Things have been changing rapidly in the UK’s political and economical landscape in the last decade. But when it comes to tech, numbers don’t lie: the UK is one of the driving forces in the European continent.

There are 151,367 eCommerce businesses and apps in the country, and 48.4% of companies sell through mCommerce channels. Additionally, 42.6% of companies implement AI technologies, positioning the UK at the forefront of AI evolution in Europe, surpassing Scandinavian and DACH regions.

This rapid adoption of AI in eCommerce, combined with a strong mobile commerce presence, provides a perfect opportunity to examine the UK market closely. An integral part of the European continent yet an EU outsider, the UK serves as an intriguing matrix of changes and differences during the AI boom era.

In today’s article, we examine British mobile commerce statistics for 2024, trying to understand the possible future scenarios and the role of the UK in pushing global mobile commerce development forward.

How has UK defined what is mobile commerce today? What are the top eCommerce app features on the British market at the moment? Dive in and discover the mCommerce trends in UK.

Why is the UK Leading in mCommerce?

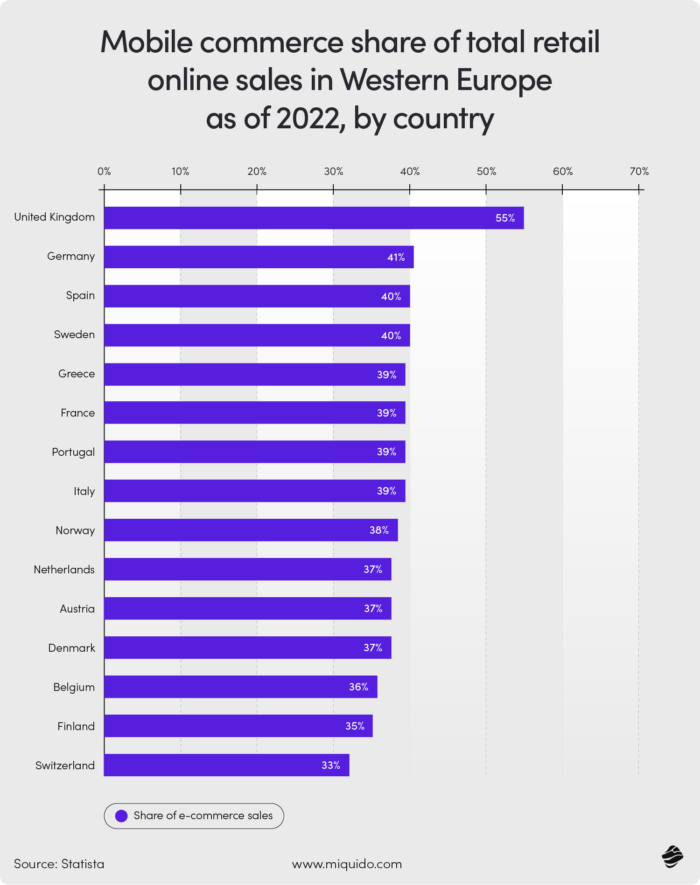

In 2022, about 55% of online retail sales in the United Kingdom were made through mobile commerce, with Germany following at 41%. This 14-percentage point difference is significant, leaving most European countries far behind. What is the reason for it?

The main factor is the high smartphone penetration rate—one of the highest in Europe. Companies can thus easily access the benefits of mobile commerce, having a broad user base at their disposal.

Additionally, the UK’s advanced mobile payment infrastructure makes mobile transactions more convenient and secure, encouraging more consumers to shop via their mobile devices. Despite relatively low 5G coverage compared to other Western and Central European countries, high-speed mobile internet provides reliable connectivity, translating to smooth mobile shopping experiences.

Why is the UK Leading AI Adoption in Europe?

Determining the exact reasons behind the UK’s leadership in AI adoption is complex, but several factors play a role. The most crucial is the strong investment landscape, with significant venture capital and government funding directed towards tech startups and innovations.

With this capital flow, apps are born more easily, making the UK a testing ground for new technologies. Notable examples include Skyscanner, Shazam, and Deliveroo — all industry-defining apps that originated in Britain. In mCommerce, Depop is another perfect example of a game-changing platform, having expanded globally shortly after its launch.

Market maturity also contributes to the flourishing AI adoption among UK eCommerce companies. Highly digitalized and automated, the local market is more ready to absorb AI and the opportunities it brings. With a highly skilled talent pool from world-renowned universities, the UK is well-positioned to remain at the forefront of AI implementation.

In-App Purchases and Social Commerce in the UK

The value of in-app purchases in the UK has been growing over the past two years and is expected to continue rising throughout this decade. From sports to books and music, the growth percentage between 2022 and 2027 is predicted to reach around 12% in the country.

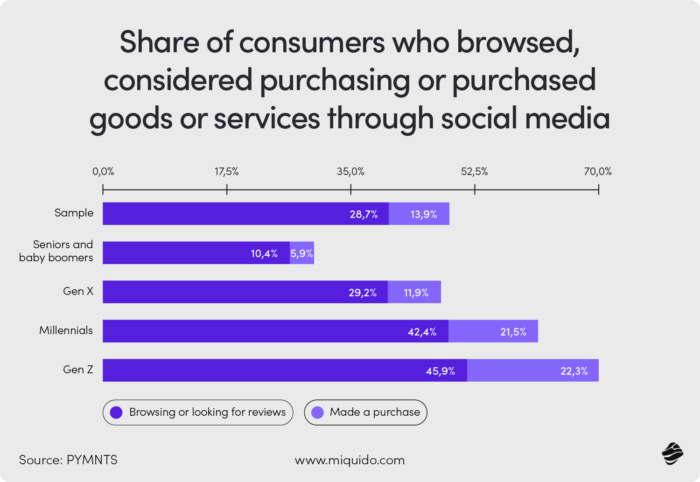

Gen Z is now a main purchasing power alongside Millennials. Both groups favor mobile devices, relying on social media to browse, check reviews, and make purchases, driving the further development of mCommerce. With purchase dynamics closely tied to mobile-first social media platforms like TikTok, mobile sales are set to increase.

And although social media are filled with posts where Millennials claim they switch to desktop interface with every “big purchase”, the statistics speak for themselves: mCommerce is strengthening, both in the UK and globally.

Mobile Commerce Trends in UK by Industries: Who is Selling the Most?

According to Statista, the segment generating the highest revenue in mCommerce is clothing. Statista Digital Market Outlook estimates that by 2028, this segment alone will generate approximately $9.63 billion in revenue.

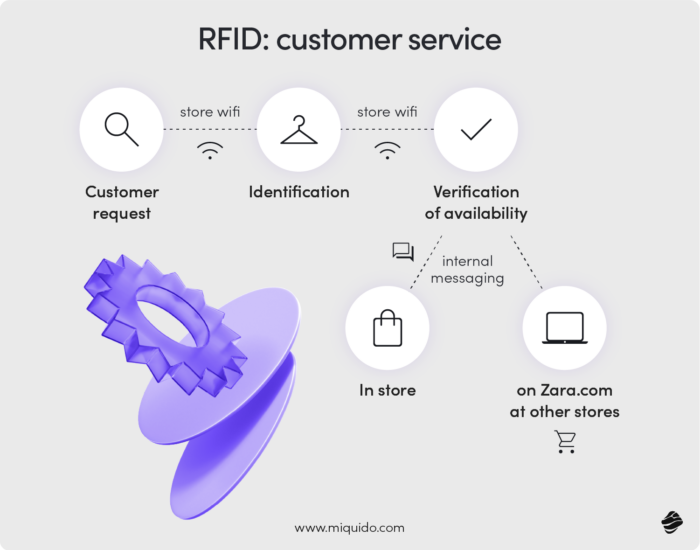

The UK mirrors the global trend, with clothing being the most purchased product category through mobile, with a share of mobile sales in this sector as high as 68%. The fashion industry has a long history of driving innovations that influence other sectors, like Zara’s RFID technology implementation, which later became standard in retail, healthcare, and logistics.

Both global and local fashion brands are UX pioneers, creating mobile-friendly designs that build a strong foundation for increasing mobile user traffic. Notable names include the international garment giants like Inditex or Shein, but also UK-based ASOS and Boohoo.

Deliveries rank second despite their mobile-first nature, as the number of companies providing delivery services is relatively small. However, the sector grew by 12.8% in 2023.

Other popular mobile purchases in the UK include food and beverages (50%), event tickets (42%), shoes and electronics (40%), books (37%), and accessories. Paying for services, like booking appointments, is less popular, with only 26% using mobile apps for such purposes.

mCommerce trends in the UK: which ones are here to stay?

Companies in the UK ecommerce and startups not only follow global trends in mobile commerce development but often set new paths in this area. Personalization is currently the main focus in mobile app development, with both AI and GenAI taking it to a new level.

Voice search optimization is another key point of interest, as the number of voice assistant users is increasing year by year. Among British users, Alexa leads the way, though Google Assistant and Siri are also popular.

Companies are competing in implementing features that create personalized shopping experiences. To achieve this, advanced personal and geolocation data must be utilized. All such implementations should be accompanied by safety measures like data encryption and processes ensuring compliance with regulations such as GDPR. Even though the UK has left the European Union, its version of this directive has been retained.

mCommerce Payments in the UK: Mobile Payment Solutions and Their Growth

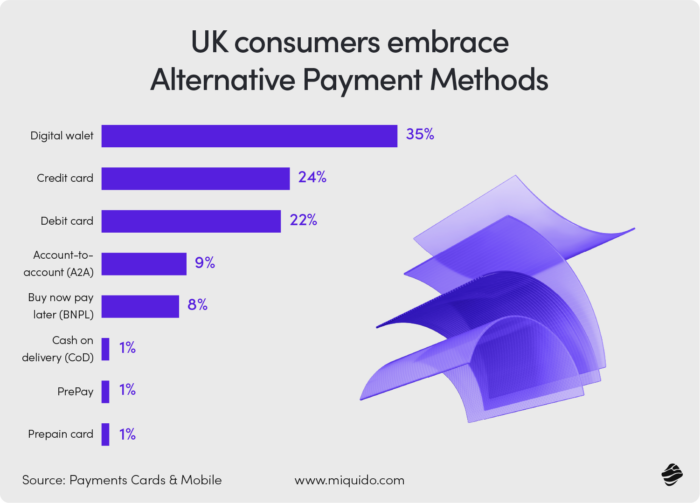

As mentioned earlier, the UK’s mobile payment infrastructure is well-developed, aligning with the overall growth of mCommerce. UK mobile app users commonly use solutions such as Apple Pay or Google Wallet and expect access to a variety of payment options.

For a long time, Barclays’ Pingit was a popular payment option in the UK. However, in 2021, the British bank withdrew it due to the rise of more popular alternatives. Despite the availability of various digital wallets, credit and debit cards remain the primary choice for online payments among Brits.

Personalized shopping experience shaping mCommerce in the UK

Advanced personalization of shopping experiences is becoming standard due to increasing competition in the eCommerce sector. The development of GenAI supports this by providing companies with powerful and creative tools to enhance customer service. The UK is no exception, with personalization particularly evident in clothing, footwear, and retail sectors.

Department stores, a British international heritage and trademark, are notably evolving. In the digital age, they must invest in their online development, aiming to translate high-quality in-store experiences to online platforms. John Lewis Partnership is a prime example.

In 2023, the company signed a £100 million deal with Google Cloud to enhance customer experience using advanced AI and machine learning technologies. The partnership leverages AI to provide highly personalized shopping experiences across John Lewis and Waitrose platforms. Their mobile app tracks users’ browsing and purchase history to recommend tailored products and uses location-based data to offer relevant in-store promotions and personalized notifications.

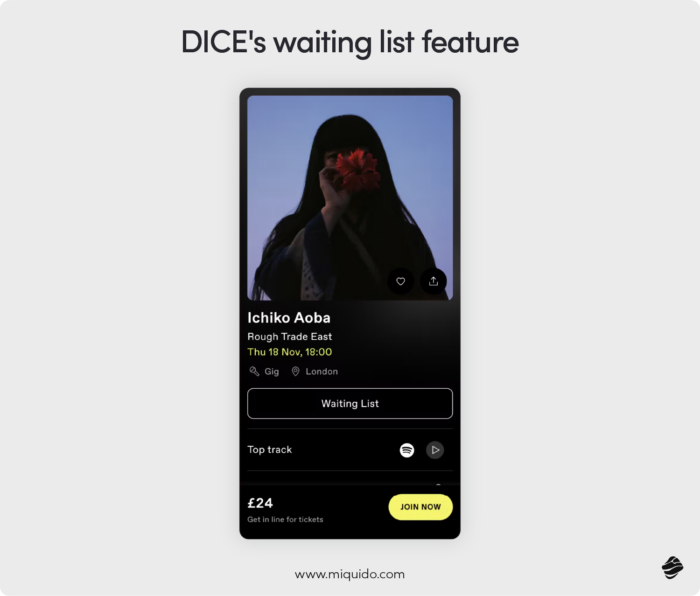

Despite the strongest presence in the fashion industry, advanced personalization is also used by other UK mCommerce niches – oftentimes, with impressive outcomes, as the example of DICE shows. Founded in 2014 in London, today the app has a strong user base in the UK, but also outside the country. It has expanded significantly in the US, especially in cities like New York and Los Angeles, but also in Portugal or Spain.

DICE’s strong emphasis on mobile-first design and personalized recommendations based on user preferences and past purchases sets it apart from other ticketing platforms. A sophisticated recommendation algorithm and seamless integration with Spotify upgrades it to a discovery tool rather than just a ticketing app.

On the other hand, it facilitates ticket exchange with friends, all while providing unique features such as mobile-only ticketing to prevent scalping. No tickets are lost on the secondary market, setting fair standards for venues and artists. DICE’s take on transparency is refreshing, eliminating hidden fees and offering a waitlist feature that allows fans to join a queue for sold-out events.

Augmented Reality (AR) and Virtual Reality (VR) in the UK mCommerce landscape

Mobile commerce trends in UK reflect the global ones, with more and more mobile applications incorporating AR or VR functionalities. In many industries, especially clothing and beauty, such features boost conversion rates. The apps allow users to virtually try on products or see how they look in their environment, breaking down purchasing barriers.

ASOS, a British leader in the fashion industry, is a pioneer in leveraging AR to drive sales. Its award-winning app includes “Match With Style,” an AR-powered search feature that enables users to find products by uploading or taking photos. The app also streamlines the checkout process with a camera card scanner, reducing shopping cart abandonment.

AI Act vs. legislation in the UK: How do they differ and how may it impact eCommerce

Considering that the UK is no longer part of the EU, the AI Act coming into force in the following months will not directly affect it. However, UK businesses deploying their AI systems in the EU will have to adjust to its regulations.

At this point, the UK’s approach to regulating AI is much less formal than that of the European Union. Although government authorities do not exclude the implementation of a regulatory framework in the future, they have decided to avoid forming super regulators for now and adopt a pro-innovation approach.

It looks like the UK aims to balance safety and innovation without the detailed procedural obligations characteristic of the EU model. Time will tell if this approach will pay off. Undoubtedly, a lightweight stance on implementing AI could propel the UK to the forefront as a European leader in innovation in this area. On the other hand, early implementation of strict regulations at such an early stage could prevent the intensification of unethical and non-transparent practices in the areas of copyrights and the use of private data.

Mobile commerce trends in UK: profit from them!

Working with companies from the UK market (including Abbey Road Studios), we understand the realities of the UK market and continuously update our knowledge, which we can translate into valuable insights for your company. As an ecommerce app development company, we combine our industry and market expertise to help you create a successful mobile product from scratch or successfully launch it in the UK.

Whether you are looking for mobile commerce development services or simply curious about mobile commerce trends in the UK and beyond, our blog is full of articles and reports that can help you refine your eCommerce strategy.