Mobile banking apps are the backbone of today’s financial services. In 2025, the pace of change is only picking up, fueled by smarter AI, rising customer expectations, and fierce competition from fintechs. For CTOs, product leads, and digital transformation teams, keeping up isn’t enough. The real challenge is leading the way.

The big question now is how fast and deeply mobile banking will change. From AI-driven personalization to seamless banking features built right into everyday apps used on mobile devices, the future of mobile banking is already reshaping how people manage and move their money.

In this article, we’ll break down six key trends in mobile banking that will define the financial sector in 2025, backed by real-world examples and practical takeaways. Plus, we’ll show how partnering with tech leaders like Miquido can help you stay ahead and turn these changes into real business results. Mobile banking trends are quite exciting and we’re happy to share our insights with you.

How technology continues to reshape mobile banking services

Digital transformation in financial services is no longer confined to backend modernization. Today’s innovation is user-centric, focusing on enhancing customer experience while using mobile banking services through intelligent automation, instant services, financial management, personalized financial advice and digital touchpoints. Technologies like AI, machine learning, biometrics, and open banking APIs are becoming essential building blocks of competitive mobile banking strategies.

Meanwhile, the line between digital banking services and everyday customer experiences is blurring. Embedded finance, super-apps, and banking-as-a-service (BaaS) are making banking ubiquitous and context-aware—available wherever users need it, often without them realizing they’re using a banking service at all.

The impact of changing consumer expectations on mobile banking

Customers now expect their mobile banking apps to operate like their favorite lifestyle platforms: fast, intuitive, personalized, and secure. This shift is fueled by digital-native generations that prioritize convenience and control and judge banking experiences by the same standards they apply to e-commerce, streaming, and social apps.

To meet these customer expectations, traditional banks must move beyond reactive digital banking services models to proactive, value-driven mobile app experiences. That means anticipating needs, offering timely insights, building trust through transparency, and addressing security concerns. Mobile platforms that embrace these digital banking trends and deliver seamlessly integrated, user-first experiences will thrive—those that don’t will struggle to stay relevant in the mobile banking sector.

Hyper-personalized customer service

In 2025, personalization in mobile banking will transcend mere greetings or transaction summaries. The focus will shift to hyper-personalized banking, where AI and machine learning craft experiences tailored to individual behaviors, goals, and financial habits. These intelligent systems continuously learn from user interactions—spending patterns, saving habits, income flows—and respond with real-time, context-aware recommendations.

This evolution transforms static digital interfaces into dynamic financial companions, offering personalized savings goals, preemptive fraud alerts, customized loan offers and investment services.

Using data analytics to anticipate customer needs

Data is central to hyper-personalization. Banks are investing in AI models that ingest and interpret vast streams of data—transaction histories, geolocation, engagement metrics—to predict customer intent and needs before they’re expressed. For instance, mobile banking app users might receive alerts suggesting investment opportunities aligned with their financial goals as their account balances reach certain thresholds. Such personalized financial insights are one of the strongest mobile banking trends.

Miquido’s AI-driven frameworks assist banks in implementing these systems responsibly, emphasizing data security, real-time performance, and user trust.

Implementation challenges and success stories

While hyper-personalization offers immense potential, it also presents a delicate balancing act between personalized services and privacy. To deliver tailored experiences, banks need to collect and analyze vast amounts of behavioral data—everything from mobile banking transaction patterns and device usage to geolocation and financial habits. However, this data is deeply personal, and customers are increasingly concerned about how it’s collected, stored, and used.

That’s why transparency is essential. Banks must clearly communicate what data they’re collecting, how it’s being used, and give users control over their preferences. Offering opt-in choices, granular privacy settings, and easy-to-understand privacy policies can help build the trust necessary to support these initiatives. Only then can mobile banking apps maintain customer engagement.

From a technical standpoint, many banks still struggle with legacy IT infrastructure and siloed data systems, which limit their ability to integrate real-time AI models across channels. These outdated mobile banking systems often lack the agility or scalability needed for advanced personalization, requiring significant investment in data modernization and cloud-native platforms.

Despite these challenges, the return on investment is compelling. Many banks that implement AI-powered personalization have seen double-digit increases in in-app engagement, customer retention, and cross-sell conversions. For users, these intelligent systems translate to more relevant offers, faster service, more efficient financial management, and proactive financial advice, making hyper-personalization a baseline expectation, not just a nice-to-have.

Advanced biometric security

As mobile banking usage soars, so do cybersecurity risks. When accessing bank accounts, passwords are no longer enough, nor is multi-factor authentication. In 2025, biometric authentication in mobile banking—fingerprint, facial, voice, even palm-vein recognition—is becoming the default method of advanced security measures.

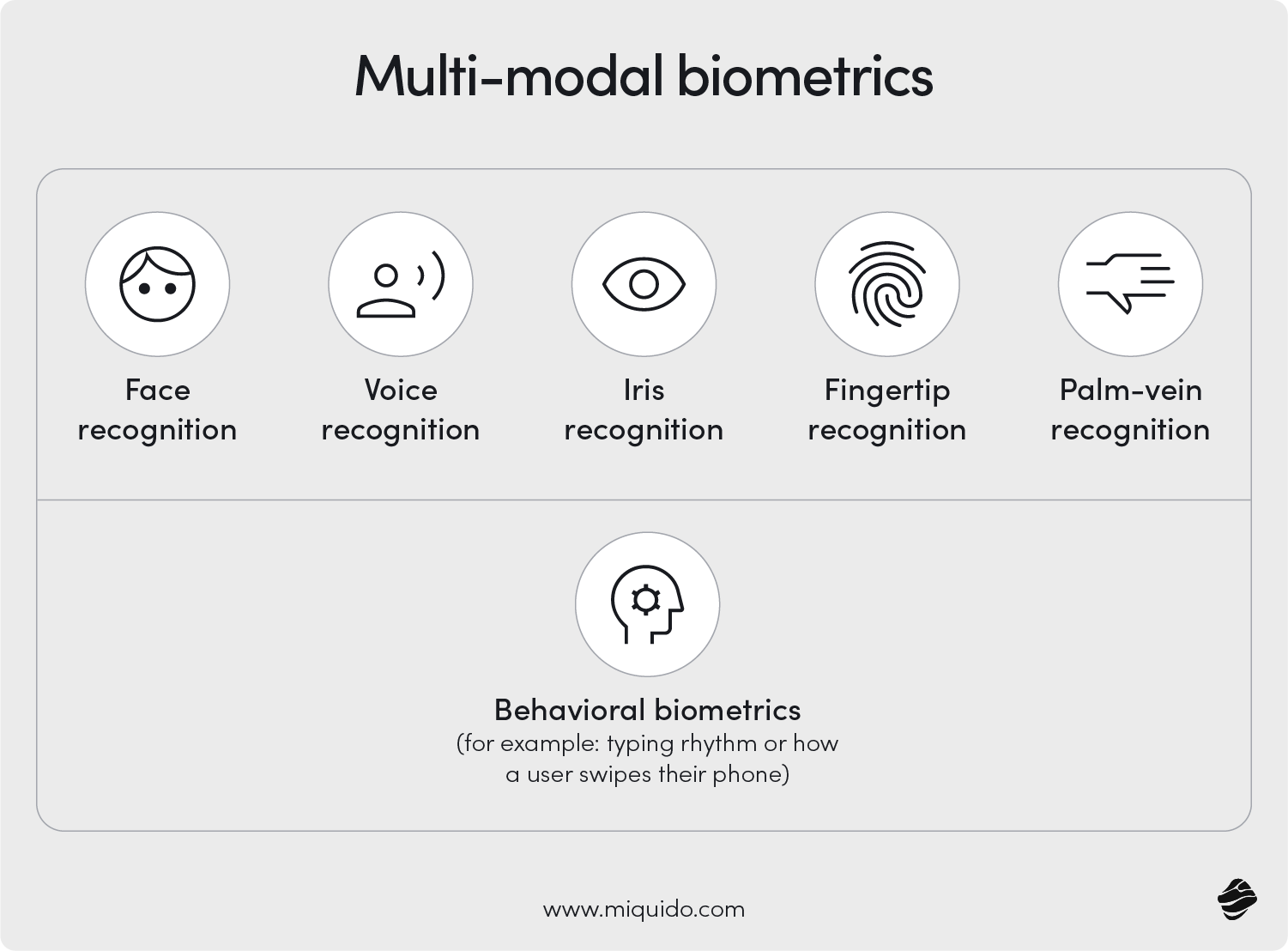

But the trend is moving beyond single-modal biometrics. We’re entering the age of multi-modal biometric authentication, which layers several identifiers to verify identity while logging into bank accounts with unprecedented accuracy and smooth user access.

Multi-modal biometrics: Balancing security and convenience

Multi-modal systems might combine facial recognition with voice and behavioral biometrics, like typing rhythm or how a user swipes their phone while using a mobile app. These layered defenses improve fraud prevention while minimizing user friction, making security seamless and invisible.

Regulatory considerations and privacy concerns

As biometric authentication becomes a standard in mobile banking, regulatory scrutiny is intensifying. Biometric customer data—whether fingerprints, facial scans, or behavioural patterns—is classified as sensitive personal information under most data protection frameworks, including the General Data Protection Regulation (GDPR) in the EU and PSD2 (the Second Payment Services Directive).

Under GDPR, institutions must obtain explicit user consent before collecting biometric data, and they are required to ensure that this data is securely stored, anonymized, or pseudonymized, and used strictly for its intended purpose. Meanwhile, PSD2 enforces Strong Customer Authentication (SCA), which supports the use of biometrics but requires multi-factor layers to mitigate fraud risks. Secure app architectures are essential for preventing cyber threats on mobile devices.

Institutions that fail to comply risk hefty fines, reputational damage, and customer distrust. Beyond compliance, there’s also a growing ethical obligation to build transparency into biometric systems, allowing users to understand what data is being captured, how it’s being used, and how long it will be retained.

Choosing technology partners like Miquido, which practice security-by-design and integrate privacy-preserving protocols from the earliest development stages, ensures not just legal compliance but also builds trust with end users—a critical component in any personalized banking experience, especially via mobile app.

Machine Learning credit scoring

Traditional credit scoring relies on static data—credit history, debt-to-income ratios, and repayment records. AI revolutionizes this approach by providing dynamic, real-time risk assessments based on a broader set of data points. These models adjust and improve as they process more data, enabling banks to conduct predictive analytics regarding creditworthiness with greater nuance and accuracy.

Alternative Data Sources for More Inclusive Lending

AI-driven credit scoring incorporates alternative data, such as rent payments, utility bills, mobile usage, social signals, and behavioral spending patterns. This inclusion opens financial access to demographics previously excluded by traditional credit systems, such as young adults, gig economy workers, or immigrants. This is the future of mobile banking.

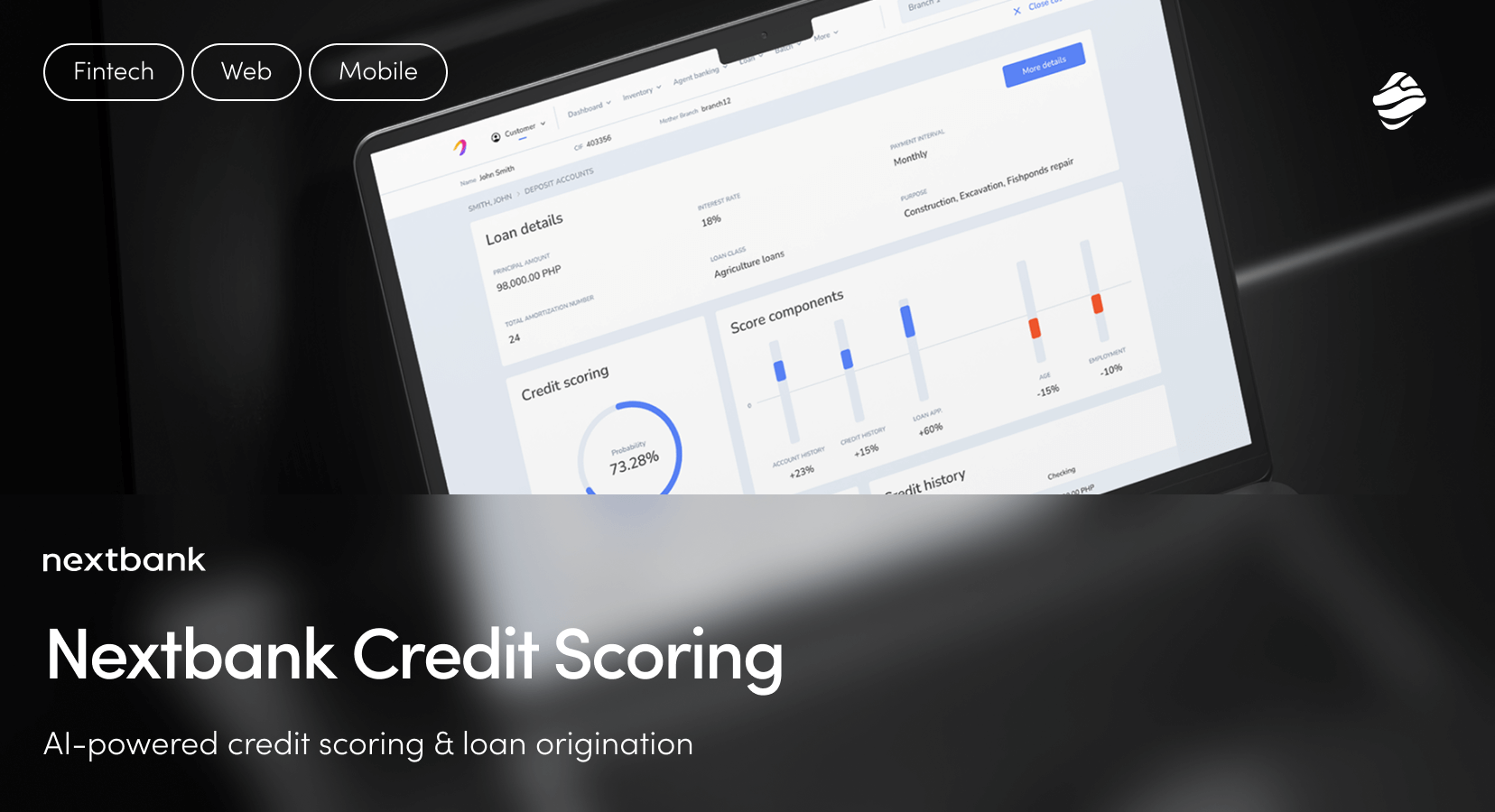

Case study: Nextbank’s AI-powered credit scoring engine

Miquido partnered with Nextbank, a fintech company operating in Southeast Asia, to develop an AI-powered credit scoring engine. This system analyzes over 600 data points, including demographics, transaction history, and credit behavior, to assess loan repayment likelihood. Utilizing machine learning models like LightGBM and XGBoost, the engine achieves a 97% prediction accuracy, effectively distinguishing high-risk loans.

Deployed in seven banks across Asia, the engine has processed over 500 million loan applications. Its microservices architecture allows seamless integration, enabling instant calculation of loan repayment probabilities. This proactive system not only ensures operational efficiency of the lending process but also identifies potential borrowers, expanding the pool of creditworthy individuals and creating new revenue streams.

Value-added services in mobile banking

In 2025, mobile banking applications will evolve into comprehensive financial ecosystems. Digital banking will integrate value-added services (VAS) that extend beyond traditional banking functionalities to meet the diverse needs of modern consumers. These services will not only enhance user engagement but also open new revenue streams and strengthen customer experience.

Within the space of value-added services in mobile banking, several key offerings are gaining prominence and becoming banking trends:

- AI-powered financial advisors: Providing personalized budgeting, saving, and investment recommendations based on real-time data analytics.

- Cryptocurrency and stock trading: Enabling users to invest in digital assets and equities directly through their mobile apps, simplifying the investment process.

- Saving vaults: Allowing customers to set aside funds for specific goals, with sophisticated features like round-up savings from everyday purchases.

- Disposable virtual cards: Enhancing security for online transactions by generating temporary card numbers for one-time use.

- Loyalty programs: Offering cashback, discounts, or reward points to incentivize spending and increase customer retention.

- Financial planning tools: Assisting users in financial management with features like expense tracking, goal setting, and financial health assessments.

- Insurance products and extended guarantees: Integrating options for purchasing insurance or extended warranties directly within the app to improve the banking experience.

Implementing these external services requires a strategic approach, focusing on customer experience, seamless integration, and compliance with regulatory standards. Banking trends have never been so applicable in other areas of life.

Financial wellness tools and lifestyle integration

Modern customers expect holistic financial solutions that align with their lifestyles. Banks are responding by embedding tools that promote financial wellness and integrate seamlessly into daily life. Features such as subscription management, carbon footprint tracking, and personalized financial education are becoming standard offerings of mobile banking institutions.

These tools not only empower users to make informed financial decisions but also position banks as proactive partners in their customers’ financial journeys. And that’s definitely an important mobile banking trend we’re expecting to see.

Creating sticky customer experiences through extended digital services

Value-added services contribute significantly to creating “sticky” user experiences—those that encourage frequent engagement and long-term loyalty. By offering services that users find indispensable, banks can reduce churn and differentiate themselves in a competitive market.

For instance, integrating lifestyle services such as travel booking, event ticketing, or e-government services can transform a mobile banking app into a one-stop solution for various needs. This multifunctionality not only enhances user satisfaction but also provides additional touchpoints for customer interaction and ensures a personalized banking experience.

Case study: BNP Paribas – GOtravel insurance feature

As part of its broader mobile-first strategy, BNP Paribas collaborated with Miquido to develop innovative solutions that extend beyond standard mobile banking functionality. One standout value-added service is the GOtravel module, integrated directly into the bank’s GOmobile app.

This feature enables users to purchase travel insurance seamlessly within the app, eliminating the need to visit a separate provider or navigate cumbersome policy forms. With just a few taps, customers can:

- select their travel dates and destination

- choose from various insurance packages tailored to different travel needs

- pay and receive digital policy documents instantly

The module is designed with user convenience and accessibility in mind, offering a frictionless experience that matches the expectations of mobile-first users. It also allows BNP Paribas to cross-sell relevant financial products in context, right when users are likely planning a trip or booking travel.

By embedding insurance functionality into the mobile banking experience, BNP Paribas demonstrates how value-added services can drive greater app engagement, customer satisfaction, and non-interest revenue—all while reinforcing its position as a full-service digital banking leader.

Sustainability in mobile banking

In 2025, sustainability has become a central focus for financial institutions, driven by increasing consumer demand and regulatory pressures. Banks are embedding Environmental, Social, and Governance (ESG) features directly into their digital platforms to meet these expectations. This includes tools like carbon footprint calculators, sustainable investment options, and paperless banking incentives.

For instance, the fintech startup Yayzy offers a mobile banking solution that calculates the environmental impact of a user’s spending by analyzing their financial transactions. This empowers consumers to make more environmentally conscious financial decisions.

Carbon footprint tracking and sustainable investment options

Banks are also providing customers with options to invest in green bonds and ESG-focused funds. These investment products support projects aimed at combating climate change and promoting social responsibility. Additionally, some banks offer features that allow customers to offset their carbon emissions directly through the mobile banking app.

Meeting the demands of environmentally-conscious consumers

Consumer interest in sustainable mobile banking is on the rise. A McKinsey study revealed that nearly 40% of U.S. consumers are interested in climate-linked financial products, with two-thirds willing to allocate a substantial portion of their savings or spending towards them. Notably, up to 40% would choose a green savings account even if it offered a 20% lower annual percentage yield compared to traditional accounts.

Regulatory bodies are also contributing to this shift. The European Banking Authority, for example, mandated climate-related disclosures starting in December 2023, pushing banks to develop comprehensive ESG reporting frameworks.

By integrating sustainability features into their mobile apps, banks not only comply with regulatory requirements but also cater to a growing segment of environmentally conscious consumers, enhancing customer loyalty and opening new avenues for growth within mobile banking services.

Embedded finance

In 2025, financial services will not start and end with your bank but are woven into the apps and experiences customers already use. This is the essence of embedded finance: offering real-time payments, loans, insurance, or investments directly within retail, travel, and social media platforms.

The rise of Banking-as-a-Service (BaaS)

BaaS platforms allow non-bank companies to offer banking features without becoming banks themselves. For example, a ride-share app might offer in-app car loans, or a freelancer platform might provide instant payouts or tax-saving suggestions.

This key trend opens massive opportunities for both fintechs and traditional banks. Institutions that adopt BaaS can monetize their infrastructure by offering white-label financial services to third parties.

Opportunities and challenges for traditional banks

The challenge? Traditional banks must rethink their models. They can’t rely solely on customer acquisition—they must become infrastructure providers or partner with fintech to stay competitive. For instance, they can offer third-party payment services to stay competitive.

With Miquido’s expertise in mobile banking, AI, and API development, banks can confidently embrace embedded finance and launch innovative products that scale and integrate with partner ecosystems.

Banking services in non-financial environments

In 2025, embedded finance has become a cornerstone of digital innovation, enabling non-financial platforms to offer financial services directly within their ecosystems. This integration enhances user experience by providing seamless access to services like payments, lending, insurance, and investments without redirecting users to external providers.

For instance, ride-sharing apps such as Uber and Lyft have revolutionized payment processes by embedding payment systems that automatically charge users upon ride completion, eliminating the need for manual transactions. Similarly, e-commerce platforms like Amazon and Shopify have integrated “Buy Now, Pay Later” (BNPL) options, allowing customers to finance purchases instantly at checkout, thereby increasing conversion rates and customer satisfaction. These examples show that real-time payments and other financial transactions are not only reserved for the mobile banking sector.

Moreover, mobile wallets like Apple Pay and Google Pay exemplify embedded banking by enabling users to store and manage funds within their preferred apps, facilitating quick and secure transactions across various services. These integrations not only streamline the user journey but also open new revenue streams for businesses by offering value-added financial services.

As embedded finance continues to evolve, businesses that leverage these integrations can enhance customer engagement, increase engagement, and stay competitive in a rapidly changing financial landscape.

Preparing for the future of mobile banking

2025 presents both opportunity and urgency. As mobile banking continues to evolve, financial institutions must prioritize:

- investing in AI and data analytics for hyper-personalization

- enhancing security through biometric authentication

- unlocking financial inclusion with ML-powered credit models

- increasing app utility through value-added services

- embracing sustainability as both a customer and compliance imperative

- exploring embedded finance and BaaS models to stay competitive

Choose the right technology partners to keep up with mobile banking trends

Successfully navigating these trends requires more than vision—it demands execution. Financial institutions need partners who understand the complex interplay of customer engagement, regulatory compliance, and scalable technology.

At Miquido, we combine deep fintech experience with cutting-edge AI, mobile banking development, and digital transformation strategy expertize. Whether you’re building the next-gen mobile banking app or launching an embedded finance platform, we’re here to help you turn innovation into impact.