Custom insurance software development services

Increase the efficiency of your financial processes or create a brand new insurtech software

Let’s work together

Professional insurance software development company

With over a decade of experience in the financial industry, insurance software development holds no mysteries for us. We specialise in creating fast, scalable and well-designed applications that ensure an excellent user experience. Ready to give your insurance company an edge over the competition?

Why opt for our insurtech solutions?

See what your business can gain by choosing Miquido’s custom insurance software development services.

Digital transformation

By integrating digital technology into your insurance company, you can improve your internal processes, attract new customers to your services, as well as personalise their experience. Digital solutions, like cloud technology for example, can give your business the boost it needs by enhancing security and accessibility of your products, while also helping to reduce costs.

Modern business strategy

Our skilled consultants will go through your business goals, needs and expectations to help you fit the business strategy to your project, as well as choose the right technology stack for it. As an experienced insurtech development agency, we can also advise you on the best possible ways of adapting to the industry’s dynamically changing environment.

Automating processes

Automating your business processes can not only optimise how your company operates, but also increase the productivity of your employees. Automation helps to reduce the time needed to complete arduous tasks and gives you and your employees the ability to focus on what’s really important. We’ll also be happy to show you how AI solutions can help to improve your business in that regard.

Personalised products

Personalisation is the key to keeping your users satisfied. With the aid of machine learning solutions, we can create powerful in-app recommendation systems, so that each and every one of your clients receives an offer suited to their particular needs. Create customised products, learn what your customers like, and watch your conversion rates grow!

Omnichannel distribution

By using multiple channels to distribute your insurance products, you can increase your selling radius and improve your company’s positioning on the market. Need to integrate your solutions to increase the efficiency and profits? Leave it to our experienced insurance app development team and watch your business grow thanks to a compatible omnichannel distribution system.

How long will you wait?

Need your idea verified fast?

Feature set for insurance applications

See what we have to offer

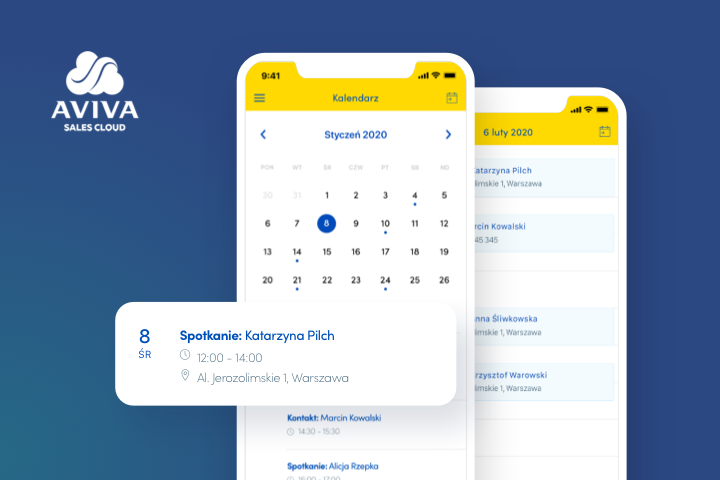

Business management platforms

We fully understand the complexity of managing an insurance company, and that’s why we excel in creating powerful tools for day-to-day operations. Save time and increase your business efficiency with HR, CRM, and ERP platforms equipped with intuitive interfaces.

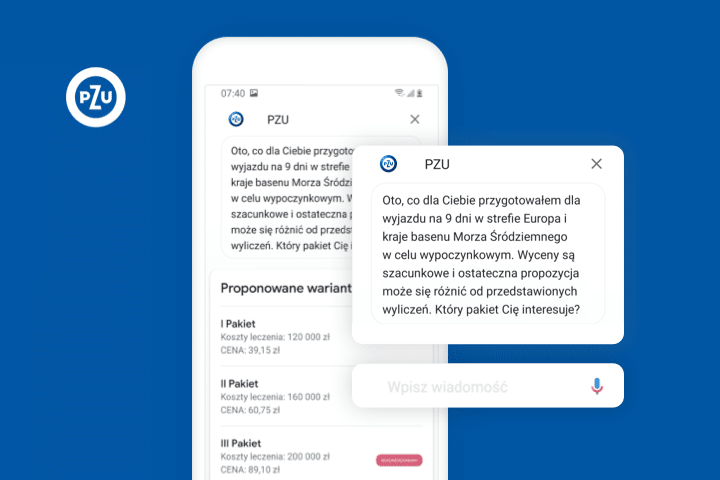

Chatbot design & development

Keep your clients satisfied and save your employees valuable time with the use of chatbots. Automate your business processes with the help of virtual assistants, and explore how you can enhance customer experience and speed up the sales process on your platform.

Analytic and predictive tools

The proper use of data and analytics can help you improve the scalability of your products, simplify the decision-making process, and help you better understand your overall business needs. Get data-driven business insights with the help of our Data Science, AI, and Big Data solutions.

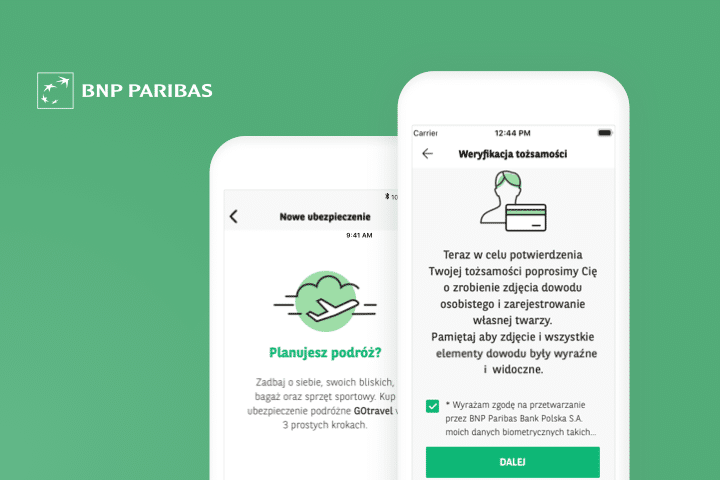

Customer relationship management

Addressing customer claims is an essential process when it comes to insurance companies, where time is crucial for both parties. Deal with issues efficiently and quickly with excellent, tailor-made claims management software created to ensure customer satisfaction.

Financial software

With years of experience in the industry, we’re aware of the need for top-level security and impeccable performance for financial software. Our custom fintech applications mix cutting-edge technology with thorough, data-driven research in order to give you a seamless product.

Sound promising? Reach out to us!

Let’s work togetherdevelopment

delivered

conducted remotely

Browse through our services

Ideation & Strategy

Find a new approach to your business or test product ideas

Discover new opportunities and polish your business strategy thanks to our Ideation and Strategy services

Product Design

Get a customised product design for your apps

Make certain that your product stays in tune with your brand image thanks to our Product Design services

Web app

Stay ahead of the game with tailor-made web apps.

Build cutting-edge web apps with our end-to-end web development services

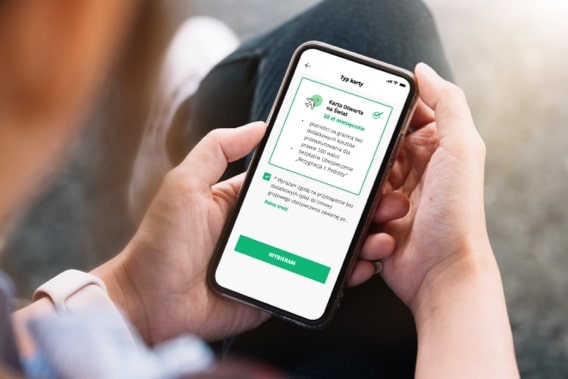

Mobile app

Hit the top of app store lists with your app delivered by experts in mobile.

Leave your mobile app development in the hands of Google-certified professionals rewarded for their expertise in building native and cross-platform apps

Artificial Intelligence

Use Artificial Intelligence for better analysis

Take advantage of Artificial Intelligence: optimise your business processes and make the most of relevant data

Custom insurance software solutions

Want to know more about insurance software development services?

Curious for more details about custom insurance solutions? Check our FAQ section, and if you still can’t find the right answers – don’t hesitate to contact us!

What features should insurance software have?

With insurance being one of the most complex of industries, there’s a need for secure and intuitive solutions. However, functional software for insurance agencies also supports the following:

- Sales

- Policy management

- Claims Processing

- Customer Management

- Billings

- Payments

- Marketing

- Reports and Analytics

- Risk management

When we talk about insurance software, we’re talking about a multifaceted tool that empowers insurance agencies to deliver top-notch service and succeed in a highly competitive industry.

Which technologies are used in Insurtech apps?

The insurance industry is increasingly using technology in its applications to streamline processes, increase efficiency and reduce costs. The most commonly used technologies in insurance applications are:

- Predictive Analytics: Insurtech relies on predictive analytics to anticipate future trends and risks by analyzing large amounts of past data.

- Machine Learning: Insurtech uses machine learning to continuously improve its functions by learning from data patterns. By studying customer behaviors and market dynamics, algorithms can recommend tailor-made policies, ensuring that policyholders have the coverage they need.

- Digital Documentation: Insurtech apps digitize and store documents, making them easily accessible.

- Automated Processing: Insurtech apps automate various insurance processes to make them more efficient.

- Drones: In some cases, insurtech apps use drones for damage assessment. It’s similar to having a camera on a remote-controlled plane to view hard-to-reach areas better, helping insurers assess claims accurately.

These technologies simplify complex insurance operations, making the industry more efficient and customer-friendly.

How to choose the right insurance software?

All insurance companies have their individual expectations and requirements. With the help of our consultants, developers and designers, you can analyse your business needs and pick the software solution best-suited for your company.

Contact us and see what’s best for your specific case.