It’s hard to imagine a banking institution without a mobile app nowadays, and with good reason. Mobile banking solutions are changing the financial market year by year, with the demand for a smooth, convenient online banking experience increasing along with the digitalisation of the sector.

So where should you start if you want to craft your own banking app? Read on to find out!

This short guide is a part of our Fintech: the ultimate guide to the finance app sector report. Download the ebook to learn everything you need to know about mobile banking in 2025!

Fintech solutions adoption is on the rise: check the numbers

- Mobile banking apps serve a growing number of users: As of 2024, 63% of bank account holders in the United States processed banking matters via mobile devices, up from 58% in 2019.

- Younger generations reach out for fintech app solutions much more often: Approximately 68% of Millennials and 64% of Generation Z primarily use mobile banking apps, while 55% of Generation X do the same.

- Mobile fintech and budgeting apps are becoming an integral element to our routine: 45% of consumers perform finance-related tasks on a mobile app at least once per day.

- When times are changing, fintech apps come as support: 55% of consumers report that fintech mobile apps assist them in managing economic challenges. During economic downturns, 56% of individuals have turned to fintech apps to navigate financial instability.

If you are thinking of entering the fintech industry with your solution, the time might be now! Our short guide combines the experience we gathered through the years as a fintech app development company. Discover our fintech app development process and real-life projects that prove its effectiveness!

Building your financial app step by step

Prepare for building a fintech app that grants success. Whether it is a budgeting, mobile payments or wallet solution, these steps will help you prepare for the challenges of the fintech market.

1. Research

Thorough research is perhaps the most important stage when it comes to fintech app development. Having an idea is the first step toward realizing your goals, but in order to succeed, you’ll need a solid base of knowledge about your user base, the fintech market, and your competitors.

Don’t risk putting out a product that’s not suited to user needs or one that’s a copy-paste of what’s already available. Instead, use the information you’ve gathered to create a finance app that will give your clients exactly what they want.

2. Idea validation/prototyping

Prototypes are visual representations of potential products meant to help you illustrate various versions of what your app is going to look like. Prototyping is a very important part of the process, as it shows you the areas where your ideas might be lacking, and in turn, helps you to choose the most suitable UX/UI solutions for your banking app.

With your prototype ready, you can start to collect feedback from actual users. Their insights will help you find the right balance between their needs, industry trends and your own business goals.

3. Building the MVP

You have probably heard the term before, but just for clarity’s sake: A Minimum Viable Product is a version of your product that has enough features to satisfy early adopters, which means it’s essentially a basic version of your product that’s ready to be put on the market. The main goal here is to gain user feedback on your banking app and learn what you should improve.

Developing an MVP instead of a full-fledged version of your financial app will help you to save both time and money. By creating a Minimum Viable Product, you put your focus only on the most important features, instead of building complex software. As a result, the time to market is much faster and cheaper, not to mention the decisions made based on user feedback will no doubt save you some costs.

4. Further development

After you’ve gained valuable feedback from your users, you can focus your efforts on design and development enhancements for your product. Make sure to equip your app with a personalised UI and UX design, and put an emphasis on intuitiveness as well as top-notch security. Remember to make use of what you’ve learned with crafting your MVP – leaving the app as-is is also a valuable option, and you can choose to focus on cosmetic changes only.

5. Product release

The day of releasing the final version of your app to the world is an awesome success, but the journey doesn’t end here. Even after launch, apps need monitoring, optimisation and updates – you may have gotten users to download the app, now is the moment to keep them engaged and make sure all works as it should. That’s why app maintenance is such a crucial part of building a digital product. Take this time to monitor mobile app ratings and reviews, look out for feedback and continue to search for improvements.

6. Additional updates

Improving your app should always remain a priority, even well after launch. At the end of the day, without users’ approval, the product is bound to fail.

When starting to work on improvements, remember to:

- Review your app and mark its weaknesses

- Prioritise fixes and roadmap in-app changes

- Conduct iterative design and development

- Keep up a constant user feedback loop

7. Scaling and including value added services

Value added services in banking apps and fintech apps can expand your user group and solidify your market position. AI advisors, cryptocurrency and stock trading, loyalty programs – all these features boost personal finance apps and help fintech startups build competitive advantage.

Always keep in mind when it comes to building a fintech application, change is the only constant. Keep working on various aspects of your digital product to gradually improve it and maintain an engaged userbase. This way, you can make sure your app stays on top in the extremely competitive financial industry.

Building a fintech app – our success stories

Fintech mobile app development has been a strong pilar of our business activity since a long time. We helped various institutions embrace financial technology and deliver value to both existing and new users.

BNP Paribas

BNP Paribas decided to revamp their digital banking app to meet the surging demand for intuitive user experiences. Partnering with Miquido, they launched the GOmobile app, offering clients seamless financial control.

The app boasts over 1 million downloads and an impressive 4.8 average rating from nearly 150,000 reviews. Innovative features like the GOtravel insurance module and facial recognition for account opening set it apart.

For aspiring fintech app developers, this success underscores the importance of user-centric design and advanced functionalities.

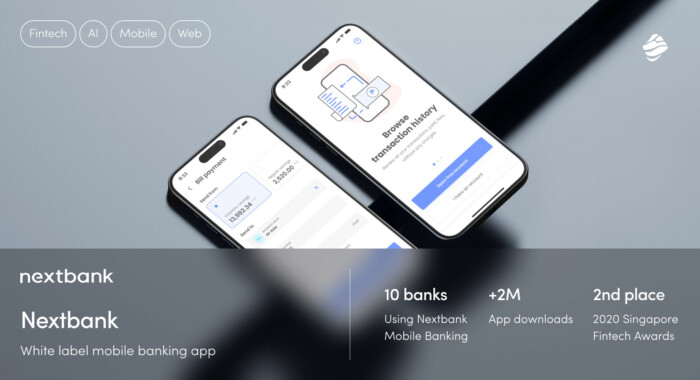

Nextbank

Nextbank, a SaaS company, sought to revolutionize cloud banking in Southeast Asia. They partnered with Miquido to develop a white-label mobile banking app, enabling financial institutions to create customized applications in under 10 weeks.

The result? Over 10 banks adopted the app, leading to more than 2 million downloads. This rapid deployment and widespread adoption underscore the app’s success.

For fintech innovators, Nextbank’s journey highlights the power of scalable, user-friendly solutions in meeting diverse client needs.

“Miquido’s greatest strengths are attention to detail and business awareness. Their expertise and attitude were the key factors to project success.”

Want to develop a fintech app from scratch or include value added services in the existing one? Let’s discuss your ideas and target audience. Your fintech app development journey could start today!

![[header] [ad] building a financial mobile app – an introduction](https://www.miquido.com/wp-content/uploads/2025/02/header-ad-building-a-financial-mobile-app-–-an-introduction.jpg)