When considering generative AI, applications in eCommerce are often the first to come to mind. However, Generative AI development offers immense innovative potential across many sectors, including highly regulated ones like fintech and banking. So far, the adoption of generative technologies in these industries has been limited to pioneers. Nevertheless, we may soon witness an acceleration in adoption rates, as Generative AI has already proven successful in banking and fintech.

How can Generative AI drive success and revenue in this sector? What risks are associated with these implementations, and how can they be mitigated? How can businesses ensure that generative AI delivers the desired outcomes in such a demanding and regulated environment? In our article, we delve into the subject of Generative AI in banking and finance industries, examining successful use cases, statistics, and emerging trends. The future of AI in fintech and banking is now – but what does it mean for the sector?

What is generative AI in banking and finance?

Generative AI leverages machine learning models, particularly deep neural networks, to create new content based on patterns learned from large datasets. This process often involves models such as Generative Adversarial Networks (GANs) or transformers. In GANs, two neural networks—the generator and the discriminator—compete with one another. The generator attempts to create realistic outputs (like images or text), while the discriminator seeks to determine whether the output is real or generated. Through this ongoing competition, the generator improves its ability to produce highly convincing data.

AI vs. generative AI in financial institutions and banking

While traditional AI is already prevalent in today’s banking and financial sectors, Generative AI is just starting to make waves. Though it may not yet be reliable for complex financial tasks, such as predicting stock prices or market trends—where accuracy and historical data modeling are crucial—it excels in simplifying data interpretation.

Surprisingly, many tasks in finance involve creativity and significant time and effort, making them ideal candidates for Generative AI. The technology can generate new data, simulate scenarios, and automate content production, even in real-time.

Key use cases of generative AI in banking and finance

With the increasing demand for fintech and banking services, Generative AI has become instrumental in covering many traditionally labor-intensive tasks. From customer service to personalized app features, sharing information, and generating insights, Generative AI is emerging as a cornerstone of growth. Here are some key ways companies are integrating this technology into their processes.

Streamlining customer service with generative AI assistants and chatbots

Generative AI assistants are becoming increasingly common across industries, facilitating more natural and effective interactions that allow customers to resolve their issues without hassle. While traditional chatbots relied on rigid scenarios that often frustrated users, Generative AI chatbots can handle any query and carry conversations forward in a more natural, human-like manner.

Given that many requests involve stressful situations—such as account blockages or suspicious activity—Generative AI significantly improves the experience, making interactions seamless without requiring customers to phrase their questions in a specific way.

Moreover, Generative AI chatbots can also empower customers in the highly regulated finance industry, where complex jargon can create additional hurdles. These AI-driven tools can help ensure compliance by providing clear information about regulatory changes, offering legally compliant advice, and ensuring that documentation processes are followed correctly.

It’s no surprise that many banks globally have already transitioned to Generative AI assistants or are planning to do so in the near future. In Europe, ING has been a pioneer in this field, while in Asia, Singapore’s OCBC Bank is leading the way.

Extracting insights for credit risk assessment and scoring

Traditional credit scoring systems rely on static models and predefined metrics, such as income, credit history, or debt-to-income ratio. In contrast, deep learning models can analyze more complex and diverse data sets, including non-traditional financial information such as transaction patterns, spending behaviours, and even social data. This approach enables a more nuanced and personalized assessment of a borrower’s creditworthiness.

McKinsey notes that certain banks employ modular credit decision models, which allow them to integrate diverse data streams, such as open banking data and customer behaviour patterns, to derive more accurate credit signals. This flexibility helps banks to react faster to market disruptions, make more precise lending decisions, and target new customer segments efficiently

Generative AI models also provide enhanced insights into customer data, streamlining credit scoring processes. Analysts can generate visualizations of specific insights, improving their understanding of the often complex habits and patterns that could impact a customer’s reliability as a credit payer and influence overall credit risk.

Nextbank Miquido’s case study – transforming credit scoring with AI-powered precision

In the dynamic fintech landscape, Nextbank has pioneered AI-driven advancements for credit scoring and loan origination, significantly improving accuracy and efficiency. Facing challenges with traditional scoring models that lacked transparency and predictive power, Nextbank collaborated with Miquido to develop a solution that leveraged machine learning for an in-depth, unbiased evaluation of loan repayment probability.

Using Miquido’s AI expertise, Nextbank’s scoring engine analyzes thousands of data points with 97% accuracy, enabling financial institutions to identify high-risk loans while reducing the chances of lending biases. This AI-powered module has streamlined operations across seven banks in Asia, processing over 500 million applications to date.

With this solution, Nextbank offers not only a scalable, high-performance platform but also a transformative shift towards fair, data-driven credit decisions—delivering impactful results in Southeast Asian banking and beyond.

Spreading knowledge within teams and supporting compliance

The fintech and banking industries are subject to constantly evolving regulations and standards. On an EU level, NIS-2 and GDPR are good examples, requiring institutions to reform their data processing, storage, and cybersecurity practices. These regulations often necessitate system, tool, and infrastructure modifications while also affecting employees.

Generative AI tools can support training by providing instant access to information about compliance and policies as needed. These AI-powered knowledge bases are becoming standard in the banking industry (as evidenced by our project for Verseo), proving effective in navigating the rapidly changing regulatory landscape. Instead of combing through traditional databases, users can quickly find and extract relevant information with a simple prompt. This is a significant efficiency boost and a valuable safety measure in both customer service and back-office functions.

Increasing security

Security remains one of the less-explored applications of Generative AI in fintech, but it holds immense potential, especially as security threats become more diversified. The ability to process unstructured data, such as chat logs or emails, allows Generative AI to enhance threat detection by flagging phishing attempts or social engineering attacks that might otherwise go unnoticed.

Generative AI not only strengthens security measures but also fosters transparency between banks and their clients, building trust and providing clearer insights into the nature and handling of security breaches. It can guide clients in real time, explaining potential risks in simple terms and empowering them to act quickly. Personalized alerts and notifications within apps, based on users’ online behaviours, further help defend against cybersecurity breaches.

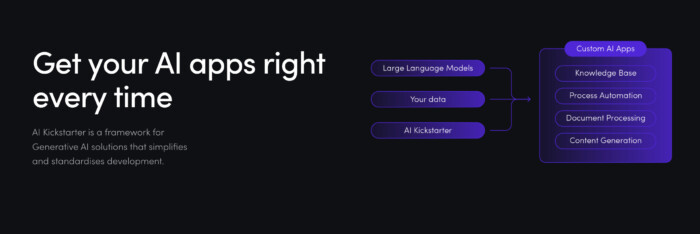

AI Kickstarter: accelerating AI adoption in financial services

Imagine being part of an R&D team at a fintech company, tasked with finding ways to integrate AI into products to enhance customer experience and improve operational efficiency. While you recognize that AI could be a game-changer, navigating through countless options can feel overwhelming.

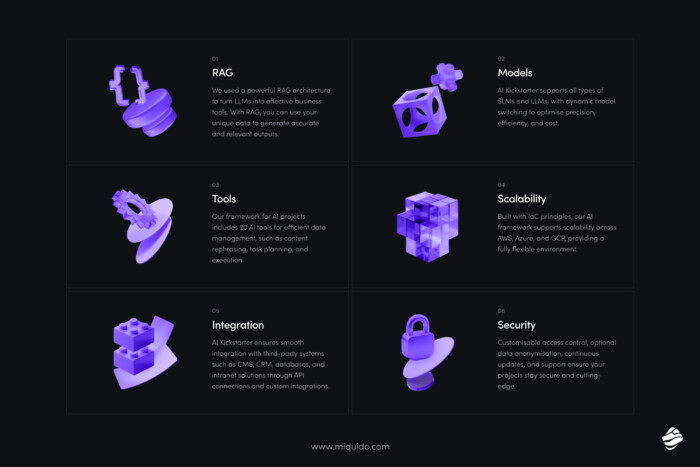

That’s where AI Kickstarter from Miquido comes into play. Our framework is designed to help your team quickly and efficiently move from vague AI concepts to actionable strategies. Instead of getting bogged down by technical complexities, AI Kickstarter enables you to focus on testing AI-driven solutions that align directly with your business goals.

Rapid prototyping

Prototypes enable teams to verify their assumptions and test them in practice—an essential step in ensuring long-term success. However, the lengthy process behind traditional prototyping often discourages companies from giving their ideas a proper reality check. In a conventional development cycle, it may take months to develop a prototype, leading to additional costs.

Our framework addresses this issue by simplifying the development process. Whether you’re optimizing fraud detection or creating a more personalized customer journey, AI Kickstarter takes you from ideation to prototype in just two weeks, ensuring your AI innovations are grounded in real-world applications.

Tailored AI solutions

Without a tailored approach, solutions are less likely to meet key performance indicators (KPIs) or provide significant value to a company. That’s why, within the AI Kickstarter framework, we begin by understanding your organization’s unique challenges and goals. This knowledge allows us to develop a custom AI solution that fits seamlessly within your existing workflows and business strategy. No compromises, full customization.

Starting from a universal framework—consisting of a set of tools, models, and RAG architecture—you’ll end up with a tailor-made solution that addresses the specific challenges of your niche.

Cost and time efficiency

By cutting implementation costs by an average of 65%, AI Kickstarter helps businesses adopt AI solutions quickly while reducing time-to-market. The savings are the result of a few factors combined:

- faster prototyping

- faster delivery

- the support of professionals without timely recruitment

Our framework also frees up resources that you can sacrifice to polish your solution rather than cover its foundational aspects. With the right tools, models, and RAG, you’re ready to go!

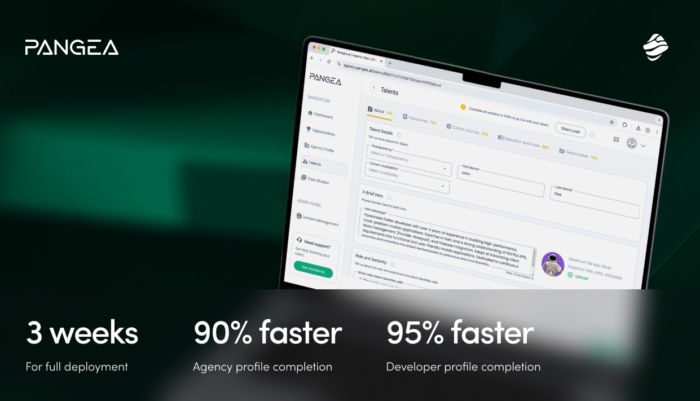

PangeaAI – A successful generative AI project developed with AI Kickstarter

As they say, “necessity is the mother of invention,” and many of our AI Kickstarter customers find themselves in similar situations. Pangea.ai is a perfect example. When the company faced growing onboarding demands, its complex profile completion system began to slow down operations, causing users to drop off mid-process. A faster, smarter solution was needed.

With its rapid prototyping and delivery capabilities, our AI Kickstarter framework turned out to be the ideal remedy. Leveraging the power of Generative AI, Miquido developed a feature that automates profile creation by analyzing documents like resumes and project case studies. The AI extracts key details and generates complete specialist profiles—quickly, efficiently, and accurately. No more multi-step forms or employee intervention.

To accommodate the growing volume of data from these profiles, Miquido also upgraded Pangea.ai‘s backend services. We ensured the infrastructure could scale to handle the surge in registrations while maintaining seamless communication with external systems like the OpenAI API. The result? A streamlined, scalable system that boosts operational efficiency enhances the user experience and frees up resources to focus on growth.

Pros and cons of Generative AI in Finance

Like any technology, Generative AI has advantages and disadvantages, especially in the banking and finance sectors. While it can offer immense benefits in automating tasks and improving decision-making, it also has challenges. Let’s examine the key pros and cons of Generative AI in banking and finance, highlighting when it truly makes a difference for financial institutions.

Pros of generative AI in finance

With its capabilities to process vast datasets, extract information, sum it up and put it in order, generative AI solves several critical issues in finance and the banking industry. How can you benefit from its capabilities?

- Improved decision-making: Advanced simulations and predictive modelling facilitate navigating the complexities of credit risk assessment and offer modifications. The crucial decisions, which often imply millions of dollars or euros, gain more solid ground with generative insights. By analyzing historical financial data and generating forecasts, financial institutions can significantly improve the accuracy of decisions, leading to better outcomes in risk management and resource allocation.

- Automation of repetitive tasks, leading to cost savings and operational efficiency: Generative AI automates routine tasks like data entry, report generation, and document handling, reducing manual labor and speeding up processes. This enables financial institutions to operate more efficiently while cutting costs, allowing staff to focus on higher-value activities. Banking operations can benefit greatly from this automation, minimizing operational delays and increasing throughput.

- Enhanced customer experience through personalization and 24/7 automated support: Generative AI improves customer interactions by delivering personalized services based on customer data and providing 24/7 support through AI-driven chatbots, enhancing accessibility and engagement. Customers receive tailored financial advice and immediate assistance, creating a seamless banking experience.

- Example: AI chatbots in banks like Bank of America’s Erica provide real-time support and personalized financial insights to millions of customers, demonstrating the capability of AI in banking to enhance customer service.

- Stronger fraud detection mechanisms and improved risk management: Generative AI enhances fraud detection by analyzing real-time data and spotting irregular patterns that signal potential fraud. It helps financial institutions respond to threats swiftly, reducing the risk of financial loss and maintaining customer trust.

- Example: HSBC uses AI models to monitor transactions for unusual behaviour, preventing fraud and saving millions in potential losses.

Cons of generative AI in finance

Although we are still discovering its capabilities, Generative AI is not a perfect solution that ends any business issue once and for all. Remember, though – no-win situations don’t exist in the digital sphere. It is all a matter of picking the right set of precautions and measures to ensure the project’s success – of course, once you make sure that generative AI is actually the right pick.

- Initial investment costs and integration complexity: Implementing generative AI models requires significant upfront costs for acquiring technology, upgrading infrastructure, and training employees. But worry not – that’s what the AI Kickstarter framework is for. Equipped with a set of tools, models, RAG, and integrations, you can focus on tailoring the solution for your needs right away and deliver much faster, cutting development costs by 65% on average.

- Potential security and data privacy concerns with AI-generated data: AI systems, especially generative models, can expose institutions to data breaches or misuse of sensitive information, raising privacy and compliance risks. However, this can be mitigated by adopting robust encryption techniques, deploying privacy-enhancing technologies (e.g., differential privacy), and complying with industry regulations like GDPR. Ensuring that customer data is protected while implementing generative AI in banking is crucial for maintaining trust.

- Dependence on data quality and potential biases in AI models: Generative AI’s output is only as reliable as the quality of the data it is trained on, and biased data can lead to unfair decisions, especially in lending or credit scoring. But there’s a solution to this issue. By carrying out regular audits of AI models and employing bias detection tools, you can identify and mitigate unintended biases, making sure historical data does not lead to skewed results.

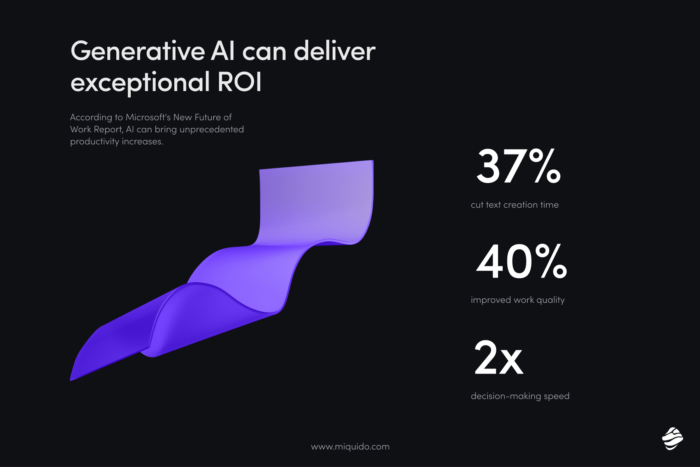

Trends and statistics in Generative AI for finance

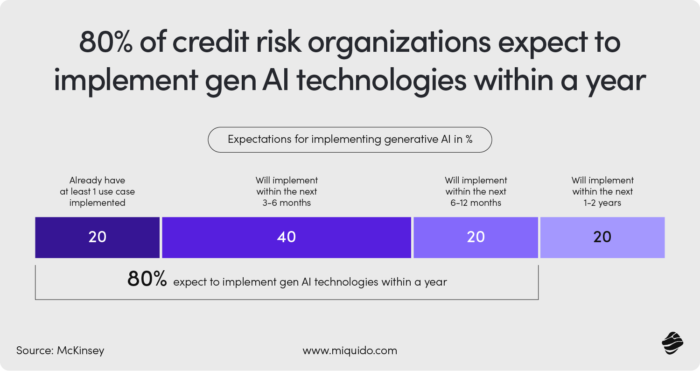

What will the future bring for generative AI in the finance and banking sector? According to reports and statistics, as well as official releases of leading institutions and financial companies, the technology is here to stay. And looking at the adoption rates, it may soon become a dominant driving factor of innovation in the industry. Let’s dive into the statistics to understand the ongoing changes and the future prospects.

Increased adoption of AI in fraud detection and credit risk assessment

As fraud schemes become increasingly sophisticated, banking and financial institutions need extra technology boosts to improve their fraud prevention. Deep learning models are a perfect solution because they can identify irregular patterns and detect fraudulent activities earlier. The natural language capabilities of generative models can also be a superpower, supporting phishing detection, a cybersecurity tactic that is becoming the main gateway for big attacks.

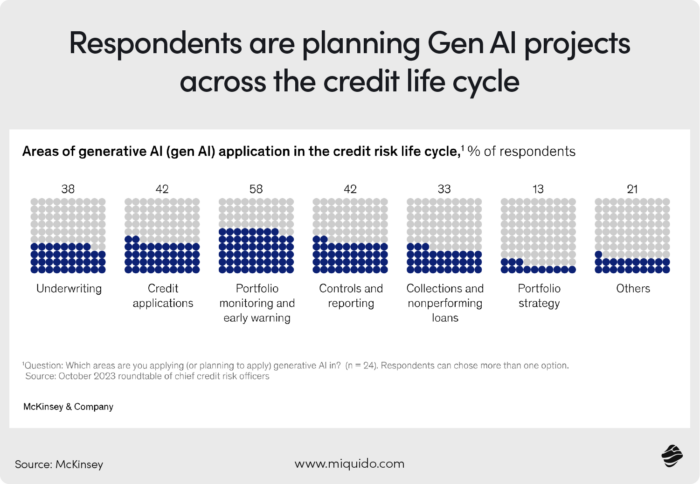

Credit risk assessment is another field where GenAI shines bright with its outcomes. According to McKinsey, most big financial institutions are actively planning their implementation for portfolio monitoring. It is the most applied use case, with nearly 60 per cent of respondents pursuing it.

What exactly can GenAI serve in this field? Routine report generation and optimization of the early warning system are the key applications mentioned in the report. The next credit risk assessment use cases, with 40% of interest, include credit application processing support.

AI-Powered chatbots for customer service

AI-powered assistants and chatbots are the main GenAI applications in banking today and across all businesses. One of the key features of mobile banking apps, they are gaining importance with the unprecedented rise of mobile users. They are relatively easy and cheap to implement, and in most cases, they show instant return on investment, which motivates more and more banks worldwide to invest.

Take the example of Erica, Bank of America’s chatbot, which has been developed since 2018. As for today, it engages with 2 million clients daily for various financial tasks. Since its birth, it has provided personalized insights and guidance over 1.2 billion times. 98% of clients receive the help they need within 44 seconds on average, which obviously impacts customer satisfaction rates.

Regulatory compliance automation

In today’s financial landscape, regulatory compliance has become more complex than ever, especially with evolving data protection and cybersecurity laws. NIS-2 and DORA now mandate that financial institutions enhance their cyber resilience, report incidents quickly, and manage risk effectively across their operations.

Add GDPR into the mix, with its strict rules on data privacy and transparency, and the pressure to stay compliant is enormous. The challenge? These regulations are often vague and difficult to interpret, particularly regarding personal data protection. This creates confusion across teams—from sales to customer service and digital projects—who may struggle to implement the rules correctly.

That’s where regulatory compliance automation powered by AI comes in. By automating the process of monitoring and interpreting regulatory updates, AI can simplify the complexities of compliance. It ensures that every department within a financial institution—whether handling customer data, managing cybersecurity, or developing digital tools—remains up-to-date and in full compliance with evolving laws. This not only reduces risk but also frees up teams to focus on core business activities.

The future of generative AI in banking and finance

Can you imagine future banking without GenAI? Think about solving routine issues with access, tracking your finances or traditionally acquiring personalized financial products. Not exactly an exciting prospect, right? Fortunately, Generative AI isn’t just here to stay—it’s continuously evolving and unlocking new possibilities.

For example, future advancements in machine learning for fraud detection will see AI systems becoming even more adaptive, and capable of spotting emerging threats in real-time by analyzing massive amounts of data faster and more accurately. Paired with technologies like blockchain, this evolution promises to create more secure, transparent transaction environments that mitigate fraud risk.

Beyond fraud prevention, AI is also transforming the customer experience by driving the growth of personalized financial products. By using deep data analytics, AI can assess each customer’s financial history, spending habits, and preferences to offer tailored products—from customized loans to hyper-personalized investment portfolios.

AI is already reshaping the way customers interact with financial institutions and companies. The future is not just digital; it’s personalized, secure, and driven by Generative AI innovations. With the right partner experienced in fintech software development and banking app development, it’s much easier to take the lead in this transition. Talk to us about your ideas or use our AI Kickstarter framework to launch your project on a high note!

![[ad] dedicated team model advantages & challenges](https://www.miquido.com/wp-content/uploads/2025/04/ad-dedicated-team-model_-advantages-challenges-432x288.jpg)

![[header] top ai use cases in manufacturing](https://www.miquido.com/wp-content/uploads/2025/04/header-top-ai-use-cases-in-manufacturing-432x288.jpg)