Gamification refers to incorporating game-like elements into non-game contexts to encourage user engagement, participation, and behaviour change.

In the financial services sector, gamification takes boring and complex tasks, like saving money, managing expenses, or learning about investments, and makes them fun, interactive, and rewarding.

The gamification approach works by tapping into several innate human instincts.

- Human desire for achievement: People naturally enjoy achieving goals and being recognized for their efforts. Gamification satisfies this by offering tangible (or virtual) rewards, badges, or trophies for completing tasks, creating a sense of accomplishment.

- Dopamine triggers: When users complete a challenge or unlock a reward, the brain releases dopamine—the “feel-good” chemical. This creates positive reinforcement, motivating users to continue engaging with the platform or task.

- Instant gratification: Unmet goals often feel distant and abstract, making it hard to stay motivated. Gamification introduces immediate rewards, like progress bars, streak points, and achievements, which satisfy the human craving for instant gratification.

- Competition and social connection: Leaderboards, social sharing, and multiplayer challenges appeal to our competitive nature and desire for social interaction, driving users to engage more consistently.

- Loss aversion: Many gamified systems create scenarios where users fear losing progress or rewards, which nudges them to stay active and consistent. For example, a savings app might encourage users to “keep their streak alive” by depositing a certain amount weekly.

Gamification mechanics ultimately motivate users to engage more deeply, stick to certain positive behaviors, and make smarter decisions, all while having fun. We’ll discuss these benefits in detail shortly.

Benefits of gamification in finance

Gamification is a powerful tool for financial institutions looking to create meaningful and lasting relationships with their customers while helping them achieve their financial goals.

Let’s look at some of the key benefits of adopting gamification in finance.

1. Enhances customer engagement

Incorporating gamification in your financial solution or platform introduces a sense of excitement into routine financial tasks that would otherwise be considered boring. This will encourage your users not only to spend more time in your app but also to keep coming back to the platform.

Studies have also proven that game-based motivation increases user engagement by 48%. Beyond that, it boosts user retention.

2. Promotes financial literacy

Financial literacy is key to long-term financial stability and success. Yet, many people find it difficult to understand complex financial concepts like budgeting, credit scores, and investment strategies.

Gamification in finance bridges this gap by making financial education engaging, accessible, and fun through quizzes, simulations, and scenario-based games.

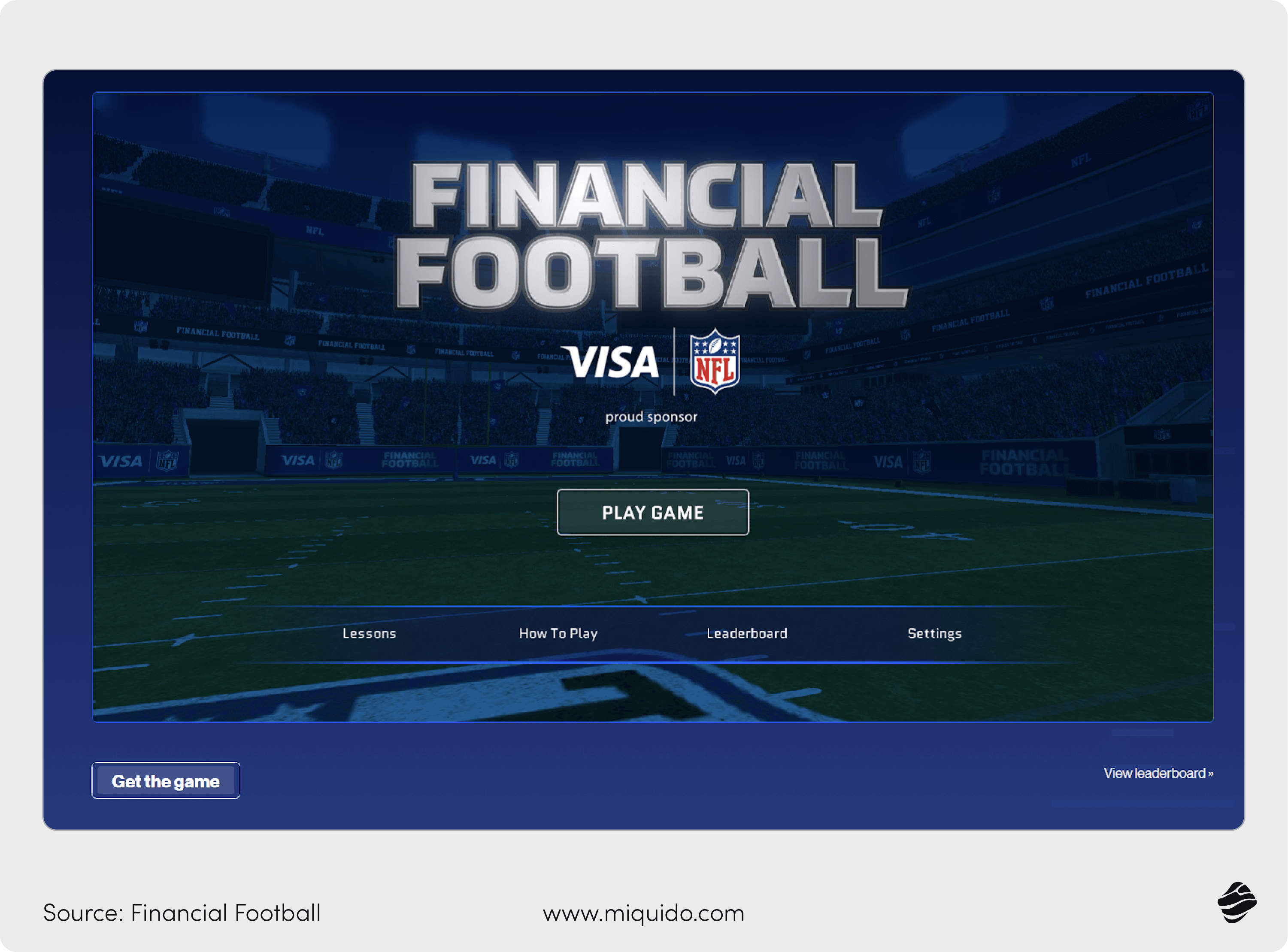

For instance, Visa and NFL’s “Financial Football”, shown below, uses literal game scenarios to simplify financial concepts like budgeting, taxes, insurance, and saving.

Its interactive, competitive teaching format makes it easy for American Football fans to pick up money management skills.

3. Encourages positive financial behaviors

By turning financial goals into achievable, interactive, and rewarding experiences, gamification helps users stay on track with their financial plans.

Research shows that gamification in financial services can positively impact financial behaviour by 67.9%. This is, of course, reliant on the financial solution’s innovativeness, the competence it inspires, and the outcomes users expect.

Key areas of application

These are some key areas in the financial sector where companies are leveraging gamification to engage and retain users:

1. Personal finance management

Personal finance management is one of the most common areas where gamification is taking root.

Managing one’s finances effectively can sometimes be complex and overwhelming due to all the little details one needs to pay attention to—and they add up quickly.

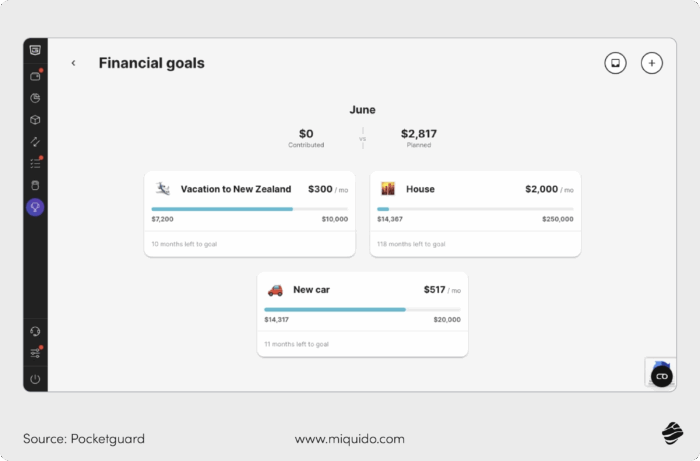

Apps like Qapital and PocketGuard allow users to track their spending, create budgets, and set savings goals while adding a gamified layer like personal finance streak points and progress bars.

See how PocketGuard uses progress bars that show users how close they are to achieving their financial goals.

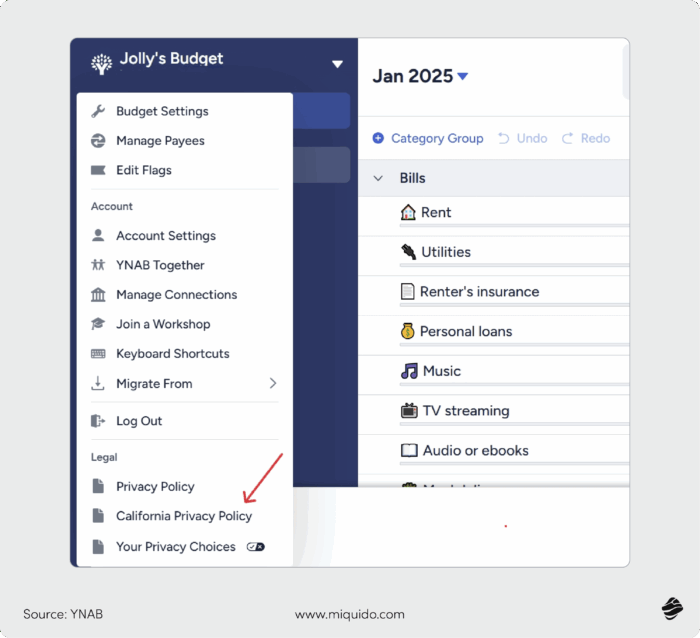

YNAB’s Loan Payoff Simulator is another gamified feature that simplifies financial management for individual users. It calculates how much interest and time users will save for every amount they put towards paying the debt.

Such interactive elements simplify the personal finance management process and encourage users to make positive financial decisions and stick with them. You can easily include these elements on your platforms by partnering with an experienced custom mobile banking solutions provider.

2. Customer onboarding processes

The customer onboarding process is usually the first interaction new customers have with a financial service or platform. As such, it sets the tone for users’ relationship with the service.

Gamification can transform the onboarding process into an engaging, seamless journey using various elements. For a platform like YNAB, new users are quickly onboarded through engaging prompts instead of endless guides and tutorials.

Other gamified financial platforms use digestible modules with interactive tutorials, simulations, reward points, badges, and progress bars. You can also include personalized challenges like asking a user to set their first investment goal.

3. Credit card reward programs

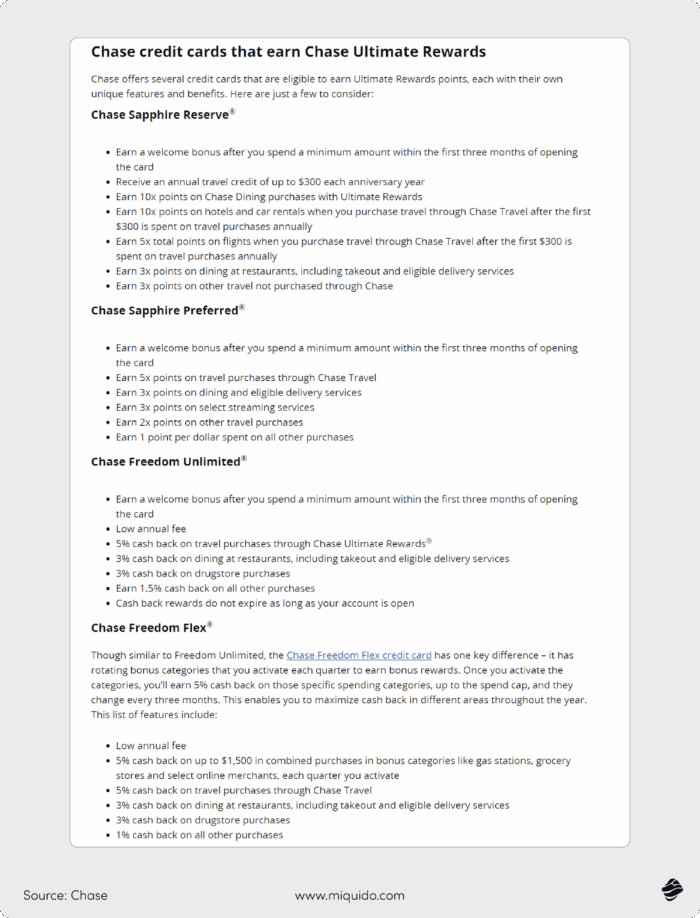

Credit card companies gamify their programs through point systems, spending challenges, and other tiered rewards systems where users “level up” by achieving certain milestones.

The rewards are increased cashback rates, travel perks, or exclusive offers.

Check out some of Chase credit cards’ program rewards below.

The gamified aspect adds an extra layer of excitement and satisfaction. It makes users feel more engaged in the process while motivating them to use their cards more frequently.

4. Investment and trading platforms

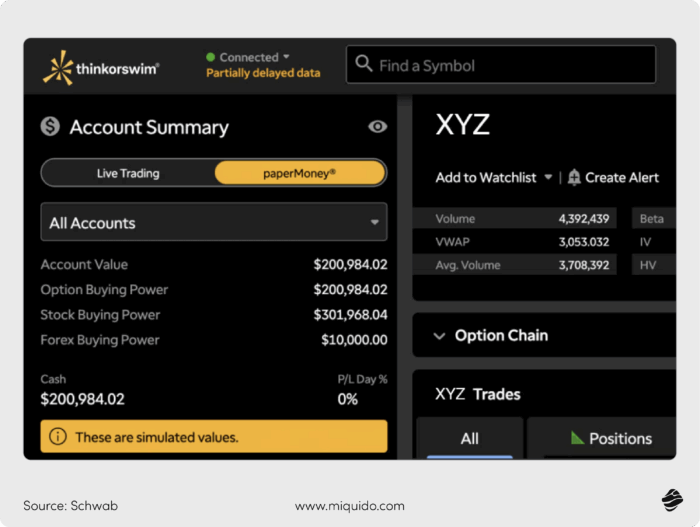

The complex data and unfamiliar terms or concepts can make investment and trading platforms feel intimidating, especially for new or inexperienced users. Gamification addresses this by including elements like virtual trading simulations, shown below.

Progress tracking, milestone rewards, badges, data visualization, and investor status tiers are other gamification elements that drive user engagement.

Examples of gamification in finance

Now that you understand the various applications of gamification in finance let’s explore some real-life examples of financial institutions and fintech companies using the approach.

1. Monzo’s spending challenges

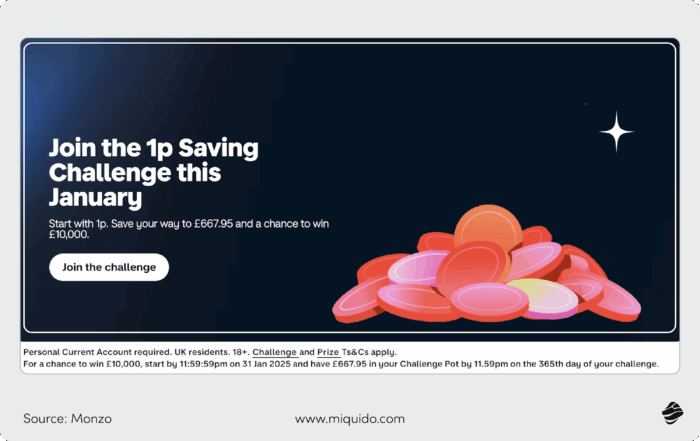

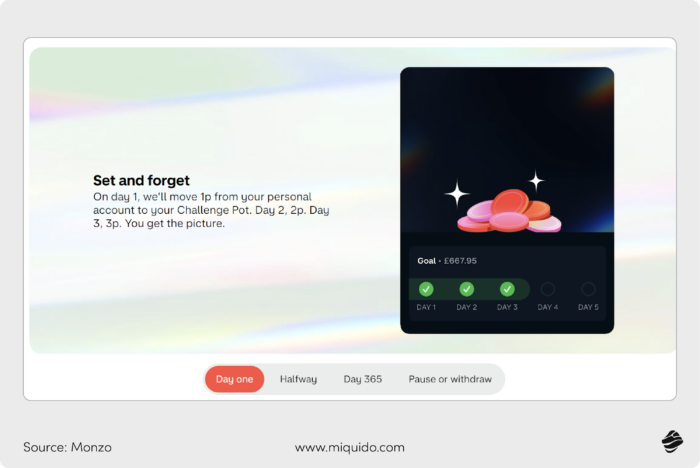

Monzo, a popular online bank in the UK, uses spending challenges to encourage users to save money and manage their expenses more effectively. They’ve had various spending challenges over the years, including their ‘pay not to be there’, “no-spend,” and their Rainy Day Savings challenges.

The most recent one is their 1p Saving Challenge for 365 days.

Monzo will put money aside from the users’ personal accounts each day into their ‘challenge pot’ until they have £667.95 saved. Users who join the challenge stand to win £10,000.

The incremental nature of the challenge makes it achievable, while the visual progress tracker and other gamified elements, like the potential rewards, will motivate users to stay consistent.

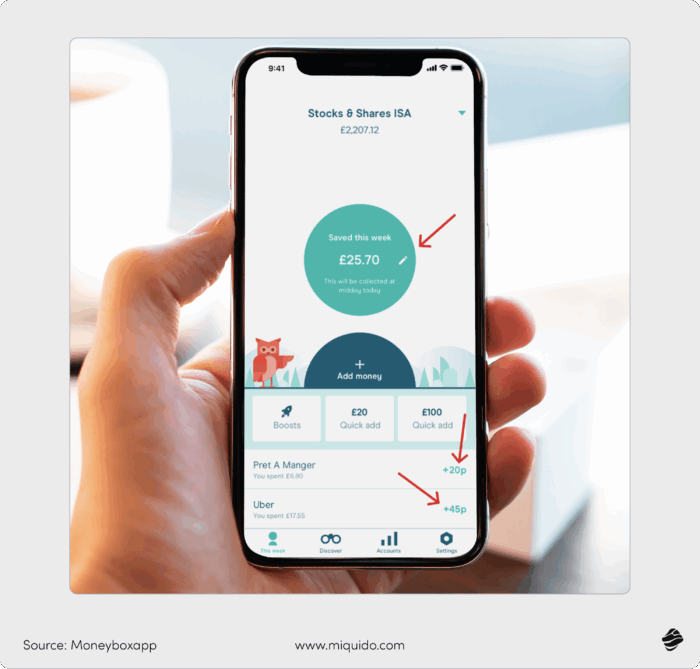

2. Moneybox’s round-up investments

Moneybox, a savings and investment app, encourages users to invest by rounding up their everyday purchases to the nearest £1. For example, if you spend £2.50 on coffee, Moneybox rounds it up to £3.00 and sets aside the £0.50.

The accumulated spare change is collected throughout the week. On Wednesdays, the total rounded-up amount is transferred from your bank account to your Moneybox investment account via Direct Debit.

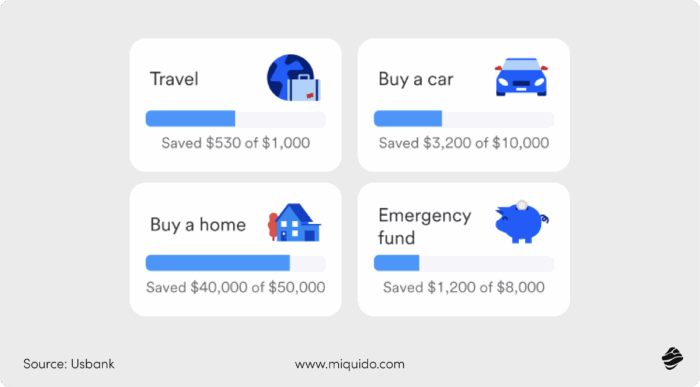

3. U.S. Bank’s Smartly Savings program

U.S. Bank gamifies the process of saving money through its Smartly® Savings program. Users set specific savings goals, such as a vacation or an emergency fund, and track their progress through a gamified interface.

The app also uses progress bars, visual rewards, and celebratory animations when milestones are achieved.

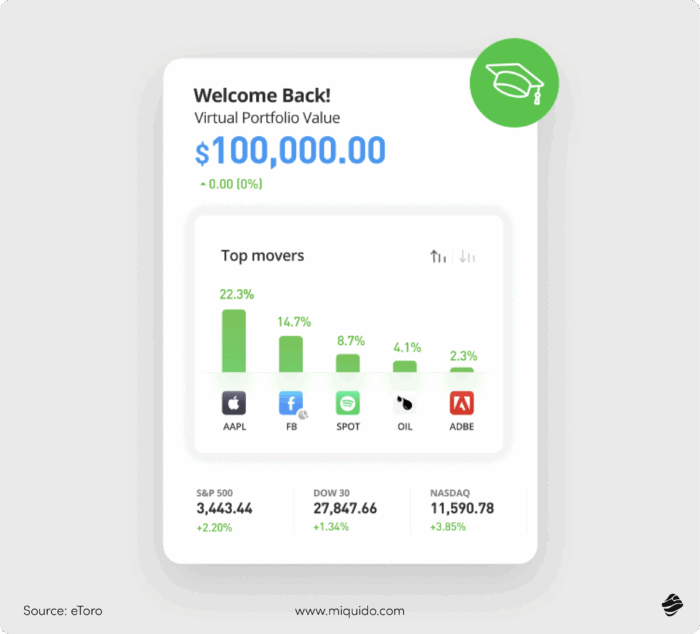

eToro is a multi-asset investment and social trading platform that gamifies the trading experience through various interactive features.

The most notable is the CopyTrader feature, which allows users to copy top-performing traders in real time. Users can see the traders’ rankings, read their strategies, and automatically replicate their investment decisions.

eToro enables users to test drive CopyTrader through a virtual simulation with a free $100,000 virtual portfolio.

eToro also includes leaderboards, news feeds, badges for top traders, and performance-based achievements to foster competition and community engagement on its platform.

In addition, users can participate in social discussions about trading strategies.

Strategies for effective implementation of gamification

Gamification in finance holds immense potential. However, its success depends on how well it is executed. Here are key approaches to implementing gamification effectively:

1. Set clear objectives

Before introducing gamified elements into your online financial services platform, it’s essential to define what you aim to achieve.

Do you want to increase user engagement, promote financial literacy, encourage savings, or drive product adoption?

To identify your ideal objectives, ask yourself: What problem are we trying to solve with gamification, or what behavior are we trying to promote? Your customer insights or feedback can also help you accurately figure this out.

Ensure your gamification objectives align with the goals of both the business and its users. They should address users’ financial pain points, like building savings or reducing credit card debt, while also contributing to the organization’s success, like boosting deposits.

Your objectives should be SMART (Specific, Measurable, Achievable, Relevant, and Time-Bound). For instance, a savings app objective could be to “increase the number of users reaching their savings goals by 20% within six months by incorporating interactive challenges and visual progress trackers”.

That makes tracking your progress and the effectiveness of the gamified elements implemented much easier.

2. Ensure a user-centric design

Gamified systems must always prioritize user experience to boost engagement and the overall success of the features.

First, conduct research to understand your audience’s preferences, pain points, and financial goals. You can use the customer data you’ve collected, research market trends, or just ask your users to tell you what works for them, what doesn’t, and some of the features they’d like to see.

Next, keep your gamified elements simple, relevant, and visually appealing to avoid overwhelming or confusing users. Additionally, your platform’s interface should be intuitive and easy to navigate.

You should also offer tailored gamified experiences, such as customized challenges, rewards, and milestones, based on individual user profiles or financial behavior patterns.

3. Balance fun with functionality

While gamification should be engaging, it must not distract from the primary purpose of the financial product—financial planning and management.

The gamified features should balance entertainment with functionality.

For instance, while animations celebrating a savings milestone can add a fun touch, they shouldn’t make it harder for users to access their account information or track progress.

Only add gamified features that enhance core functionalities, such as saving, investing, budgeting, and others that boost users’ financial well-being.

4. Monitor and adopt user feedback

Regularly monitoring user engagement and gathering feedback ensures that the gamified features on your platform remain relevant and effective.

You will need to use surveys, app reviews, analytics, and Net Promoter Score (NPS) to understand user satisfaction and areas of improvement.

Monitor how users interact with gamified features, including participation rates and drop-off points. Then, update the game mechanics based on the insights. You can introduce new challenges, rewards, or design improvements.

For instance, say a savings app’s analytics shows that users drop out of savings challenges after a certain period. This could indicate that the challenges are either too difficult or take too long. The app could replace them with shorter, more achievable challenges to maintain engagement.

Challenges and considerations

As great as gamification in financial services is, it comes with its own set of challenges that you must carefully manage.

1. Maintaining user trust and security

Financial services deal with sensitive personal and financial information. With users getting increasingly concerned about data security, gamified elements that collect additional data, like spending habits, can raise privacy concerns.

Hence, you must provide privacy disclosures as proof of security in fintech solutions.

Clearly communicate how gamification features work, why certain data is collected, and how it will be used. Studies show that 87% of customers expect some level of privacy rights from the companies they engage with online.

Also, use advanced encryption, two-factor authentication, and regular security audits to safeguard user data.

2. Overgamification

Overgamification, where you overload your platform with excessive gamified elements, is a common pitfall for most financial apps. It takes away credibility and frustrates users, leading to high churn rates.

To avoid this, use gamification strategically to complement, not replace, essential financial tools. Also, tailor gamification elements to the preferences of your target audience.

For example, while young users may appreciate fun badges and leaderboards, older audiences might value progress trackers or educational tools more.

3. Regulatory compliance

The financial industry is highly regulated. As such, your gamification features must align with all applicable laws and guidelines or risk hefty fines and irreparable reputational damage.

Ensure compliance with relevant data and financial regulations, such as the EU’s GDPR (General Data Protection Regulation) and the CCPA (California Consumer Privacy Act) in the U.S.

Collaborate with legal and compliance teams during the development of gamified features to ensure you get it right from the word go.

Future trends in financial gamification

Technological advancement, constantly changing consumer preferences, and the need for innovative engagement strategies will continue to change how financial institutions approach gamification. Below are three key trends of gamification in finance.

1. Integration with emerging technologies

Technologies like AI, virtual reality (VR), and augmented reality (AR) are revolutionizing financial gamification, offering more secure, immersive, and tailored experiences. For instance, you could use Generative AI in banking apps or investment platforms to create interactive quizzes or financial scenarios that help you deliver personalized banking services.

2. Personalized gamified experiences

Financial services are moving away from one-size-fits-all solutions.

A survey by Capco showed that over 70% of customers rate personalization as “highly important” to their online banking experience, regardless of age.

As such, apps will continue to leverage advanced AI and machine learning technologies to deliver hyper-personalized gamified experiences to make their clients feel valued.

3. Expanding beyond traditional banking

Gamification in finance is no longer limited to traditional banks and budgeting apps. It’s expanding into diverse areas of the financial ecosystem, like insurance and fintech.

Many fintech software development companies are incorporating gamification to differentiate their clients in a competitive market.

For example, micro-investing platforms like Stash and Acorns have features like leaderboards, progress tracking, and roundups to attract beginner users and younger generations.

Wrapping up

Gamification can enhance user engagement, promote financial literacy, and encourage positive financial behaviors. From personal finance management apps to investment platforms and credit card reward programs, institutions use gamified elements to help users make smarter, more informed financial decisions.

But to implement gamification successfully, you must set clear goals, have a user-centric design, balance the fun with functionality, and regularly update your elements. You will also need to comply with relevant financial regulations and privacy laws.

Gamification has the potential to transform how people interact with their finances. As the financial services industry continues to adapt to changing consumer expectations and technological advancements, its role will only grow bigger.

Managing finances will become more intuitive, rewarding, and even fun!