In the last two decades, the music market has undergone an incredible transformation. Physical media, now serving mostly as curiosities for enthusiasts, have faded into obscurity. The digital revolution in music, from MP3s to streaming, has brought tangible consequences for artists and labels. As the importance of traditional sales channels like record distribution declined, new doors and pathways for generating income have opened.

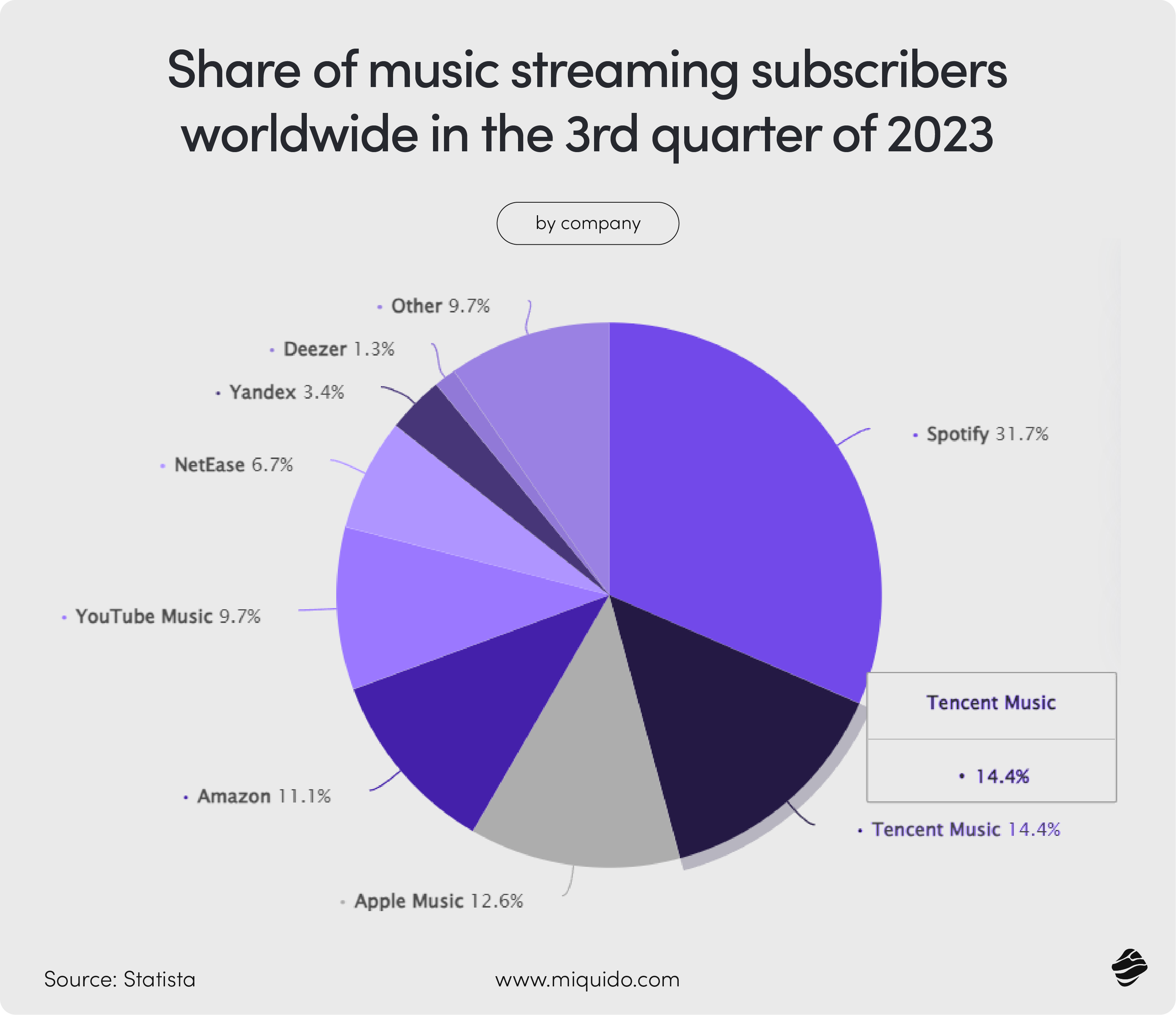

Today, being present on streaming platforms is a necessity for any artist aiming to stay afloat. The market, dominated by Spotify, presents many challenges, with its income-generation rules sparking controversy. Unsurprisingly, the biggest players take the lion’s share, while the rest are left with crumbs.

Although streaming reigns supreme, artists now have access to numerous ways to monetize their music. In this article, we analyze the revenue models of various platforms and suggest additional ways to generate income. Find the optimal path for yourself or dive into trends in media and entertainment that dictate the future growth of the music app niche. Learn best practices to confront streaming music industry challenges.

Music streaming app market – platform comparision

The global streaming market is divided among a few giants. Breaking through in this industry isn’t easy, and convincing users to switch platforms is even harder. Ultimately, the service is similar across platforms—users’ final choice often depends on interface functionality, recommendation accuracy, and sound quality. Additionally, community and brand voice play significant roles—areas where Spotify is especially hard to beat.

Let’s focus, however, on what each platform can offer music creators and other industry professionals. Most combine revenues from multiple platforms. To maximize income from monetization, it’s crucial to thoroughly understand the payment policies of individual companies. The differences may be subtle, but they have a significant impact on overall revenue.

Spotify – biggest reach and recognition

Spotify remains the undisputed leader in the music streaming market, leaving its competitors far behind. Its success is attributed to several factors: a distinctive brand, a user-friendly interface, a freemium model where premium means ad-free, and very clever marketing! A prime example is Spotify Wrapped, the biggest annual campaign in the music industry, which earns the company millions of free shares on social media.

The greatest advantage of being on Spotify? Undoubtedly, its vast reach and opportunities for building an artist’s image. In other areas, the market giant performs moderately—its rate per stream is lower than YouTube Music or Apple Music, and its sound quality doesn’t particularly stand out compared to Tidal.

Apple Music or Amazon Music – sweet spot for artists

Apple Music, the second most popular music streaming platform after Spotify, offers quite a similar spectrum of features and options, but provides one key advantage for artists: higher income. Of course, these rate differences only gain visibility with a relatively high number of monthly listeners, but still – Apple’s model stands out with its payout rates. Another advantage Apple has over other streaming platforms is the developed user ecosystem. For staunch Apple users, picking this particular platform will be a natural step. Plus, it is cheaper to use it wi

Amazon Music, on the other hand, offers a middle ground with its payment-per-stream approach, providing clearer earnings calculations. As for users, it offers more advanced spatial audio options and a fair variety of curated playlists. However, its interface is often referred to as inferior in comparision with Apple and Spotify.

Tencent: bringing listeners closer to artists

When scrolling through music streaming statistics, you may come across an unfamiliar name: Tencent. Over the past few years, this Chinese music app has climbed the rankings, now holding second place behind Spotify in terms of user numbers. Importantly, its operational model isn’t a mere copy of Western streaming giants like Spotify or Apple Music. Tencent takes a unique approach to music monetization and artist compensation.

Rather than relying solely on subscriptions, advertising revenue, or downloads, Tencent’s music streaming app combines these with user contributions. These micropayments are sent directly to the artist’s account and can be withdrawn or exchanged for virtual goods, offering a fresh take on how streaming services generate revenue.

Many in the music industry see Tencent’s innovative model as a game-changer. It emphasizes strengthening the bond between fans and artists, echoing the success of platforms like Patronite or Twitch, which thrive on user contributions. This approach could be a future of music streaming, encouraging fans to have a direct role in supporting their favorite artists.

YouTube Music: redefining monetization in music apps

YouTube Music is another platform disrupting the dominant per-rata payout model in the streaming music industry. It offers a multi-faceted approach to revenue generation, combining various income streams. Artists can earn through Content ID, which allows them to monetize user-generated content that includes their music, as well as through ad revenue from their verified artist channels.

This model provides new opportunities for music artists to diversify their income. However, the reliance on ad revenue introduces unpredictability, as payouts depend on factors such as user engagement, the type of content, and regional demographics. Despite these challenges, YouTube Music’s approach is a welcome change from the traditional methods.

Streaming payment models: comparison

Most artists and labels combine income from various platforms, supplementing it with additional monetization sources. However, it’s not always worth the effort to promote oneself on every platform—much depends on the audience and popularity in specific locations. Our comparison will help you understand the differences between different models, which often are quite subtle.

Although the per-rata model is dominant at the moment, we may soon see a shift into a user-centric model that promotes individual contributions. With generations Z and Alpha gaining importance, new doors open for artists and streaming services providers: having

| Payment Model | Description | Key Platforms | Advantages | Drawbacks |

|---|---|---|---|---|

| Per-Rata | Revenue pooled and distributed based on total streams. | Spotify, Apple Music, Deezer | Simple to calculate; incentivizes streaming growth. | Favours top artists; smaller artists earn little. |

| User-Centric (UCPS) | Revenue is allocated only to artists a user listens to. | Deezer (testing), SoundCloud | Fairer for small artists; reflect user behaviour. | Complex to implement; modest payout increases for many. |

| Direct Artist Payments | Users tip or allocate part of their subscription to artists. | Bandcamp, SoundCloud, Patreon | Strengthens artist-fan relationships; transparent payouts. | Relies on user willingness to pay extra. |

| Advertising Revenue Sharing | Revenue from ads shared with artists. | Spotify (Free Tier), YouTube | Monetizes non-paying users; expands artist exposure. | Low payout rates depend on ad revenue. |

| Flat Licensing Fee | Fixed fee paid to rights holders regardless of streams. | Pandora (radio service) | Predictable revenue; capped costs for platforms. | Disincentivizes streaming growth; less fair to artists. |

| Hybrid Models | Combines multiple approaches like pooling and direct support. | Tidal, Patreon | Flexible and balanced; suits diverse artist needs. | Complex to manage; may dilute benefits of individual models. |

| Ownership/Equity-Based | Artists/labels own equity in the platform. | UnitedMasters | Aligns artist and platform success; potential long-term gains. | Limited to influential artists; depends on platform success. |

| Pay-Per-Stream | Users pay directly for each stream or download. | iTunes (historical), niche platforms | Transparent payouts are proportional to engagement. | Unpopular with users; discourages casual discovery. |

| Blockchain-Based Models | Transparent payments via cryptocurrency or NFTs. | Audius (emerging) | Decentralized; clear royalty tracking; new revenue streams. | Complex adoption barriers for non-tech-savvy users. |

Types of music monetization

Streaming royalties

As you can see, streaming giants offer various monetization strategies, with pre-rata model domintating in the industry. But what does it really mean that the income depends on streams? On Spotify, 30 seconds of listening are enough to qualify as a stream. It does not matter how long the song will be played – if it is more than half minute, you have your fixed income quaranrteed.

Organic streams are pure profit, but breaking into the mainstream and capturing the algorithm’s favour is no easy task. This is why streaming platforms offer the option to place tracks on sponsored playlists. Beyond the official editorial playlists curated by the music streaming services provider, artists often collaborate with independent curators with a large subscriber base. These curators’ playlists can target your core audience effectively. However, Spotify classifies such guaranteed placements through third-party services as not legitimate practices.

| Aspect | Spotify | Apple Music | Amazon Music | YouTube Music |

|---|---|---|---|---|

| Revenue Sources | Premium subscription fees and ad revenue from free-tier users. | Monthly subscription fees from users. | Premium subscription fees and ad revenue from free-tier listeners. | Premium subscription fees and ad revenue from free-tier users. Additional revenue from Content ID monetization on YouTube. |

| Net Revenue Calculation | Subtracts taxes, processing fees, billing, and sales commissions from gross revenue. | Subtracts taxes, processing fees, billing, and sales commissions from gross revenue. | Subtracts taxes, processing fees, billing, and sales commissions from gross revenue. | Subtracts taxes, processing fees, billing, and other costs from gross revenue, plus a portion allocated to YouTube’s ad-driven model. |

| Royalty Model | Pro-rata model based on total streams and an artist’s share of overall platform streams. | Pro-rata model based on total streams and an artist’s share of overall platform streams. | Payment-per-stream model with payouts ranging from $0.004 to $0.008 per stream. | The average payout rate of $0.008 per stream on YouTube Music. YouTube’s Content ID pays $0.00087 per stream; artist channels pay $0.00164. |

| Payout Rates | $0.003 – $0.005 per stream, varying by country and agreements. | $0.006 – $0.01 per stream, higher and more predictable than Spotify. | $0.004 – $0.008 per stream, varying by subscription tier, region, and agreements. | Average of $0.008 per stream on YouTube Music. Content ID payouts: $0.00087 per stream; verified artist channel: $0.00164 per stream. |

| Territory and Currency Impact | Royalties vary significantly by listener location due to country-specific subscription costs. | Royalties vary significantly by listener location due to country-specific subscription costs. | Geographic location impacts payouts due to regional differences in subscription pricing and free-tier contributions. | Geographic location affects ad revenue and subscription costs, causing significant variation in payouts across regions. |

| Listener Engagement Impact | Listener engagement (frequency and duration of streams) affects the share of royalties, rewarding active listener bases. | Listener engagement (frequency and duration of streams) affects the share of royalties, rewarding active listener bases. | Listener engagement indirectly affects payouts since more streams generate higher earnings under the payment-per-stream model. | Listener engagement drives ad revenue on user-generated content via Content ID and influences verified artist or YouTube Music rates. |

| Rightsholder Role | Payments are made to rightsholders, who then distribute royalties to artists/songwriters based on individual agreements. | Payments are made to rightsholders, who then distribute royalties to artists/songwriters based on individual agreements. | Payments are made to rightsholders, who distribute earnings among artists, songwriters, and labels based on agreements. | Rightsholders are paid directly via AdSense for YouTube content, while YouTube Music payouts are distributed to artists based on streams. |

| Payment Timing | Typically monthly, but timing and amount depend on agreements with labels, distributors, or collecting societies. | Typically monthly, but timing and amount depend on agreements with labels, distributors, or collecting societies. | Typically monthly, with variations depending on agreements with Amazon Music or intermediaries. | Typically monthly, with revenue from YouTube Music and YouTube bundled together, dependent on AdSense or platform agreements. |

| Impact on Smaller Artists | The pro-rata model and lower payout rates, combined with its ad-supported free tier, amplify challenges for smaller artists. | The pro-rata model still disadvantages smaller artists but offers higher per-stream payouts, which may mitigate disparity. | The payment-per-stream model provides clearer calculations but still favors artists with higher stream counts. | Higher payout rates on YouTube Music benefit smaller artists, but Content ID monetization requires significant streams to yield meaningful revenue. |

To have a clearer view on streaming, let’s understand the platforms’ specifics through the lens of their beneficiaries. Which model is the most favourable for a particular group?

Spotify’s labels

Spotify’s revenue model prioritizes rights holders and allows labels to maximize their earnings through global reach and detailed royalty allocation by country. The combination of premium subscription revenue and ad-supported free tier offers flexibility for marketing strategies.

Emerging artist without a label: YouTube Music

YouTube Music offers high average payout rates ($0.008 per stream) and additional revenue opportunities through Content ID. Artists can earn directly from both streams and user-generated content, making it accessible for independent artists without the backing of a label.

Emerging artist with a label: Apple Music

Apple Music’s higher payout rate ($0.006–$0.01 per stream) provides more predictable and advantageous earnings for artists supported by a label. The global pooling of royalties ensures consistent payouts regardless of the artist’s listener geography.

Popular artist in their domestic country looking to expand globally: Spotify

Spotify’s country-specific royalty pooling and wide global reach make it ideal for artists aiming to expand internationally. Its ad-supported tier ensures accessibility to audiences in emerging markets, boosting exposure and fanbase growth.

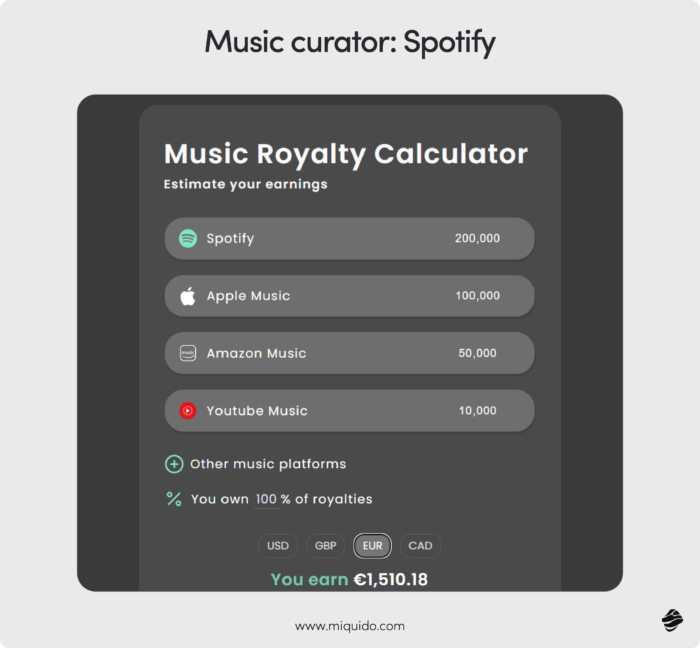

Music curator: Spotify

Spotify’s focus on playlist culture and personalized recommendations provides curators with the largest impact. It rewards engagement and allows curators to influence music discovery significantly through platform-generated and user-created playlists.

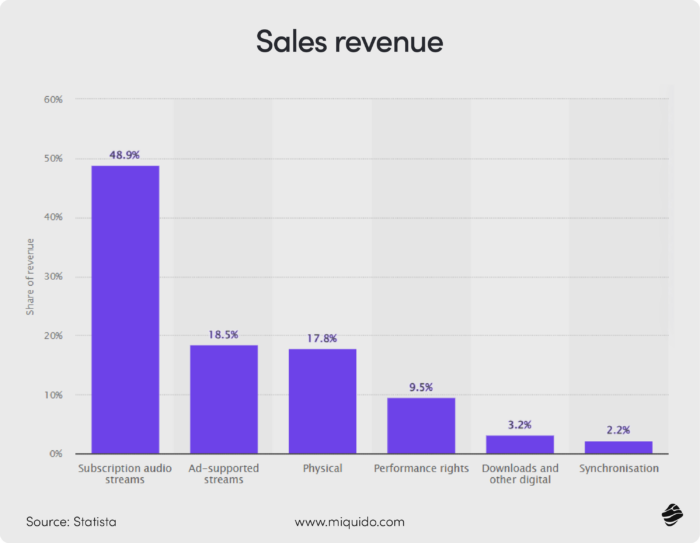

Sales Revenue

Although the artists’ income today strongly relies on streaming, traditional sales still hold a revenue potential. Digital files sales are dropping, but the nostalgic revival of the physical mediums creates perfect conditions to diversify the income. Physical sales still stand strong in 2023, as the statistics prove. Dropping a limited vinyl records series might thus be a great way to boost the artist’s wallet. In app purchases through iTunes are losing income-driving power with the increasing domination of streaming.

Sync licensing and royalties

Another way to collect income from music is through licensing it for use in visual media. From TV shows, through movies, trailers and ads, to video games, music embedded in the media creates monetizing opportunities. The monetization strategies depend on the constituted sync deal. In some cases, the right holders agree on a sole upfront payment, but oftentimes, tne upfront fee is combined with ongoing royalties.

Royalties are ongoing payments made to rights holders for the use of their music based on usage metrics such as streams, radio plays, live performances, or sales. You can claim:

- performance royalties: when your music is performed live or broadcast publicly.

- mechanical royalties: whenever a song is reproduced or distributed. whether in a physical or digital channel.

The responsibility for collecting royalties lies on rights organizations like ASCAP, BMI or SESAC. These organizations charge fees for their services, which are usually deducted as a percentage of the royalties they collect on behalf of the rights holders. In exchange for the fees, which usually combine administrative costs and membership, they provide comprehensive coverage which includes:

- Licensing businesses and broadcasters.

- Monitoring music usage.

- Collecting and distributing royalties.

- Enforcing copyrights when necessary.

Licensing success stories

Sync licensing and royalties can be a great source of steady income, often becoming a primary profit base for artists across genres. Music industry is filled with stories of musicians which have never made it to the top of the charts and maintained a relatively small audience base but establilished a strong licensing income base. Take the indie artists like Ingrid Michaelson or Gary Jules, whose “Mad World” was reproduced in multiple channels after its usage in “Donnie Darko”.

When listing licensing giants, probably Queen, Vangelis, the Beatles, Phil Collins are the firsts that come to mind. But think of Natasha Beddingfield’s “Unwritten”, Feist’s “1234”, Empire of the Sun’s “Walking on a dream”, or MGMT’s “Time to pretend”. These 00s hits are imprinted in our memory due to frequent commercial use, continuing until today and likely providing their authors with the solid income.

With the rise of streaming platforms like Twitch, artists and labels gained new prominent monetization channel. The creators can incorporate music pieces into their live streams and generate revenue for artists on the basis of licensing. Games and mobile apps can be another significant source of licensing income. Artists can, for instance, license music to Peloton for workout playlists or Calm for meditative soundtracks. It’s just a matter of finding the right music library for your content.

Content ID revenue

With the rise of social media, and its evolution to video-first medium that took place in the recent years, tracking copyrighted music in user-generated content has become an essential monetization strategy. Platforms like YouTube and TikTok use Content ID or similar systems to identify copyrighted music in user-generated content. Revenue comes from ads placed on videos containing their tracks. And although it may not be the ultimate income boost for the majority of artists, once the song goes viral, the profit skyrockets.

The algorithm is inclusive—ranging from 80s hits to songs by newly emerging stars without labels, anyone can win the lottery. It is not uncommon for TikTokers to revive forgotten tracks or spotlight songs that never received the attention they deserved. For example, the recent explosive success of Jain’s Makeba or the Stranger Things-inspired resurgence of Kate Bush’s Running Up That Hill earned the British artist $2.3 million in a relatively short period.

Crowdfunding

Artists no longer have to rely solely on income from streaming and royalties, which often involve intermediaries. Direct support models, which became popular primarily through podcasters, are gaining traction. For podcasters, earning through streaming platforms was practically impossible until recently, so they turned to patronage for income.

Similarly, this form of support is becoming increasingly popular among music artists, bridging the gap between creators and fans. This relationship is mutually beneficial—the supporting listener often gains access to exclusive content, live Q&A sessions and early access to new songs and albums.

Platforms like Patreon, Kickstarter, and GoFundMe enable artists to build communities, secure funding, and share content with patrons. Even Patronite itself has musical roots—it was founded by Jack Conte, a musician whose musical duo, Pomplamoose, once achieved significant success on YouTube.

NFTs and Blockchain Music Sales

In recent years, many experts predicted that blockchain technology would revolutionize the music industry. Its potential was especially significant in the area of ticket sales, where blockchain mechanisms could make transactions more secure. The immutability of the blockchain ensures the ability to track the entire journey of a ticket, making counterfeiting and unfair resale on the black market more difficult.

Another promising innovation for artists was NFTs. While primarily associated with visual arts, NFTs also presented opportunities for significant income in the music industry. Artists could sell digital collectibles, limited-edition tracks, or ownership rights to their music as NFTs (Non-Fungible Tokens). High-profile figures like Snoop Dogg, Eminem, Shawn Mendes, and Grimes embraced the NFT trend.

However, after an initial wave of enthusiasm, interest in NFTs has waned. It is now estimated that over 95% of NFT collections are considered “dead.” While there is potential for revival—since the value of NFTs depends on their perceived utility and demand—there is little indication that the market will regain momentum in the near future.

GenAI and monetization strategies

With the rise of GenAI’s popularity, an increasing number of creators are using these tools to make music. Platforms are emerging that transport iconic voices into modern genres. Jim Morrison singing reggaeton? Nina Simone rapping? With GenAI, such scenarios are now possible.

On the other hand, this is an unprecedented situation in the context of copyrights. The first court cases are currently underway, which will determine how GenAI-generated content is perceived and, consequently, its monetization potential.

Are you thinking of launching your own music streaming app? It might be the best moment, considering the recent disruptions made by GenAI and the growing openess of audiences to direct support forms. As an entertainement app development company working with such music giants as Dolby and Abbey Road Studios, we can help you succesfully bring your vision to life. The time for new monetization models and music premium features is now!Read our music app development guide for more technical tips and good practices for music app developers.

![[header] how is ai used in the music industry overcoming trust, fraud & transparency challenges with ai](https://www.miquido.com/wp-content/uploads/2025/04/header-how-is-ai-used-in-the-music-industry_-overcoming-trust-fraud-transparency-challenges-with-ai-432x288.jpg)

![[header] the future of music royalty management min](https://www.miquido.com/wp-content/uploads/2025/03/header-the-future-of-music-royalty-management-min-432x288.jpg)

![[header] top music industry events & conferences to attend in 2025](https://www.miquido.com/wp-content/uploads/2025/03/header-top-music-industry-events-conferences-to-attend-in-2025-432x288.jpg)