Growth slowing down, dropping rates – times are changing in the banking industry, bringing new challenges. The biggest challenge: maintaining profitability while adapting to newer generations with different needs and expectations for banking services.

Offering value-added services in banking can become the best shield against these changes, providing financial institutions with a smooth landing in this new landscape. What specific solutions are worth implementing?

In our article, we explore various innovative solutions, their potential, and how to maximize their value. Find out what customer expectations are.

Use value-added services to attract new customers, reduce account-to-account churn, and retain your existing base.

What are value-added services in banking?

Value-added services (VAS) in banking are supplementary offerings that enhance the customer experience beyond traditional banking products. Such services not only improve customer satisfaction but also contribute to banks’ revenue streams.

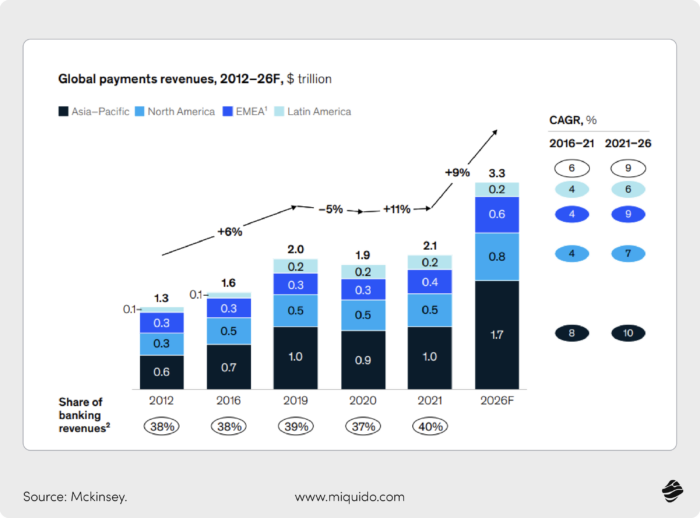

Banking value-added services in numbers

- Consumer Preferences for VAS: A survey by Wildfire Systems in October 2024 revealed that consumers prioritize services that help them save money. Cashback rewards and coupons were rated as more useful than features like in-app offers or Buy Now Pay Later plans.

- Revenue Growth from VAS: Mastercard reported a 19% year-over-year growth in its value-added services and solutions segment, reaching $2.6 billion in Q2 2024.

- Digital Payment Adoption: In the Central and Eastern Europe, Middle East, and Africa (CEMEA) region, digital payments have experienced over 32% year-on-year growth over the past four years.

- Consumer Banking Methods: A 2023 survey by the American Bankers Association found that 48% of bank customers use mobile apps for banking, indicating a significant shift towards digital channels where VAS can be effectively integrated.

Value-added services in banking examples

Digital banking solutions

Applications in banking are a necessity, and advanced features are the simple path to winning customers’ hearts—especially for neobanks that younger target groups trust.

Most modern banks, apart from classic transaction functions, now offer a wide range of services accessible via their apps. This mobile availability is key—more than ever, the ability to complete tasks quickly and from the comfort of home, even when they require document verification, is crucial.

To illustrate it with a real-life example, let’s take a look at the services ING offers through its app. Beyond the payments section, where customers can find options such as payment requests, currency exchange, or bill splitting, there’s also access to areas like:

- Promotions, discounts, and offers

- Financial management

- Transport

- E-government and document services

Not every country enables such a range of services, often due to limitations in integrating with government systems. However, more countries, like the UK and Indonesia, are moving toward implementing single-sign-on digital ID systems, which allow banks to include e-government services in their apps. Once these become standard, a well-thought-out interface and intuitive user journey are critical.

Bill splitting, automated investments, saving spare change during purchases, submitting declarations, and even purchasing public transportation tickets—today, users expect to perform these actions and much more.

A golden tip? Don’t overdo it. Actively monitoring whether and how users engage with specific features is the key to success.

AI Advisors

Imagine needing expert financial advice, but every visit to an advisor’s office feels time-consuming and costly. AI-powered advisors in banking apps solve this problem by providing instant, personalized recommendations on budgeting, saving, or investing based on advanced analytics and machine learning.

For example, banks like JPMorgan Chase and BBVA offer AI-driven financial advice directly through their apps, helping customers meet their evolving needs with ease.

Cryptocurrency and stock trading

A part of your customers may be seriously interested in crypto investing but feels overwhelmed by complex platforms and lack of guidance. It is a perfect opportunity to step in with the value-added service that the majority of banks has not embraced yet.

With integrated cryptocurrency and stock trading features, banking apps simplify investing, offering a seamless, beginner-friendly experience alongside tools for advanced traders. The users can trust you and your selected partnerships instead of having to do a timely research on their own to avoid fraudulent trades.

Revolut is a great example of a banking app driving growth by empowering users with accessible trading options. Its users can trade Bitcoin, Ethereum, and other popular cryptocurrencies with their everyday banking app instead of using multiple channels.

As Revolut declares, all the tokens pass stringent tests before being listed. Minimum risk, maximum gain!

Saving vaults

Savings accounts are as old as the world itself, but saving in a challenging economic landscape requires more radical measures.

Customers want to start saving, but juggling multiple accounts and expenses makes it difficult to stay organized and takes away visibility.

Saving vaults in banking apps bring you one step forward towards your financial goals than the typical saving features. They allow you to set aside money for specific goals automatically, such as vacations or emergency funds, while also enabling features like round-ups on purchases to effortlessly grow savings.

ING and Monzo are leaders in this area, combining advanced analytics with personalized offers to help users achieve their financial goals.

Disposable virtual cards

Your customers worry about fraudulent transactions more often than they admit. Disposable virtual cards in mobile banking apps eliminate this fear. By generating a new card number for each transaction, they can easily enhance security during e-commerce activities.

Although not a new solution, they would usually require installing a dedicated app. Now, neobanks and modern financial institutions tend to integrate it to their apps.

Revolut and Citi offer this added service, giving users peace of mind while shopping online and driving loyalty through innovative security measures.

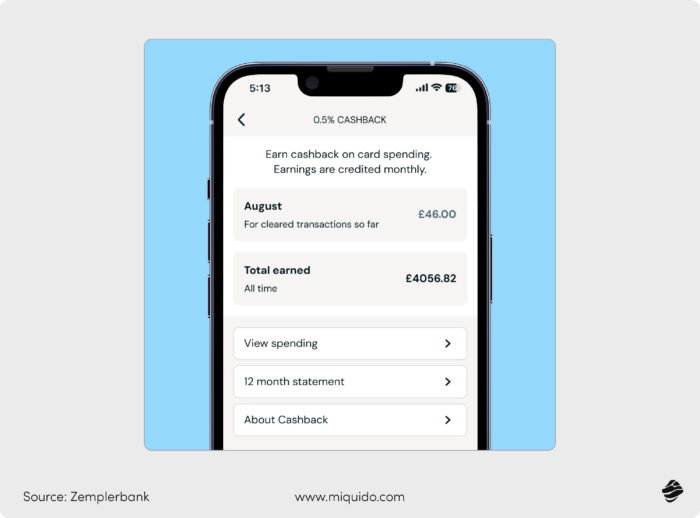

Loyalty programs

How can you turn everyday transactions into opportunities to boost customer loyalty and engagement? Loyalty programs are one of the most effective added services to meet evolving demands while increasing user retention.

By offering cashback, reward points, or exclusive discounts, banks can seamlessly enhance the customer experience and build a stronger connection.

Citibank’s rewards program, for instance, has successfully combined partnerships with retailers to deliver additional benefits. By introducing such new services tailored to your users, you can attract new customers while maintaining the trust of your existing ones.

Financial planning and advisory services

In today’s market, customers want more than a basic bank account—they want a financial partner that understands their unique needs. By integrating advisory features, such as budgeting and investment tools, you can provide added services that build long-term relationships.

Ally Bank, for example, empowers users with tools to set savings goals and monitor progress. Offering such additional services can not only drive customer loyalty but also position your app as an essential part of their financial life, increasing usage and lifetime value.

Bespoke private banking and wealth management tools

How can banks maximize their appeal to high-net-worth individuals? With added services like tax advisory, personalized investment strategies, and tailored financial planning tools, you can address this premium market’s evolving demands.

UBS and HSBC have set benchmarks with their dedicated private banking platforms, offering a superior merchant experience and exclusive additional benefits. By integrating similar new services into your app, you can increase profitability while building enduring client relationships.

Insurance products and extended guarantees

An increasing number of customers is looking for a bank that provides peace of mind alongside financial services.

Bundling additional benefits, such as travel, health, or life insurance, with a bank account adds immense value for users while driving revenue. Extended warranties for electronics purchased with bank cards also enhance customer loyalty by increasing the perceived worth of your offerings.

Barclays exemplifies this with its insurance add-ons, which improve user satisfaction and retention. By offering similar added services, you not only meet evolving demands but also attract new customers seeking convenience and security.

Specialized SME support services

What do small businesses really need from their banking partner? Flexible financing, tools to streamline operations, and tailored support. By introducing added services like customizable loans, invoicing systems, and tax automation, you can address the specific needs of SMEs and improve their merchant experience.

For example, Santander’s SME-focused tools provide additional benefits that make managing finances easier, creating value beyond traditional offerings. Offering new services like these allows you to win new customers in the SME segment and foster customer loyalty through meaningful support.

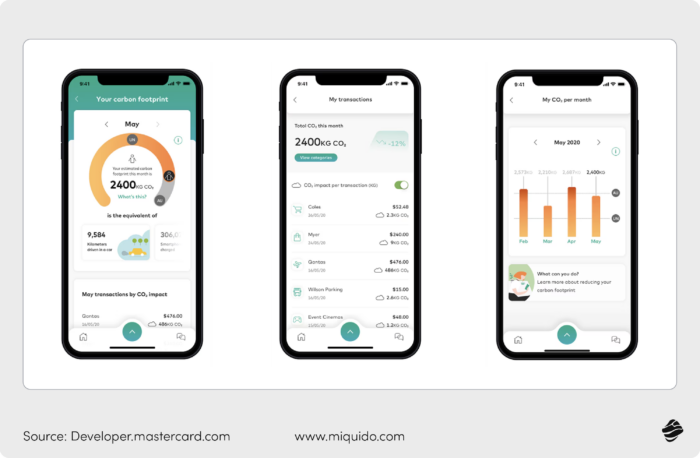

Green banking initiatives

Sustainability is no longer optional – it’s a business imperative. Offering eco-friendly features, such as preferential loan rates for green projects or carbon footprint tracking, aligns your brand with customer values and attracts environmentally conscious users.

Crédit Agricole’s initiatives around green financing highlight how banks can promote sustainability while driving engagement. Implementing similar offerings positions your institution as a leader in responsible banking, appealing to both customers and stakeholders.

7 crucial factors in VAS implementation

Product

The banking services should cater to customer needs and include a variety of financial products like loans, savings accounts, credit cards, and insurance, offering tailored solutions to different customer segments.

Price

The cost of banking services should be competitive and transparent, with clear interest rates, fees, and charges. Flexible pricing options should be offered to meet the financial capacities of various customer groups.

Place

The banking services should be accessible and available whether through physical branches, online platforms, or mobile apps, ensuring customers can access them conveniently at any time.

Promotion

The banking services should be promoted through effective marketing strategies, using advertising, social media, and customer engagement campaigns to communicate value and reach potential customers.

People

The banking services should be delivered by knowledgeable, professional, and friendly staff, ensuring excellent customer service and building trust through positive interactions.

Process

The banking services should be efficient and user-friendly, offering easy and quick processes for account opening, transactions, loan approvals, and other banking activities.

Physical Evidence

The banking services should be supported by tangible elements such as the design of the bank’s branches, the quality of the website, and branded communication materials, reinforcing a strong brand image and trust.

Future trends in banking value-added services

The next few years in the banking sector will undoubtedly be marked by increasingly personalized services, especially within mobile applications.

Features that provide insights into finances and allow users to maximize the potential of available funds, loans, and financing options will become one of the main reasons for changing banks, even though they were previously considered marginal.

Lowering interest rates will once again stimulate the mortgage market, but users will enter this new era with different expectations. Advanced 24/7 advisory services and support for filling out applications and completing formalities without leaving home will become the new normal. Those who fail to adapt may lose their market position.

The focus on artificial intelligence will continue, often determining competitive advantages. In many banking segments, AI can generate substantial value.

Where does the biggest potential lie? Retail banking could gain $306 billion, and corporate banking – $321 billion, through successful AI implementations.

Generate profit with value added services in your banking app

Gain an advantage with us! We’ve already developed popular applications for BNP Paribas and Nextbank. We can help you integrate value-added services that will generate maximum value for your company.

![[header] top 5 mobile app monetization strategies that work](https://www.miquido.com/wp-content/uploads/2025/08/header-top-5-mobile-app-monetization-strategies-that-work-432x288.jpg)

![[header] top ai fintech companies transforming finance in 2025](https://www.miquido.com/wp-content/uploads/2025/05/header-top-ai-fintech-companies-transforming-finance-in-2025-432x288.jpg)

![[header] why the flutter fintech app is transforming finance min](https://www.miquido.com/wp-content/uploads/2023/01/header-why-the-flutter-fintech-app-is-transforming-finance_-min-432x288.jpg)