The music industry has undergone a seismic shift in recent years, driven by advancements in technology and changing consumer behaviours. The rise of streaming platforms like Spotify, Deezer, Soundcloud or Youtube Music (and many more!) has fundamentally altered how music is consumed, distributed, and monetized, creating new opportunities and challenges for artists, labels, and tech companies alike. As an experienced music app development company that has worked with Abbey Road Studios and Dolby On, we understand the evolving landscape of music technology. Our expertise in building innovative platforms positions us to explore how streaming will shape the future of music consumption and monetization. However, we believe the future of music streaming is a topic best explored through the eyes of those shaping the industry; that is why we invited Pete Downton, as he is one such leader!

With a distinguished career spanning roles at Warner Music Group, Apple, YouTube, and Spotify, Pete brings a wealth of experience to the table. As the former Deputy CEO of 7digital, he successfully guided the company through going public and securing key clients. Now, as the chair of Gixon and a board member of Centralized.me and MediMusic, Pete continues to drive innovation in the music space. Additionally, he is contributing to the global expansion of Miquido at the forefront of music and entertainment technology.

Meet Pete’s visionary perspective, hitting all the right notes as this article explores the evolving landscape of music streaming and the transformative rhythm it’s setting for the future.

In case you are more interested in technology, trends and tactics shaping the future of the music industry, we invite you to a free report:

Timing and transformation of music industry

“Everything in life is timing. I joined the music industry just as it was about to be upended by technology, and this turned out to be my lucky break!” – starts Pete. Dive deeper to get to know his music industry history and expert insights!

When I walked into Warner Music UK’s distribution center in late 1997, I had no idea what an amazing journey I was about to begin. Less than a year later, someone with the username “Napster” revealed to users in an internet chatroom that he’d been working on a piece of software to make music accessible from the internet. The rest, as they say, is history!

Now, as artificial intelligence comes of age, I will try to draw on some of the lessons learned and offer a few practical implications as I race toward my fourth decade working at the intersection of music and technology.

History may not repeat itself, but it often echoes. Recalling the seismic shift in the music industry triggered by the advent of the internet. For those who witnessed or studied this era, there’s a compelling draw to the lessons learned then and their resonance today. The music industry has successfully navigated these turbulent waters, particularly from a business standpoint. Today, investors and industry leaders are reaping the benefits. However, this success story has its nuances.

While we may all view history through the lens of our own experiences and biases, an attempt at objectivity reveals some clear lessons from that transformative period.

On the positive side, the industry effectively adapted and enforced copyright law, finding alignment with key stakeholders like the tech giants and policymakers. These steps were crucial in shaping the music landscape we see today.

Conversely, the industry’s struggle with enabling innovation stands out as a significant challenge. Despite advancements, there has been a continuous struggle to balance protecting rights with fostering creativity and technological progress. It has often led to a tug-of-war between maintaining traditional business models and embracing new, disruptive ideas.

Moreover, the industry has faced difficulties in developing a sustainable ecosystem where creators can thrive. This crucial yet often overshadowed aspect underscores the need for a more inclusive and forward-thinking approach. Streaming services might also raise prices to improve profitability amid growth in subscriber numbers, aligning with market growth expectations similar to the video streaming industry.

AI and technology: a double-edged sword

In 2024, the integration of AI and technology in the music industry embodies a double-edged sword, presenting both challenges and opportunities.

On the one hand, the arrival of AI brings forth innovative opportunities in music creation and business analytics, offering artists and labels new tools for creativity and market insight. AI’s potential in enhancing personalized fan experiences and streamlining production processes opens up fresh avenues for industry growth and artistic expression.

However, this technological advancement also introduces significant challenges. The development of AI-generated content raises concerns about the dilution of artistic quality and the potential for increased streaming fraud, posing threats to revenue integrity and copyright control.

Moreover, navigating the ethical implications of AI in music, such as using deepfakes or replicating artists’ styles without consent, adds a layer of complexity to copyright laws and moral rights in the digital age.

Any attempt to consider how AI and technology will change the music industry in the coming years would be like trying to boil the ocean, so I will now concentrate on three key areas at the vanguard of this broader change.

The rise of the algorithm

When iTunes launched in 2003, it featured just 200,000 songs. Today, major music streaming services offer over 100 million songs, with over 100,000 newly released songs added daily. It is hardly surprising that users rely increasingly on recommendations to navigate what they listen to.

Early recommendation systems borrowed heavily from what had gone before, categorizing music into genres and providing basic recommendations based on top charts and human-curated playlists.

To a significant extent, these systems were designed to complement existing promotional activities, e.g. radio airplay, traditional media appearances and record label marketing activities.

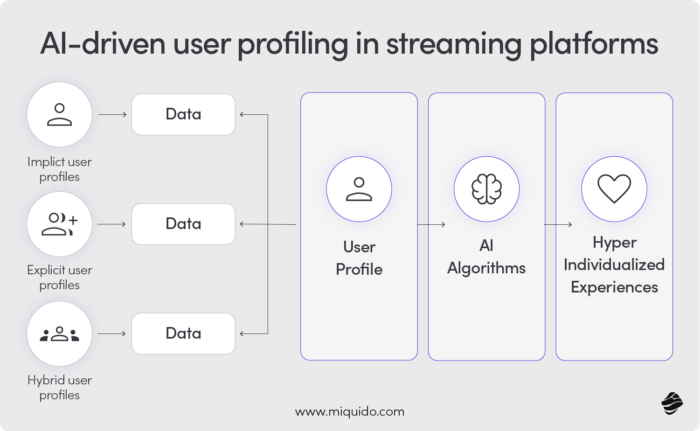

Conversely, today’s algorithms leverage machine learning and artificial intelligence to offer personalized recommendations. They analyze vast amounts of data, including listening history, user interactions (likes, skips, replays), and even the time of day or activity, to predict what listeners might enjoy next.

Prioritizing user engagement

Today’s streaming services operate in a fiercely competitive environment that necessitates prioritizing user engagement above all else. Often referred to as the ‘attention economy’, many in the music industry bemoan this development and express concern that it might negatively impact artists’ development, potentially diminishing the emotional connection between artists and fans.

This shift towards ever more personalized experiences has unquestionably weakened the ability of music distributors, labels or technology platforms to affect their artists’ relative performance within streaming services.

Pushing against this trend and the declining share of streams represented by major distributors, Spotify was heavily lobbied to introduce a threshold last year, which means tracks with less than 1,000 plays in the previous 12 months will no longer attract royalties. To put this in perspective, this represents tens of millions of songs but only $40m (0.5%) of current Spotify revenues.

The move nevertheless feeds the narrative that Spotify is moving away from its early role as the disruptive startup trying to democratize the music industry. A view is already gaining credence following the company’s introduction of ‘Discovery mode’, where tracks are promoted in Spotify’s radio and autoplay features in return for a lower royalty rate.

In addition to the announcement that Spotify would be cutting more than 1,500 jobs, many have concluded that this will only accelerate the trend of humans being taken ‘out of the loop’.

Music’s difficult relationship with music video platforms

From the inception of MTV in the early 1980s, which revolutionized music consumption by marrying visuals to the auditory experience, to the viral dynamism of TikTok in the digital age, these platforms have consistently redefined the paradigms of music promotion and accessibility.

MTV, YouTube, and now TikTok have become indispensable tools for music promotion, enabling artists to reach global audiences with a click. Translating this exposure into tangible income – be it through CD sales, music streaming subscriptions, or concert ticket sales – remains elusive for many.

The truth is that beneath the sheen of a digital revolution lies a persistent tension: the promise of unprecedented exposure for artists versus the reality of stark financial remuneration for most artists.

That said, music video platforms today represent around a third of all music consumption, similar to the audio streaming share. Unsurprisingly, the music industry has continued to lobby for deals that reflect the increased importance of music to the platforms and the platforms to music!

It is probably best evidenced by Universal Music Group’s (UMG) recent decision to withdraw its artists’ music from the TikTok platform, claiming that TikTok is paying artists and songwriters only a fraction of the rate that similarly situated major social media platforms pay. UMG argues that less than 1% of its digital revenues come from TikTok, despite the short-form video, which TikTok dominates, representing more than 10% of all music consumption (Rameswaram, 2024).

This, however, is not a new phenomenon.

In 2006, I was a member of the Warner Music team, which signed the first landmark deal with YouTube.

A short time after the deal was announced, Google acquired YouTube, which led to over a decade of wrangling at what constituted a ‘fair deal’. As that landmark deal came up for renewal, Warner pulled its catalog in a spat strikingly similar to today’s disagreement between UMG and TikTok.

Fast forward to 2024, and YouTube is now the industry’s second-largest single source of streaming income, and Google as a whole is trending to overtake Spotify.

History tells us that improving direct income from music video platforms is a long-term endeavor and a conversation which only a handful of the world’s largest music companies can genuinely influence. Aside from this, artists have to make a living. Leading video platforms play a hugely significant role in delivering streaming activity, on and off the platform, and they increasingly present the potential to facilitate direct-to-fan commerce opportunities.

From serving the ‘passive massive’ to super-serving a ‘superfan’

The music industry, historically geared towards broadcasting to the ‘passive massive’ – a broad audience with generalized tastes – needs to shift towards catering to the ‘superfan’, a niche yet highly engaged segment that thrives on personalized experiences.

To someone outside the music industry, the idea of serving music fans might reasonably sound like business as usual. Still, in reality, this represents a paradigm shift to most involved in the business day-to-day. The departure from the one-size-fits-all approach to a more tailored, fan-centric model will require many to rethink how they best serve the artists they represent.

In 2023, Goldman Sachs claimed that 20% of paid music streaming subscribers could be classified as ‘superfans’ and are prepared to pay double what non-superfans spend on music yearly, implying an untapped opportunity of US$4.2bn. While this struck a chord with many in the industry, the interpretation of how best to unlock this opportunity varies greatly (Goldman Sachs, 2023).

Industry analysts Luminate break down what it means to be a superfan, explaining that its methodology defines a superfan as “a music listener aged 13+ who engages with an artist and their content in multiple ways, from streaming to social media to purchasing physical music or merch items to attending live shows” (Stassen, 2023).

‘Superfans’, according to Luminate’s report, spend 80% more on music each month versus the average US-based music listener. Additionally, physical music buyers of formats such as vinyl, CDs or cassette tapes are more than twice as likely (+128%) to be music superfans.

Here, there are opportunities for music labels and managers to learn from each other and from the live music industry, which has experimented with segmentation and premium pricing strategies for some time.

I would argue that the tools needed to unlock the superfan opportunity are substantively available today. What’s now required is a more holistic approach to all aspects of an artist’s interactions with their most engaged fans.

The bigger question is, who will be responsible for orchestrating this?

So, what is the future of music streaming services?

Considering what has changed and what has stayed the same since Napster’s arrival, I am struck by how major labels have managed to maintain such a dominant share of music distribution.

It is despite a vastly changed consumer landscape and as artists increasingly adopt technology to create music and related content.

As I think about the current distribution landscape, I am reminded of meetings with mobile executives during their transition to 3G in the early 2000s. Over and over, executives would speak of their need to transition from being just ‘dumb pipes’ to becoming ‘intelligent platforms’ that offer consumer services.

Today, these telcos are twenty years into a journey that most large music companies have yet to begin seriously. In the end, telcos only embraced change when their competitive landscape changed, and they had to respond to the challenge posed by big tech. Similarly, I expect that large, profitable music labels and distributors will only feel the need to focus on innovation when their dominance is challenged.

Music streaming trends in numbers: data-driven insights shaping the music industry

The global music streaming industry is experiencing rapid growth, with streaming platforms like Spotify, Apple Music, and Amazon Music expected to drive revenue streams to $103.07 billion by 2030. The increased demand for personalized music services and the popularity of both audio and video streaming services are key factors.

Many music streaming platforms are embracing hyper-personalization to connect users with great music, while independent artists and musicians are leveraging these platforms to monetize their content. As subscription prices for family plans and premium tiers rise, streaming services are creating more opportunities for many artists to make more money through virtual concerts and other innovative formats. Consumers are increasingly turning to subscription-based streaming for an ad-free experience, contributing to the ongoing shift in how we experience music worldwide.

Additionally, the integration of streaming services with social media platforms and the rise of live music streaming are expected to drive future market trends. The Middle East & Africa region is anticipated to see the fastest growth, with a CAGR of 17.5%, thanks to increased smartphone adoption and internet penetration.

To conclude, the journey to smart distribution

Since ChatGPT was launched, the industry response has been reminiscent of the early reaction to Napster, so maybe this could be the thing to kickstart innovation ‘within’ the industry.

I would suggest that the very thing (AI) that has led to a wave of technology-induced panic at the major music companies also holds the key to reinventing the music industry. The journey from “dumb pipes” to “smart distribution” opens up the potential to target and grow fan bases, personalize engagement, conduct creative experimentation, and foster growth and engagement without overwhelming costs.

My personal advice to any entrepreneur or intrapreneur hoping to thrive in this environment is to begin by ensuring your organization becomes data-centric and AI-literate.

When Napster came along, the music industry had to respond to an entirely new dynamic that was uniquely exposed at the time. Today’s music executives can borrow from the playbooks of trailblazers in adjacent industries such as FinTech, MarTech and the luxury goods industry. So, let’s end this article where we began by suggesting that everything in life is timing! And this really is the very best of times to be innovating in the music industry.

![[header] fintech challenges in 2025](https://www.miquido.com/wp-content/uploads/2025/07/header-fintech-challenges-in-2025-432x288.jpg)

![[header] how is ai used in fintech use cases & insights](https://www.miquido.com/wp-content/uploads/2025/06/header-how-is-ai-used-in-fintech_-use-cases-insights-432x288.jpg)