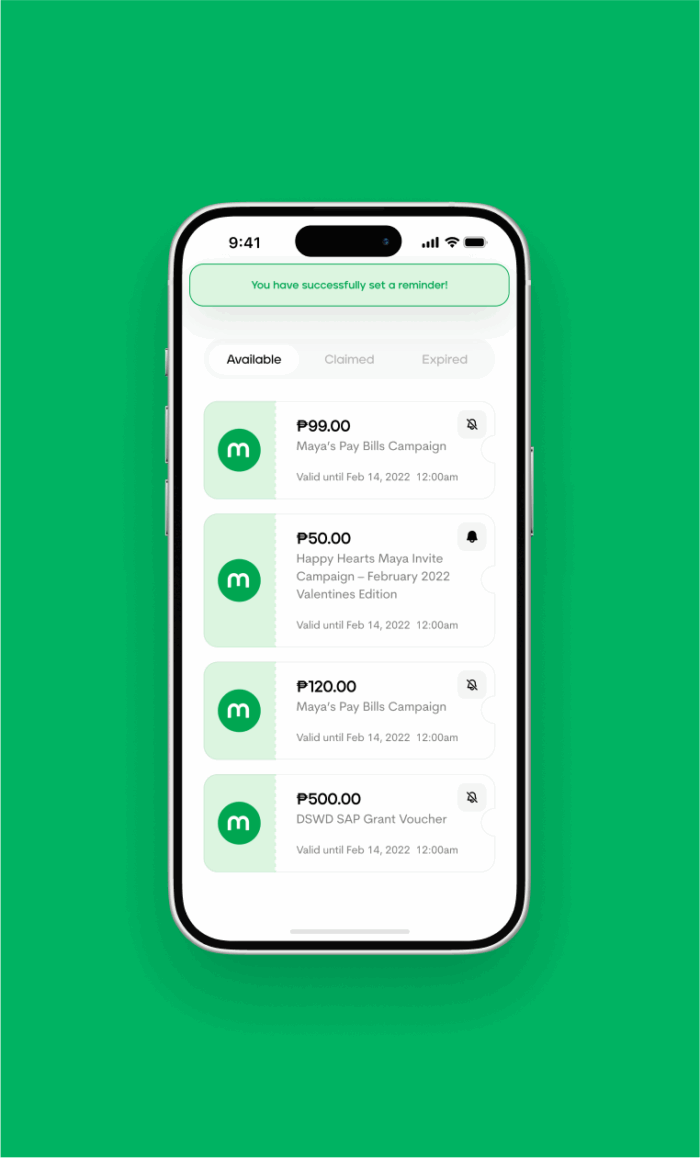

We delivered a full-featured digital bank in just two months—a month ahead of schedule—with all features fully functional, secure, and compliant. Over seven months, we completed eight major development projects, including Credit, Savings, and BNPL modules. This collaborative effort ensured a smooth transition and successful market entry for digital Maya Bank.

Scalable platform for millions

Today, the app serves over 50 million users and accounts for more than half the adult population in its primary market. It features versatile e-wallets, peer-to-peer transfers, cashless payments, and secure savings solutions. With nearly 1 million positive reviews, the app’s success cements our client’s position as a market leader in digital banking.

Available for projects

Want to talk about your project?

Partner with us for a digital journey that transforms your business ideas into successful, cutting-edge solutions.