Many traditional banks have responded to digitalization. Technology advances at breakneck speed, and many in the banking sector don’t know which digital solutions to adopt. Since the existing platforms continue to serve their original purpose, these companies continue with legacy software.

The problem is the tech revolution hasn’t just introduced new tools for daily living. It has changed consumer behavior and expectations. The modern customer demands convenient and instant access, which old banking platforms struggle to provide.

Sooner or later, banks must grapple with how (not if) they should upgrade their systems. According to IDC predictions, investments in direct digital transformation will reach $7.1 trillion as organizations become digital enterprises.

This article will guide you through modernization strategies for your core banking platforms. It will help you identify the signs your system needs to modernize, outline objectives and processes for a modernization strategy, discuss various approaches, and highlight the risks you should mitigate.

What are legacy financial systems?

A legacy system is an outdated technology infrastructure that an organization continues to use. In the financial sector, this is obsolete hardware and software that supports core banking operations such as account opening, transaction processing, and more.

40% of banks use COBOL, a programming language developed in 1959, as the foundation of their systems.

If it still works, why fix it? Right?

Many legacy platforms are custom-built solutions, and the cost and complexity of upgrading current systems can be prohibitive.

The issue with using legacy financial systems is it restricts a bank’s ability to grow. Limited integration, security vulnerabilities, and operational inefficiencies reduce the organization’s ability to deliver new products, services, and customer experiences. As a result, they can’t compete with modern fintech solutions.

Furthermore, experts familiar with legacy systems in banking are aging out of the market, with no one to replace them.

The digital revolution waits for no one. You have to modernize sooner or later.

Signs you need to modernize your legacy financial system

If you’re unsure about updating legacy core systems, the following reasons for legacy app modernization may help you decide.

- Limited integration

Compared to SaaS solutions that work with third-party tools, legacy core banking systems aren’t equipped to talk to other applications. Consequently, they aren’t compatible with other new software, making integration with mobile and other innovative apps difficult.

- Data silos

Since legacy tools don’t integrate, they create silos, which require workarounds to pass data across your ecosystem, e.g., digital channel transactions to core banking.

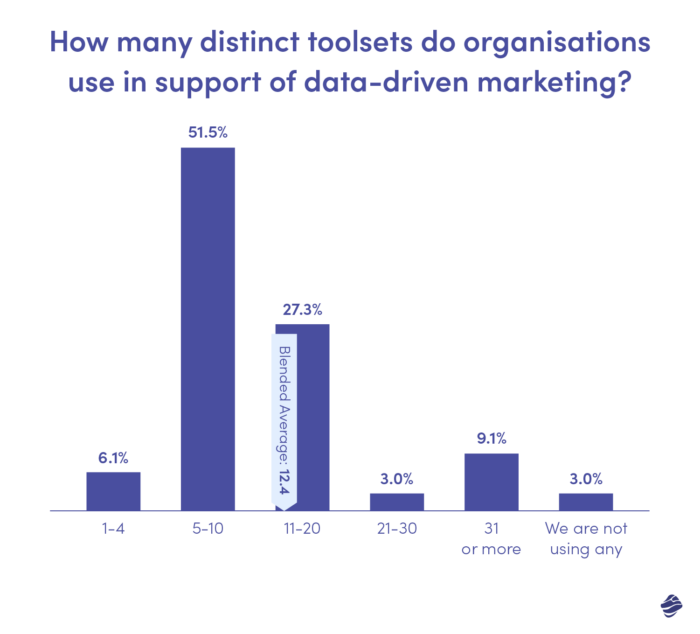

The average organization uses between 11 and 20 different tools, with their own dashboards, analytics, and data sets, in marketing alone.

Data silos lead to inefficient processes and impede your ability to deliver fast and accurate service. They also create opportunities for cybercrime.

- Security and compliance issues

Data silos make it difficult to identify and respond to security threats. Multiple data entry points increase opportunities for hackers to access your system.

Furthermore, the complexity of legacy systems, with continuous development and numerous databases, makes it challenging to locate personal data, which regulations like the GDPR (General Data Protection Regulation) mandate should be encrypted and stored securely.

- Limited automation

So far, legacy systems can leverage automation to optimize efficiency and performance. The next leap in automation is artificial intelligence and machine learning. Unfortunately, legacy systems can’t take advantage of the full potential of these technologies.

For instance, the large amount of centralized data required for machine learning slows down legacy systems.

- High costs

Holding onto outdated banking legacy systems comes with apparent and hidden costs. A case study on the cost of legacy systems shows that banks and insurance companies spend up to 75% of their IT budget on maintaining legacy systems.

That’s not all.

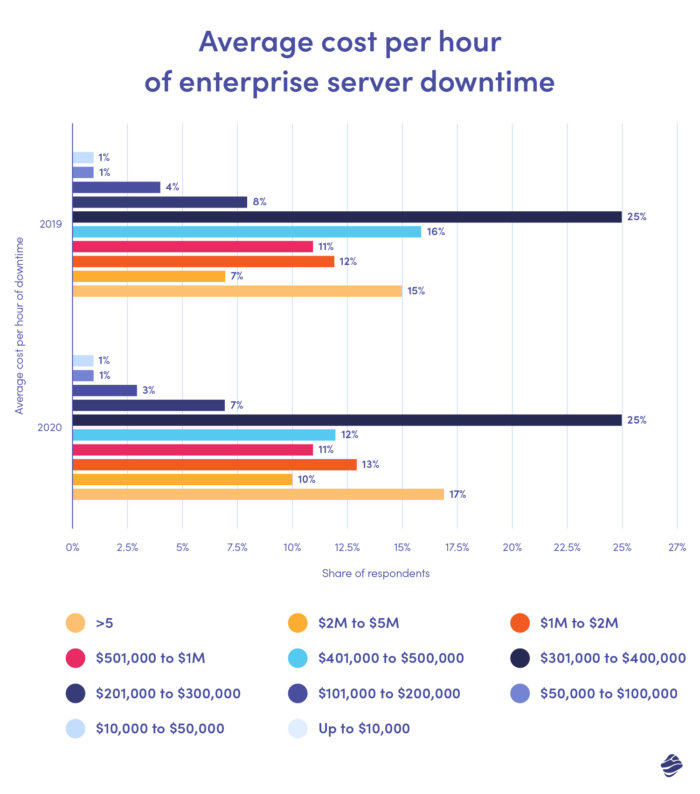

The above graph shows the average hourly cost of server outages for 25% of surveyed respondents is between $300,000 and $400,000.

The hidden costs of these systems include:

- Missed business opportunities: legacy systems don’t integrate with new software, limiting growth.

- Security vulnerabilities: legacy systems can’t handle modern cyberattacks, leaving institutes vulnerable to regulatory violations and fines.

- Operational inefficiencies: legacy systems require manual updates and maintenance, reducing employee productivity.

- Poor customer experience: legacy systems can’t meet customer expectations for fast, convenient, and user-friendly processes, reducing your competitive edge.

So, while you think you’re saving money keeping legacy systems, you’re actually losing more.

Setting objectives for a legacy financial system modernization process

Before you jump into modernizing your legacy banking system, you need to outline objectives for this project. Setting goals allows you to communicate the purpose of the task, understand your capacity, prepare accordingly, track progress, and assess performance.

Examples of goals you should be setting for updating old banking systems include:

- Improved efficiency

- Enhanced security

- Reduced costs

- Enhanced scalability

Be sure your goals align with the overall business strategy. Think about this.

Well-defined objectives helped Atom Bank identify the need for a cloud-based banking system. As the bank began to scale, it outgrew its legacy software. It required a core banking platform that supported its projected growth and vision for transformative banking, which cloud-based technologies provide.

Twelve months after launching its core banking system on Google Cloud, Atom Bank reported a significant increase in positive customer reviews due to faster speeds and smoother app performance.

How to create a legacy financial system modernization strategy

You’ve identified your organization’s need to modernize its legacy tools and the goals you hope to achieve with the project. Now, let’s explore steps to ensure a successful digital transformation.

1. Analyze your legacy system

The first step is analyzing your system’s shortcomings. Here are several questions to guide your evaluation:

- How does the system limit business opportunities, and what are the opportunities?

- Where is the business losing value?

- Which parts of the system are agile (and which aren’t)?

- What are the costs of maintaining the legacy system?

- Is the current maintenance sustainable and scalable?

- What are the security and compliance vulnerabilities?

Be sure to get input from key decision-makers and stakeholders who use the system’s core services.

2. Understand your business processes

You shouldn’t pursue digitalization projects in isolation. You must understand how organizations get work done to optimize the modernization process. Aligning IT capabilities with business processes ensures you achieve the overall business goals.

To do this, conduct a process analysis to see how data moves within your bank’s ecosystem. What are the decision-making points? How do different departments interact with data and each other? How do customers interact with the bank’s services?

Completing the process analysis puts you in the position to know if you should optimize, upgrade, or replace your legacy system.

3. Evaluate modernization options

Now that you understand the system’s technical condition and the business requirements, you can make informed choices on which modernization scenario best meets your needs.

There are two ways of dealing with legacy problems: revolutionary and evolutionary.

Revolutionary modernization involves shutting down the old systems and starting from scratch with a new one. Evolutionary modernization modifies the current legacy system step-by-step and focuses on solving specific problems.

As you can imagine, the revolutionary method is more expensive and risky than the evolutionary method and comes with considerable disruptions to business processes. However, the latter doesn’t address underlying factors causing system problems. You have to decide if the cost of an overhaul outweighs the cost of security breaches or system downtime.

4. Involve key stakeholders

Legacy modernization is a team effort and requires cooperation between key stakeholders, such as management, IT teams, and end users.

Each party brings expertise and insight to ensure the project meets its objectives. The management faction ensures the project aligns with overall business goals, IT personnel execute the digital transformation, and end users provide feedback on system performance.

Involving stakeholders early on ensures you receive all the requirements for the project. It also reduces resistance in the implementation stage and prepares employees for the upcoming changes.

5. Pick a suitable solution

With all the information above, you can now select a suitable solution for your project. Choose the option that provides the highest effect and value by mapping each approach across functionality, risk, and cost.

If you haven’t already done so, consult with expert legacy app modernization services. Miquido can help you prioritize your goals, choose the most appropriate architecture and cutting-edge tech stack, and advise you on various issues that will come up. We have experience modernizing mobile and web applications, from product strategy consulting to front and backend development.

Modernization approaches

There are several modernization techniques, each handling code and legacy infrastructure differently. Besides the technical aspects of the project, your budget and project timeline will also determine which approach you will implement. The easier the method, the less risk, cost, and disruption to business processes.

Encapsulation

Encapsulation extends the life of legacy systems by making their functions and data available via API. The legacy code is wrapped in new code, enabling it to integrate with modern software. That gives the legacy a revamped look while keeping the original code intact.

This method is best suited for legacy systems with high-quality code. It carries minimal risk and is a cheap and fast modernization solution. Unfortunately, it only addresses superficial problems with the legacy software. Deeper issues, such as maintenance, will continue.

Rehosting

Rehosting is moving the banking system into a different environment (e.g., a new server) without changing the code. It gives your software a performance boost, increasing efficiency.

This method carries the lowest risk and cost. It is also the fastest modernization solution, with minimal impact on business processes since the system operates as usual. That also means you retain the limitations of the original code.

Replatforming

Replatforming moves your banking systems from an outdated platform to a new one. It allows you to leverage the latest technologies that improve performance, reduce maintenance costs, enhance security, and increase scalability.

This method is best suited for banks whose current platforms lack scalability. It requires changes to the original code to function in the new program. It also comes with risks related to data loss, system downtime, compatibility issues, and disruptions to business processes.

Refactoring

Refactoring involves changing the structure of the existing code to solve its underlying inefficiencies and improve performance. You would use this method with poorly written code that is hard to maintain.

The advantage of this method is it allows you to customize the code. Since you’re only optimizing the code, you don’t have to retrain users to use the software. The downside is it carries higher risk and cost. You need a team of skilled developers to reduce the technical debt, and the development cycle is longer than the solutions mentioned above.

Rearchitecting

Rearchitecting involves significant changes to code to adjust it to a new architecture, for instance, switching from a monolith to a microservices architecture. It allows legacy systems to leverage the capabilities of new environments and integrate with advanced technologies.

This method has increased risks and costs, including disruption to business and data loss. The process takes months and is expensive, with two teams working on the old and new architecture to keep operations running.

Rebuilding

Rebuilding is rewriting the code from scratch without changing its scope or specifications. The difference between rearchitecting and code refactoring vs. rewriting is the difference between renovating and rebuilding a house.

You get the benefit of removing redundancies and adding new features. However, this modernization method can be a hard sell to large legacy banks. It is an extensive project that can take months, even years, to complete.

Replacing

Replacing takes rebuilding to the next level – new scope and specifications. Essentially, it’s a different banking app. You would use this option if the security risks are unacceptable, the maintenance costs exceed replacement costs, vendor support no longer exists, or the system doesn’t align with the organization’s long-term goals.

Modern technologies that support legacy banking system modernization

Whatever modernization method you choose, there are technologies you must adopt to facilitate the process.

- API enables core systems to integrate with third-party applications like digital payment systems.

- Cloud computing allows institutions to outsource IT infrastructure, reducing the cost of ownership while delivering faster, scalable services.

- Microservices divide the systems into independent services, facilitating quicker modifications without affecting the entire application.

- DevOps practices help the institution deliver new features and updates faster, ensuring regulatory compliance and a competitive edge.

Potential risks associated with modernization

Modernizing your legacy banking systems is the right step toward total digital transformation. However, there are potential challenges you should prepare for to ensure a successful transition.

- Data loss: Legacy systems accumulate lots of valuable data, which will migrate from the old application to the new one. Data loss during the migration process is a devasting reality. To mitigate this scenario, backup data to multiple locations, like cloud storage or external hard drives.

- Data security: Data is also vulnerable to cyberattacks during the migration process. Changes in the code and environment create opportunities for unauthorized access and data leaks. To reduce security risks, apply data security best practices and use database transfer tools with data protection features.

- Integration issues: Most legacy financial systems are incompatible with new technologies. Therefore, you can expect data inconsistencies or process disruptions. You can mitigate these by conducting integration testing to catch and resolve compatibility issues early.

- Business disruptions: Any change to the banking code or environment will disrupt business operations, impeding productivity and customer service. Develop a continuity plan to minimize the impact of these disruptions, including a phased implementation approach.

Don’t let these challenges scare you from modernizing your legacy banking systems. You can overcome most of them with careful planning and by partnering with the right banking software development agency.

For example, the Royal Bank of Scotland successfully re-platformed its legacy system from physical servers to the cloud. The result was a $9 million savings in manual server processes two years after implementation.

Why you should partner with a software development agency for modernization projects

Modernizing legacy banks can be overwhelming, from correctly analyzing banking applications to choosing the best modernization approach and implementation. The process is complex and risk-prone.

Fortunately, the right digital modernization agency can guide you through your project. The ideal choice is a full-service company with over ten years of experience and a top 7% Pangea verification for software development.

Miquido ticks these boxes, and that’s how we’ve consistently delivered exceptional products for fintech companies like Nextbank and BNP Paribas. Check out our portfolio for cloud migration, code refactoring, software auditing services, and more.