Although relatively small in size, Europe is extremely diverse in its business landscape, as shown in our recent mobile commerce research. Customer habits and behaviors can vary dramatically from the Costa Blanca to the Norwegian fjords or a major Silesian city.

Europe is built on consumer contrasts. Both open to innovation and traditional at the same time, it embraces mCommerce with caution. Which countries could become major development drivers in the coming years? Will the new generation change the script for European mCommerce?

The European mobile commerce statistics for 2024 that we gathered from various sources in this article shed light on the answers. Numbers do not lie – benefits of mobile commerce are evident, but if you launch your mobile app in Europe, there are a few essential things you should know. Dive in!

eCommerce in Europe – Online Shoppers Landscape

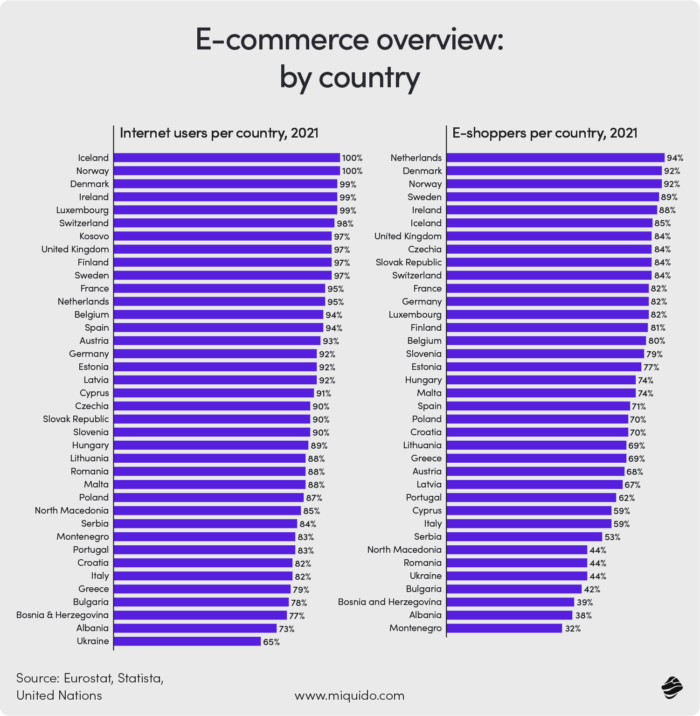

Whether mobile or desktop, let’s explore general statistics on eCommerce as a starting point. According to the Europe E-Commerce Report 2022, Western and Northern Europe boast higher numbers of online buyers compared to Middle-Eastern and South-Eastern Europe. Scandinavia leads the rankings, with the Netherlands at the top (94%), followed closely by Denmark (92%) and Norway (92%).

France and Germany sit in the middle (both at 82%), while Czechia and the Slovak Republic surpass them with 84%. Poland ranks surprisingly low at 72%, and the Balkan countries, along with Albania and Ukraine, rank the lowest, with Montenegro being the lowest at 38%.

Western Europe remains the leader in eCommerce with the highest turnover and significant contributions to GDP. Northern Europe exhibits high internet usage and a large proportion of e-shoppers, indicating a mature eCommerce market. Eastern Europe, while experiencing higher growth rates in B2C eCommerce sales, still lags behind in overall turnover and GDP contribution compared to Western and Northern Europe.

mCommerce Development in Europe by Country

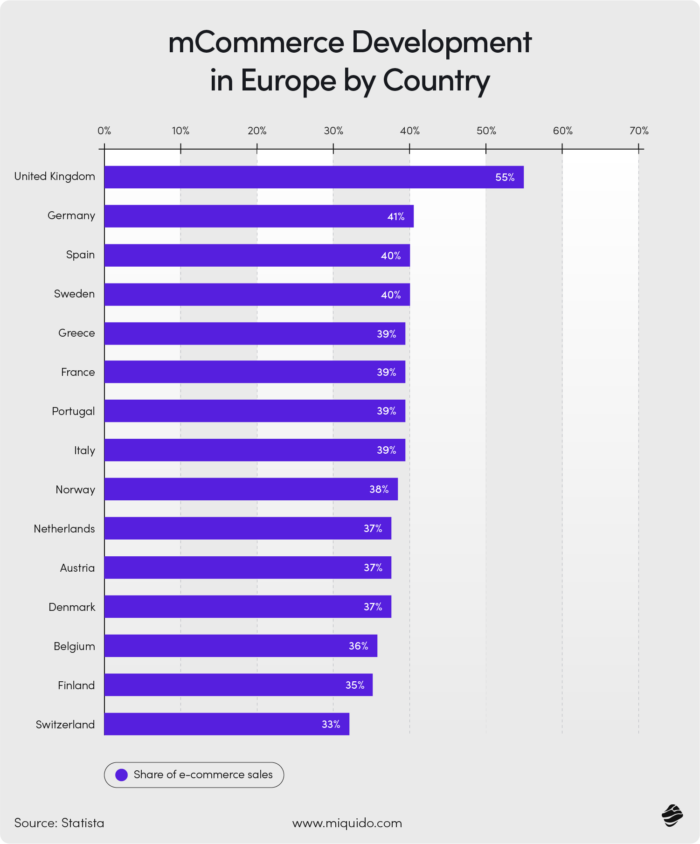

Interestingly, mobile commerce (mCommerce) shows different trends. The UK leads with 55% of shoppers using smartphones for purchases, leaving other European countries behind. Germany and Spain follow, despite ranking mid-range in general eCommerce.

Greece also shows a high mCommerce rate (39%), although Greeks are generally reluctant online shoppers. This suggests that a strong eCommerce and mCommerce presence don’t always go hand in hand. In some cases, if consumers must shop online, they prefer using a smartphone, which they always have on hand.

The development of mCommerce in a country is significantly influenced by the state of mobile infrastructure and smartphone penetration. For more insights, check out our article on mCommerce in the UK, which is an example of a mobile commerce powerhouse.

Mobile Shopping Preferences in Consumer Behaviour in Mobile Apps

What do Europeans buy most through mobile? How do they make these purchases? Do they have specific habits? In this section, we examine mobile shopping preferences and beyond. Analyzing these behaviors offers insights into the economy and demographics.

Popular Products in Europe through Mobile Channels

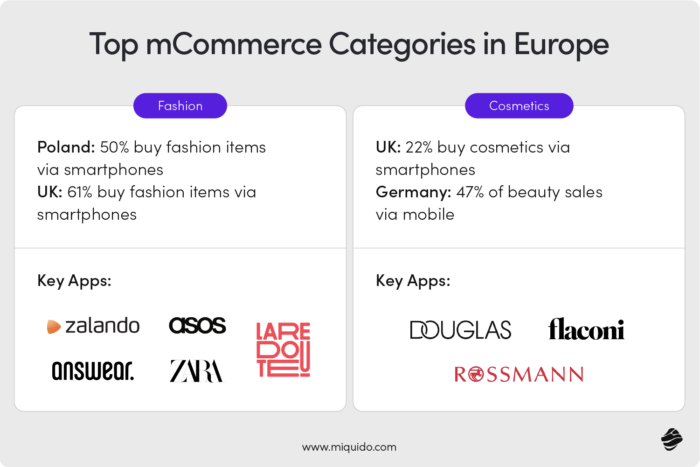

Fashion is the undeniable winner in mCommerce across Europe. In Poland, at least 50% of clients buy clothing, footwear, and accessories via smartphones, and in the UK, it’s 61%. Fashion mobile apps like Germany’s Zalando, the UK’s ASOS, Poland’s Answear, Spain’s ZARA, and France’s La Redoute set industry standards.

Cosmetics, however, are purchased through mobile channels by only 22% of Brits, whereas Germany sees 47% of online beauty sales from mobile. Other DACH countries also show high percentages. German giants like DOUGLAS, Rossman, and Flaconi emphasize digital integration across all sales channels, including mobile.

DOUGLAS’s mobile app, with its excellent reviews, reflects ongoing development and the rise of mobile shopping. Rossman also heavily invests in its app, offering promotions exclusive to mobile users. The way how is AI used in ecommerce also impacts the rise of mobile traffic. With shopping decisions being made faster and often more impulsively due to the mobility, retailers are polishing recommendations and data usage, finding these precious windows of time when the chances of conversion are the highest.

Sustainable Shopping and mCommerce Development

Another growing trend is the demand for eco-friendly products. Over 70% of German consumers consider sustainability when purchasing cosmetics. This trend impacts mCommerce by necessitating new mobile ecommerce app features. Retailers diversify their offerings and enable product origin verification.

For example, mobile apps now offer barcode scanning to check if products are eco-friendly. This trend is also visible in B2B eCommerce, with Alibaba’s improved Request for Quotation (RFQ) feature addressing sustainability terms serving as a good example.

Small European countries often emerge as leaders in sustainability. Estonia, a highly digitalized country, is an excellent example. According to DPD’s annual pan-European e-barometer consumer survey, 53% of regular Estonian e-shoppers believe that brands and companies should take environmental responsibility. Emerging startups and mobile apps in Estonia cater to these needs.

eCommerce/mCommerce vs. In-Store Shopping

Even though stores invest heavily in streamlining return processes, many Europeans still prefer in-store shopping or combine both methods. An interesting phenomenon is the ROPO Effect (Research Online, Purchase Offline), especially visible in Poland for electronics and home appliances, with 40% of consumers researching products online before purchasing them in a physical store. This effect is also notable in the footwear category, but interestingly doesn’t translate to clothing.

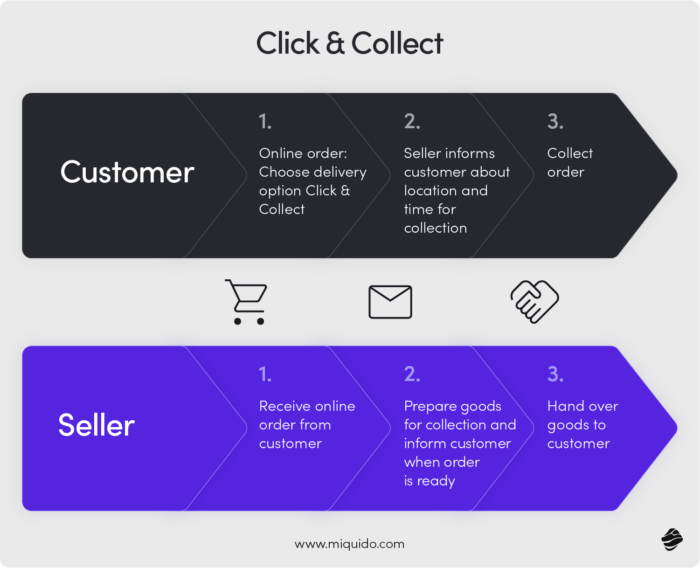

European eCommerce businesses are aware of this mechanism and introduce features aimed at smoothly bridging digital and physical shopping experiences. Features like Click & Reserve and Click & Collect allow easy reservation and collection of products ordered online in physical stores, securing conversions.

Analyzing the progress of mCommerce in Europe, it’s important to consider age-related factors, which are closely tied to the sector’s expansion. Gen Z naturally dominates the statistics when it comes to shopping with mobile apps. Older adults (50+) are generally less active in online shopping across many categories.

Therefore, in countries with a higher average population age, the penetration of eCommerce and mCommerce may be lower. The statistics prove it, with countries like Italy ranking low in both eCommerce and mCommerce adoption.

Social Commerce in Europe: Is mCommerce Moving to Social Media?

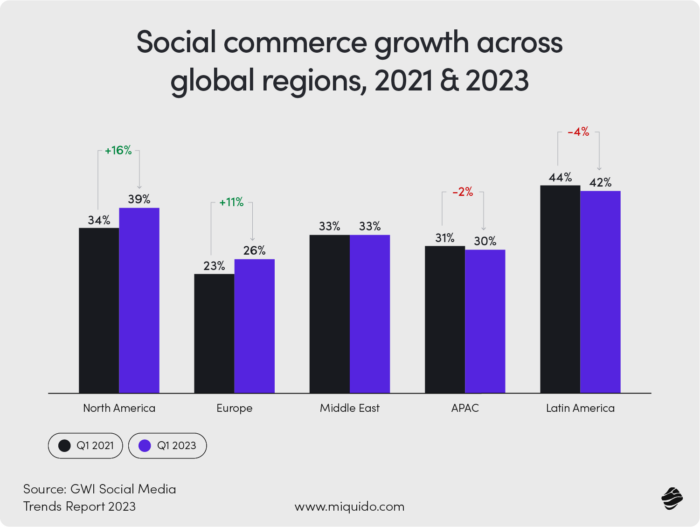

Although Europe is not lagging behind other continents in eCommerce development, social commerce presents a different story. According to the 2023 Deloitte report “The Rise of Social Commerce,” only 26% of platform users in Europe have used social commerce services in the past month, the lowest among the studied regions (Europe, China, North America). However, social commerce is still growing in Europe, with sales in these channels increasing by 11% since 2021.

What causes the significant difference in approach to social media? A key factor is that eCommerce platforms have been developing intensively in Europe for many years, and users may simply lack the motivation to seek other sales channels. Additionally, European data protection regulations, such as GDPR, can hinder the rapid expansion of social commerce platforms (take Meta and its Facebook Marketplace’s case).

Influencers, directly linked to social media, also have less impact on European consumers’ choices. According to Deloitte, 28% of European shoppers express a desire to purchase directly from influencers, compared to 41% globally. Consumers’ attitudes towards influencers may reflect the general legislative climate. In the past two years, many European countries have established quite restrictive regulations to govern influencers’ activities, with more on the way.

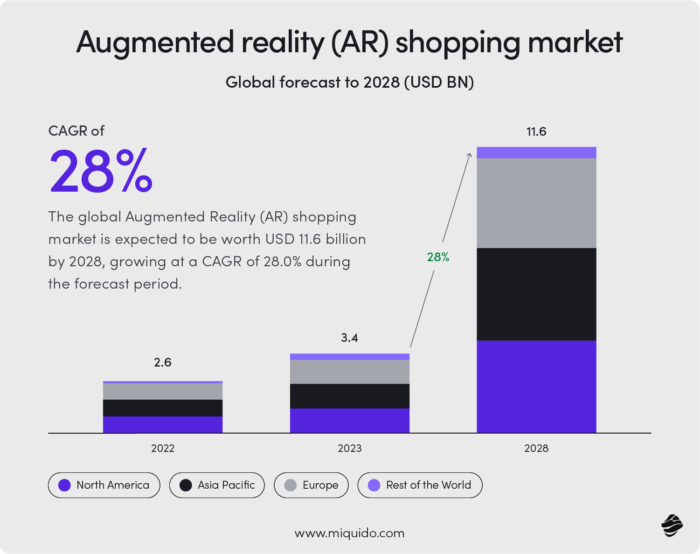

Research shows that the old continent is indeed old-fashioned in some aspects. The approach towards new technologies in eCommerce and social media commerce is quite cautious. For instance, only 50% of European customers participating in Deloitte’s study are interested in Augmented Reality (AR) shopping experiences, compared to 60% globally.

When it comes to social media channels, the differences between continents are striking. Latin America is a staunch Facebook supporter, with 39% of online shoppers likely to purchase through this channel. Asia-Pacific, on the other hand, treats Facebook equally as TikTok, a platform that has very little outreach in terms of social media commerce on other continents (however, it’s growing). Both Latin America and the Middle East love shopping through Instagram and WhatsApp, social media channels that have relatively low outreach in North America, Asia, and the EU.

mCommerce in Europe: Consumer Behaviour in Mobile Apps, Purchase Motivation, Device Usage, and Payments

As you can see, mobile shopping stands strong in Europe, and mobile app providers put continuous effort in fulfilling their expectations in this field. But let’s think of the basics – sometimes the simplest questions are the most interesting. Why do consumers prefer mobile shopping?

Consumer behaviour in mobile apps reveals that the primary motivation for mobile shopping is convenience, with 70% of respondents indicating that the ability to shop anytime and anywhere is the main reason for using mobile devices for purchases. As app-exclusive offers become more common, consumers have another reason to stick to the mobile channel.

Simplified shopping paths with features like Tap and Pay also play a significant role. In Europe, shopping via smartphone is often easier, as companies have focused on perfecting their mobile apps, previously somewhat neglected in favor of the desktop platforms, following the principle, “if it’s not broken, don’t fix it.”

Preferred Devices for Mobile Shopping

Smartphones are the preferred device for mobile shopping, with 80% of mobile transactions conducted on smartphones compared to 20% on tablets. EU-wide roaming supports mobile-first habits, facilitating cross-border mobile app usage and allowing customers to rely solely on their smartphones.

Popular Payment Methods in Mobile Apps

Europeans increasingly use mobile wallets such as Apple Pay and Google Pay. 45% of mobile shoppers use them as their preferred payment method, surpassing traditional credit/debit cards. The Polish mobile payment landscape is an interesting exception, with fast online bank transfers being the most popular payment method, used by 69% of online shoppers. Blik, a mobile payment service, follows closely at 63%, leaving cards in third place according to the Gemius E-commerce Report 2023.

Use consumer behaviour in mobile apps for your own benefit

As a company providing custom mobile commerce development services, we strive to stay up-to-date with market trends and share our insights with you, ensuring everyone is on the same page. We understand what is mobile commerce through firsthand experience and leverage our expertise to secure your market success. Whether you have an idea for a mobile solution or simply want to explore future possibilities, let’s chat – it’s always worth it!

![[header] how is ai used in the music industry overcoming trust, fraud & transparency challenges with ai](https://www.miquido.com/wp-content/uploads/2025/04/header-how-is-ai-used-in-the-music-industry_-overcoming-trust-fraud-transparency-challenges-with-ai-432x288.jpg)

![[header] benefits of competitive analysis in your business strategy](https://www.miquido.com/wp-content/uploads/2025/04/header-benefits-of-competitive-analysis-in-your-business-strategy-432x288.jpg)

![[header] off the shelf vs. custom ecommerce software](https://www.miquido.com/wp-content/uploads/2020/05/header-off-the-shelf-vs.-custom-ecommerce-software-432x288.jpg)