According to forecasts, advances in generative AI could automate up to 50% of current job tasks between 2030 and 2060.

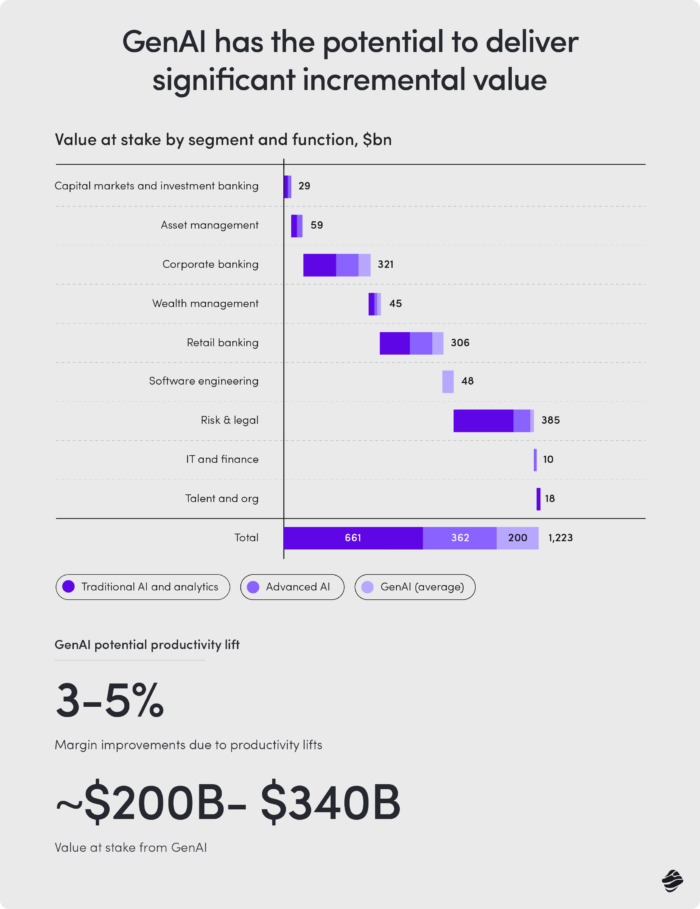

Generative AI in financial services is poised to boost labor productivity by 0.1% to 0.6% annually until 2040. This innovation is expected to inject an additional $200 billion to $340 billion into the industry. Given the current emphasis on cost reduction in strategic planning for banks, harnessing generative AI in financial services to enhance productivity is becoming increasingly essential.

The banking and securities sectors are ripe with opportunities for applying Generative AI, presenting a wide array of potential uses across various enterprise functions and business groups.

McKinsey highlights that the most significant advancements are taking shape within four key areas: Customer Engagement, Coding & Software, Concision, and Content Generation.

We share this view and believe it captures the essence of GenAI’s potential in the BFSI sector. In this article, we’ll explore the pivotal applications of generative AI in financial services, organized by four critical categories, to uncover how they’re reshaping the industry. We’ll also pinpoint areas where generative AI currently struggles, such as reliable credit scoring, and recommend alternative solutions.

Generative AI in financial services: risk management and strategic scaling

While initial successes of GenAI in BFSI are starting to show, formulating risk management strategies for GenAI is paramount in the technology’s nascent stages – especially for financial institutions. Building significant trust is a prerequisite before the technology can be scaled, an aspect we will also address.

While deploying a Proof of Concept might seem straightforward, scaling it successfully and fostering adoption demands a holistic approach.

This includes a clear management vision and strategy, commitment to resources, alignment of data and technology with the operating model, robust risk management, and effective change management.

So, what’s on the agenda for this blog post on Generative AI use cases in financial services?

We will:

- Explore how GenAI is revolutionizing the finance sector, touching on everything from enhancing customer service to improving fraud detection.

- Showcase leading financial institutions that have pioneered the adoption of innovative GenAI solutions.

- Tackle the challenges and potential pitfalls of GenAI implementation, offering strategies for mitigation.

- Forecast the future of GenAI in finance, highlighting the potential opportunities and expert predictions.

- Provide actionable insights for businesses ready to integrate GenAI into their current systems and workflows.

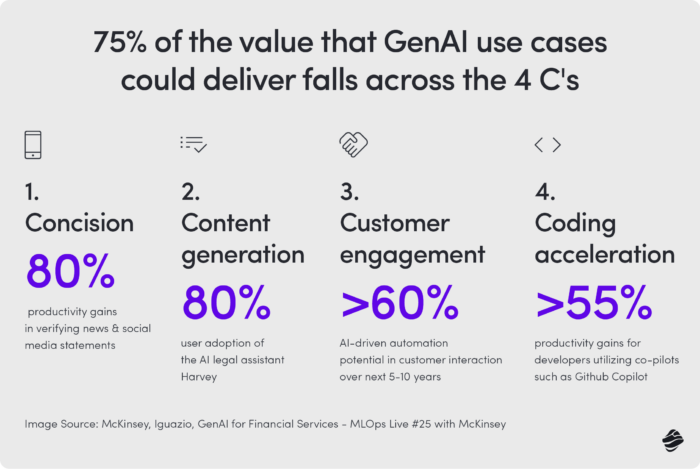

The “4 C’s” value proposition of Generative AI in financial services

Let’s first understand the “4 C’s” value proposition framework proposed by McKinsey before we dive into specific use cases of Generative AI in financial services.

The transformative power of GenAI can be categorized into four categories, which are Concision, Content Generation, Customer Engagement, and Coding Acceleration. Each category has unique benefits and applications that can help enhance productivity and innovation.

1. Concision (Virtual Expert).

Imagine sifting through endless streams of data – from dense documents to bustling social media feeds – and distilling the essence in moments. That’s the magic of generative AI in financial services. It revolutionizes research and problem-solving by:

- Streamlining insight extraction from lots of unstructured data sources, dramatically reducing research time.

- Empowering users to swiftly validate information sources, ensuring reliability and accuracy.

- Offering a remarkable productivity boost, up to 80%, especially in verifying statements across news and social media. Note: this capability is changing the game in information processing.

2. Content Generation.

Generative AI in financial services is also redefining content creation, making it faster, more personalized, and incredibly efficient.

It automates drafting essential documents like contracts and NDAs, slashing manual effort and enhancing speed. By generating personalized messages and tailored product recommendations, it drives customer engagement and sales to new heights.

3. Customer Engagement.

In customer engagement, GenAI introduces AI-driven co-pilots, offering personalized experiences that boost satisfaction and loyalty:

- It leverages intelligent chatbots for 24/7 customer support, responding to queries with unmatched efficiency.

- With the potential to automate over 60% of customer interactions in the next 5 to 10 years, GenAI is ushering in a new era of AI-driven customer service.

4. Coding Acceleration.

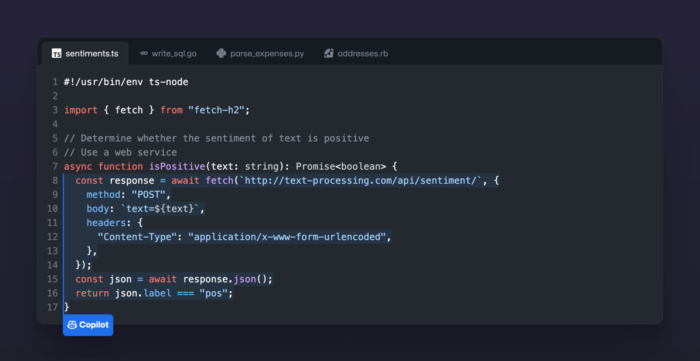

For developers, GenAI is a game-changer, simplifying and accelerating the coding process:

- It aids in interpreting, translating, and generating code, easing migrations from legacy systems and reducing errors.

- GenAI facilitates synthetic data generation and rapid prototyping, speeding up development cycles.

- With tools like GitHub Copilot, developers see productivity gains of over 55%.

This comprehensive exploration of generative AI use cases in financial services showcases its potential to revolutionize various aspects of business operations, setting the stage for unprecedented efficiency and innovation across industries.

Generative AI use cases in financial services

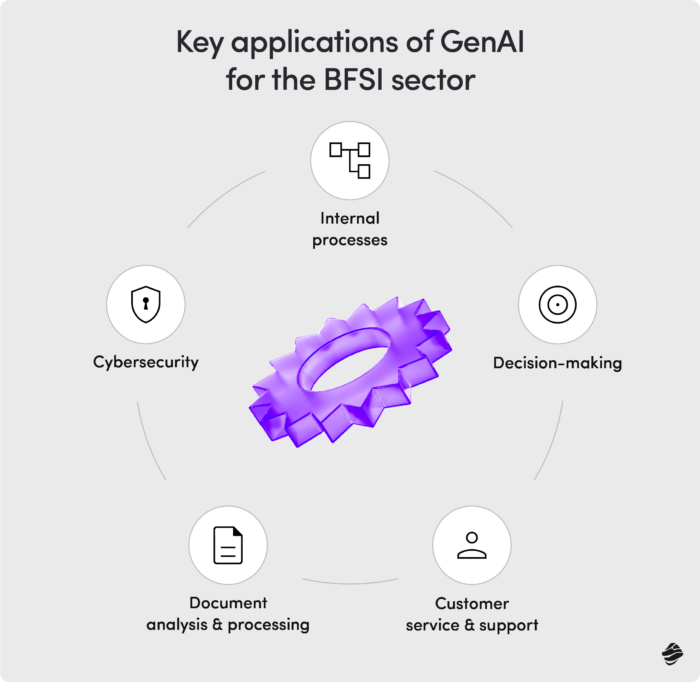

The BFSI sector is characterized by the management and analysis of a vast amount of text-based documents. Many of its internal operations and client-facing tasks demand the sophisticated handling of natural language, an area where large language models and the broader spectrum of Generative AI excel.

This section will delve into the segments within the BFSI industry that are ripe for automation. Furthermore, we will investigate the most impactful approaches for integrating AI technologies.

So, how can financial organizations benefit from GenAI?

1. Decision-making

The adoption of Generative AI in the BFSI sector is a game-changer for decision-making processes. AI assistants provide executives with insights drawn from a vast data pool, including the web and proprietary sources.

While Large Language Models are initially trained on extensive web data, their effectiveness is significantly enhanced when supplemented with specific organizational data such as internal knowledge bases or historical performance metrics. For example, integrating data about service popularity helps refine LLMs’ market trend predictions, making them more reliable for strategic planning.

These AI-enhanced models aggregate and analyze data from specialized sources, offering dynamic, data-driven responses crucial for adapting to market changes.

Organizational efficiency powered by AI

Generative AI in financial services is a key driver of digital growth within organizations, primarily by optimizing internal processes such as IT support and human resources management. This technology enhances overall operational efficiency, ensuring smoother and more effective company-wide functions.

Introducing GPT-based chatbots for IT helpdesks or HR support represents a strategic first step in an organization’s digital transformation journey. This approach includes experimenting with new technologies, tailoring workflows to meet specific organizational needs, and training employees on innovative AI tools like GenAI.

Moreover, deploying internal AI in fintech rapidly delivers tangible benefits, including heightened efficiency and significant cost reductions in internal processes. These immediate gains streamline operations and strengthen the organization’s competitive edge in the digital era.

Generative AI: Not one-size-fits-all

Generative AI can streamline internal processes and assist with key business decisions. However, for tasks like predicting creditworthiness or analyzing financial statements, caution is needed.

Recent efforts to use large language models for financial predictions are underway. Researchers from the University of Chicago explored using GPT-4 to predict earnings changes. The early results are promising, showing GPT-4 can sometimes outperform human analysts in predicting future stock returns.

While these advancements are exciting, it’s crucial to understand that generative AI isn’t a universal solution. Specific applications, especially in sensitive areas, require careful consideration and specialized expertise.

In our opinion, the GPT-based earnings prediction solution needs much more testing to be commercially viable. For strategic decisions in financial organizations, we recommend using more reliable technologies. Machine learning, for example, is proven and innovative, offering predictability and success in many commercial projects.

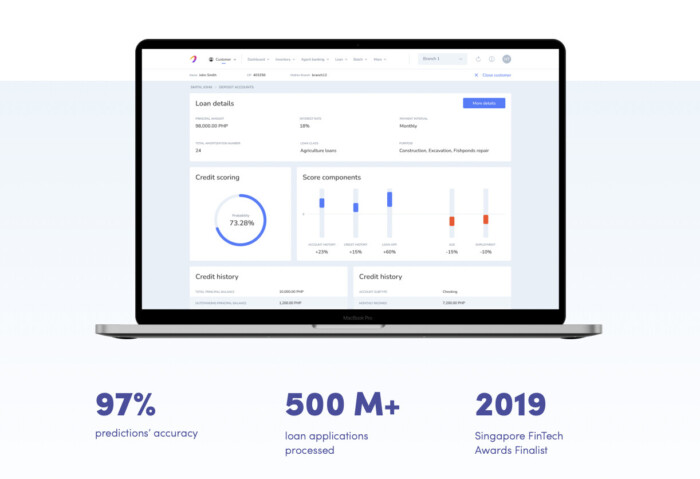

For instance, we developed a robust machine learning solution for Nextbank, demonstrating the effectiveness and reliability of this technology in large-scale applications.

AI-powered credit scoring for Nextbank

In collaboration with Nextbank, a fintech leader in Southeast Asia, we developed an AI-powered credit scoring system that automates the loan assessment process. This system analyzes thousands of data points to determine an individual’s likelihood of repaying a loan.

Key features of our solution include:

- High accuracy: The AI and ML-based engine boasts a 97% accuracy rate in distinguishing high-risk loans.

- Proactive customer identification: It not only assesses loan applications but also actively searches for potential customers.

- Widespread deployment: Successfully implemented in 7 banks across Asia, processing 500 million loan applications to date.

To measure the system’s performance, our data science team tracked key metrics like ROC and F1 Score. The results were impressive:

- ROC: 0.75 (linear regression) and 0.85 (LightGBM), indicating the model’s strong ability to differentiate between paying and non-paying customers.

- F1 Score: -0.69 (linear regression) and -0.71 (LightGBM), showing comprehensive assessment accuracy.

In a test sample, our machine learning model accurately predicted 1,450 out of 1,500 loans, demonstrating its effectiveness and reliability.

As you can see, generative artificial intelligence is not the only option for enhancing decision-making efficiency in the financial industry. For more sensitive operations, it’s wise to rely on proven solutions like our AI-powered credit scoring system. If you’d like to learn more about successful AI implementations in fintech, we encourage you to download our e-book.

Next, let’s discuss how generative AI can be further applied in the BFSI sector.

2. Marketing

Marketing in the finance sector is complex, aiming to sell financial products and services, connect with customers, and build brand loyalty in a highly competitive field – all at the same time. Companies need to deeply understand customer needs, navigate strict regulations, and innovate to stand out.

Artificial Intelligence app development might be a real game-changer here, offering customization, efficiency, and deep insights that can transform traditional marketing into strategies that really focus on the customer.

Creating effective marketing materials with the help of Generative AI

Generative AI in financial services might be used to tailor content directly to each client’s interests and history, making communications more meaningful and potentially boosting loyalty and satisfaction. AI can also speed up the creation of marketing materials by pulling information from reports, customer data, and product usage, cutting down on manual work and freeing up staff for bigger-picture tasks.

Identifying and prioritizing potential new customers

What’s more? Generative AI in financial services can help companies identify and prioritize potential new customers by analyzing both public and private data, making marketing efforts more focused and effective. Virtual assistants can give personalized investment advice and suggest strategies, including tax optimization, to improve returns.

AI can pinpoint each customer’s unique needs by analyzing unstructured data like CRM notes or call transcripts, leading to more targeted marketing. It can also enhance analytics models by extracting key text information, improving predictions and trend analysis for strategic decisions.

In short, Generative AI in financial services can automatically generate marketing and sales materials, making it easier to create consistent, high-quality content across different channels.

3. Document management and analysis

Harnessing OpenAI’s technology can revolutionize document management and analysis within Banking, Financial Services, and Insurance. By leveraging generative AI, these sectors can dramatically reduce their reliance on manual labor, minimize errors, and speed up decision-making processes. This transformation can be implemented swiftly and efficiently, with minimal human input required.

Custom analytical workflows

Large Language Models offer remarkable adaptability and can be tailored to the unique needs of financial organizations. These institutions can craft custom GenAI workflows designed to target strategic areas. Such workflows can be deployed organization-wide or focused on specific departments, offering flexibility in automation and the option of human oversight for reviewing AI-generated preliminary decisions.

Every financial institution has its own set of challenges and requirements. GenAI empowers these institutions to develop workflows that are finely tuned to meet their specific needs.

4. Customer service & customer support

Companies in the BFSI sectors often spend a significant amount of money on customer service and support. However, this area can be optimized through the use of generative AI.

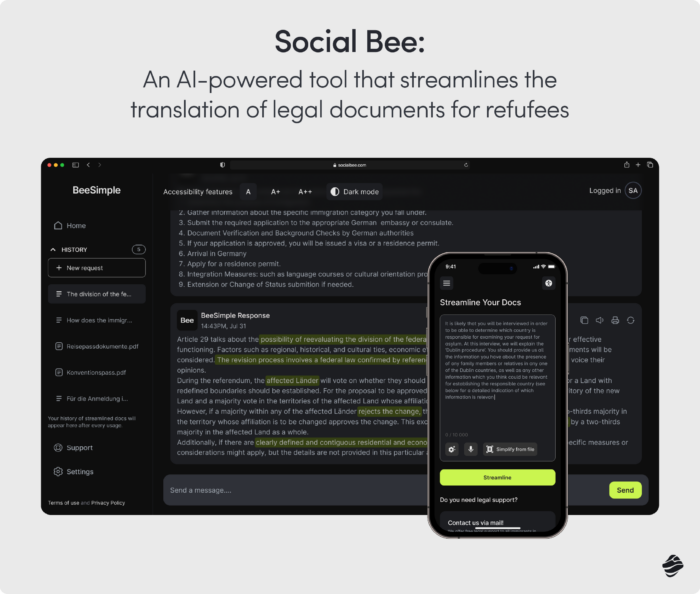

In customer support, language models can revolutionize the way businesses interact with their clients. These advanced tools can power conversational shopping experiences and sophisticated chatbots that provide information about products and services in a seamless and intuitive manner.

Moreover, chatbots driven by artificial intelligence app development can significantly improve customer assistance by simplifying or translating complex regulations and contracts. This help is invaluable for clients who may not be familiar with industry-specific jargon or for those who need quick access to precise information without the hassle of sifting through lengthy documentation.

Inclusive customer service

Chatbots powered by generative AI in financial services are revolutionizing accessibility to financial services, making them more efficient and inclusive.

Firstly, AI chatbots provide 24/7 availability, bypassing the need for human consultants and enhancing customer service experiences.

Secondly, chatbots with multilingual capabilities allow for cost-free interaction in preferred languages, breaking down language barriers and providing comfortable and confident access to services for a broader range of customers.

Finally, AI chatbots simplify complex financial documents, such as mortgage loan terms, making them more understandable. This helps users feel more secure and informed about using fintech solutions.

5. Automation in Mid-Office Operations

Financial institutions’ mid-office, which plays a crucial role in managing risks, ensuring compliance, and processing transactions, are undergoing a transformational shift through automation. This shift is being driven by the adoption of Generative AI in financial services, which automates tasks that traditionally require the deep expertise of subject matter experts.

GenAI is highly skilled at understanding the complex language and nuances in financial reports of different business units, environmental, social, and governance reports, and various contractual documents related to loans and mortgages. This capability not only simplifies the document preparation process but also diminishes the risk of human errors.

The benefits are twofold: it enables subject matter experts to focus on more strategic initiatives that require human insight and enhances the speed and accuracy of document management.

Uninterrupted technical support

AI-powered assistants in the mid-office provide uninterrupted technical support. They can process confidential information, including company policies, research data, and historical customer interactions, efficiently and precisely.

Before the emergence of GenAI, achieving this level of reliable support was impossible, but it now represents a new era of operational capabilities for mid-office functions. Consequently, financial institutions are now better equipped to manage risks, comply with regulations with minimal effort, and execute transactions more accurately.

6. Cybersecurity

As the field of AI advances, companies face increasingly sophisticated threats such as deepfake videos and voice generation scams. This is particularly challenging for businesses in the BFSI sector, where it is crucial to act quickly and decisively to protect customer trust and maintain security.

Fortunately, generative AI has the potential to help enhance security by developing solutions that can detect fraudulent activities. This involves using AI-based systems to scrutinize messages through sentiment analysis and identify signs of fraudulent behavior, such as unusual language patterns or inconsistencies that are not typically seen in legitimate interactions. By integrating these advanced AI capabilities, BFSI companies can improve their ability to proactively identify and mitigate threats, ensuring a safer environment for their customers and operations.

Generative AI use cases in financial services

As the financial services industry rapidly evolves, more and more companies are utilizing generative AI to improve their operational efficiency, enhance customer experience, and ensure compliance with regulatory standards. With the help of AI, these institutions can automate complex processes, analyze vast amounts of data with incredible speed and accuracy, and generate actionable insights.

Companies that use Generative AI in financial services

The financial industry is undergoing a significant change as prominent companies in mobile banking app market, insurance, and financial services adopt generative AI technologies. Leading institutions such as Morgan Stanley, JPMorgan Chase & Co., Goldman Sachs, Broadridge, and Fidelity Investments are spearheading this wave of innovation.

Morgan Stanley: enhancing wealth management with AI

Morgan Stanley has employed a GenAI assistant that can easily search through a vast repository of 100,000 research documents to extract relevant information quickly. This AI tool not only synthesizes data but also summarizes client meetings and drafts email follow-ups. The impact of this innovation is a significant boost in the efficiency and effectiveness of wealth managers, enabling them to serve their clients better and more quickly.

JPMorgan Chase & Co.: streamlining document processing with DocLLM and SpectrumGPT

JPMorgan Chase has developed two specialized tools: DocLLM and SpectrumGPT. DocLLM is tailored to understand complex business documents such as forms, invoices, and reports, while SpectrumGPT analyzes vast amounts of documents and proprietary research to provide insights for portfolio managers. These tools have led to a marked improvement in document comprehension and operational efficiency, achieving a 15% performance enhancement over more ‘general’ technologies like GPT-4.

Goldman Sachs: accelerating code development with AI

Goldman Sachs employs an AI tool that speeds up the code development and testing phases by automatically generating up to 40% of the required code. This feature reduces the time and resources required for software development. It boosts the company’s productivity and competitiveness in technology-driven markets.

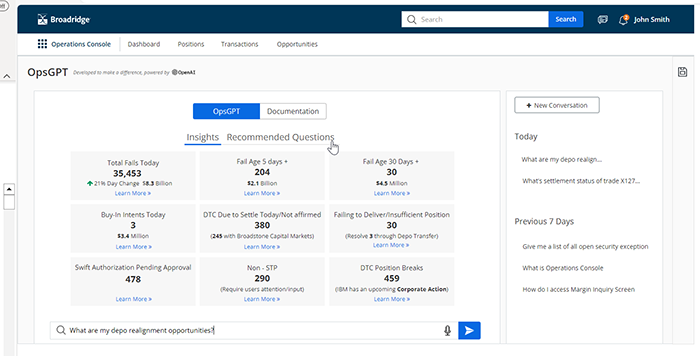

Broadridge: transforming post-trade workflows with OpsGPT and BondGPT

Broadridge’s recent launch of OpsGPT and BondGPT is a significant development towards streamlining post-trade processes. OpsGPT is designed to improve operational efficiency and minimize risk. BondGPT helps asset managers, hedge fund managers, and dealers to accelerate their bond selection and portfolio construction activities. As a result, it promotes greater transparency in financial operations.

Fidelity Investments: streamlining compliance with Saifr

Fidelity Investments has entered the world of regulatory technology with Saifr. It uses its own Natural Language Processing models to help financial institutions create, review, and approve public communications. It simplifies the compliance process from content creation to regulatory filing, ensuring that everything adheres to the necessary guidelines.

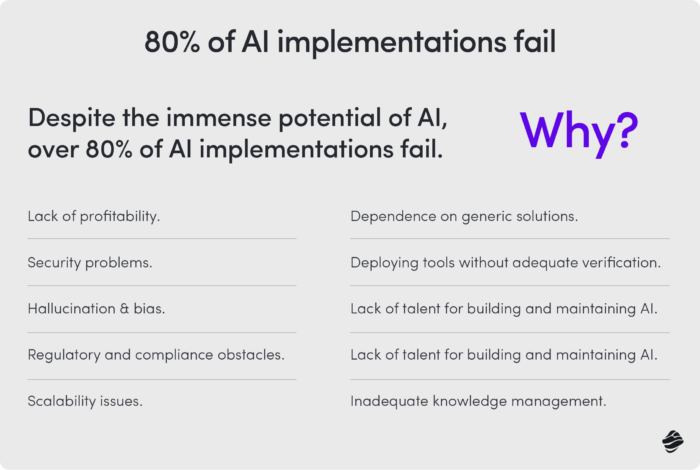

Risks and disadvantages of Generative AI in financial services

Generative AI is making waves across various sectors, including financial services, bringing improved efficiency, personalization, and predictive analytics in fintech capabilities. However, this technology isn’t without its drawbacks, especially in a sector as crucial and sensitive as finance. Here’s a closer look at the significant risks and disadvantages of deploying generative AI in financial services.

1. Risk of errors and misjudgments

In finance, even minor errors can lead to substantial financial losses. Generative AI systems may suffer from issues with accuracy and reliability. For instance, in credit scoring, an AI might misjudge a borrower’s risk by relying on biased or incomplete data. This can result in unjustified credit decisions. Such mistakes can harm individuals’ financial status and could ripple out to broader economic impacts.

2. Regulatory and compliance challenges

Strict regulations bind financial institutions to ensure market transparency, fairness, and stability. Generative AI in financial services must adhere to these regulations. Particularly in roles involving critical decision-making like loan approvals or risk assessments. However, AI systems can be opaque, making it hard to trace how decisions are made. This opacity can complicate compliance, especially with regulations that demand explanations for credit decisions provided to customers.

3. Performance issues under high load

In areas like high-frequency trading, decisions need to be made in milliseconds. Generative AI, depending on its complexity and the available computational power, may not always meet these high-performance demands. In times of high volatility or heavy transaction volumes, AI might slow down, causing delays and potentially significant financial losses.

4. Bias in AI outputs

The quality of generative AI’s outputs heavily depends on its training data. If this data contains biases, the AI’s decisions will reflect these biases. This could lead to unfair credit scoring or investment models that disadvantage certain groups in financial services. These biases harm individuals and expose financial institutions to legal and reputational risks.

5. Challenges with complex document generation

Creating financial documents with accuracy and adherence to specific legal terminology and clauses is crucial. However, poorly designed generative AI systems may find it challenging to produce long, intricate documents that meet strict legal standards. Any inaccuracies or misunderstandings in these documents could result in legal issues or miscommunications, causing financial and reputational damage.

Planning and strategy are crucial to make your GenAI project successful

While generative AI presents significant opportunities for transformation in financial services, its integration demands meticulous planning and strategic implementation. Financial institutions can combat potential problems by committing to deliberate AI development that prioritizes data integrity, transparency, regulatory compliance, and ethical standards. By proactively addressing these challenges, the financial sector can maximize the benefits of AI while effectively mitigating its risks.

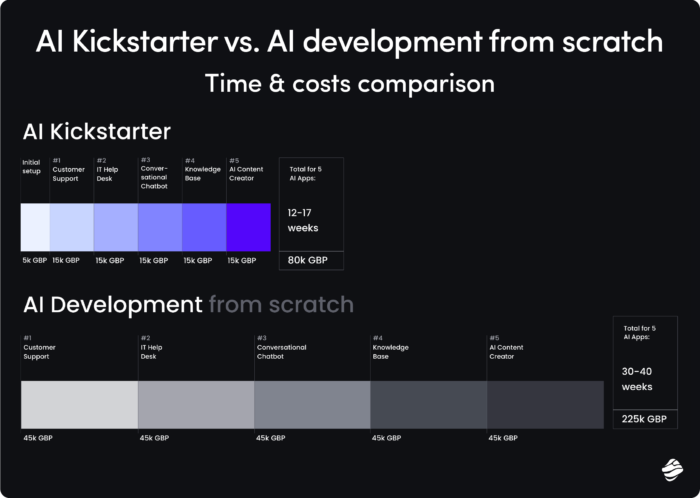

AI Kickstarter: One framework to fast-track your AI apps

AI Kickstarter is an AI framework developed by Miquido. It facilitates the development of reliable, context-aware, and scalable apps and tools at a pace 3x quicker than solutions built from scratch. Plus – with much more security, flexibility, and effectiveness than generic, pre-made options.

It utilizes a powerful Retrieval-Augmented Generation architecture to turn large language models into potent business tools. Thanks to RAG, you can use your unique knowledge and data to produce accurate, relevant, and tailored outputs. All without the need for costly, restrictive fine-tuning.

Key considerations for secure GenAI deployment

AI, while not a panacea, is a valuable tool that necessitates judicious and responsible deployment, particularly within the fintech services and banking sectors. This article has highlighted several areas where AI is currently being used safely, delivering tangible benefits such as cost reductions and enhanced operational efficiencies.

Choosing the right AI provider

AI technology is rapidly evolving, driven by competition among major tech companies. This means we can anticipate significant advancements shortly. When utilizing generative AI, it’s critical to engage in continuous experimentation. Testing various approaches to prompt engineering, AI architecture, and technology stacks is essential. Generative AI development company should ideally engage in ongoing scientific research to refine and validate its AI solutions.

Experience in Commercial AI Implementations

Deploying AI in commercial BFSI (Banking, Financial Services, and Insurance) settings demands a carefully crafted and meticulous strategy. Therefore, when selecting an AI consultant or service provider, it’s crucial to examine their track record across a broad spectrum of AI implementations.

Miquido has a solid track record with over six years in the AI field. So far, we’ve successfully completed more than 200 projects, including many in the fintech industry. In the last year alone, Miquido has undertaken over 20 projects involving generative AI.

AI as a catalyst to high ROI

Research and practical experience both demonstrate that identifying suitable AI use cases is a frequent challenge for businesses. It’s often complicated by stringent regulations, security requirements, and inexperience.

Therefore, when initiating partnerships with financial institutions, we advocate for the adoption of AI solutions that are straightforward and cost-effective. Such solutions should also promise significant ROI in a relatively short period, typically a few months to a year.

![[header] top ai use cases in manufacturing](https://www.miquido.com/wp-content/uploads/2025/04/header-top-ai-use-cases-in-manufacturing-432x288.jpg)