Just like many other retail niches, the furniture eCommerce market has undergone a significant transformation over the past two decades. Online furniture sales have grown substantially, although not long ago, purchasing from brick-and-mortar stores seemed almost like an obvious choice. Logistics have become much simpler as more furniture retailers have shifted to modular furniture models that are easy to transport.

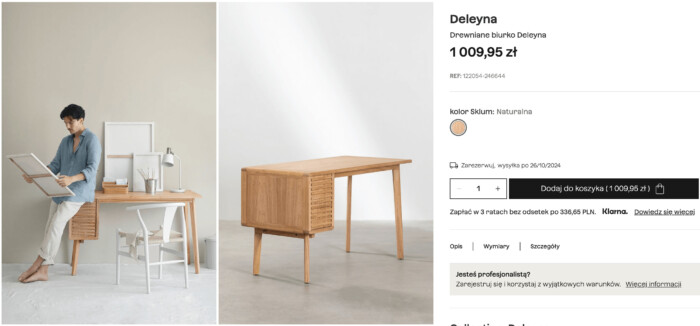

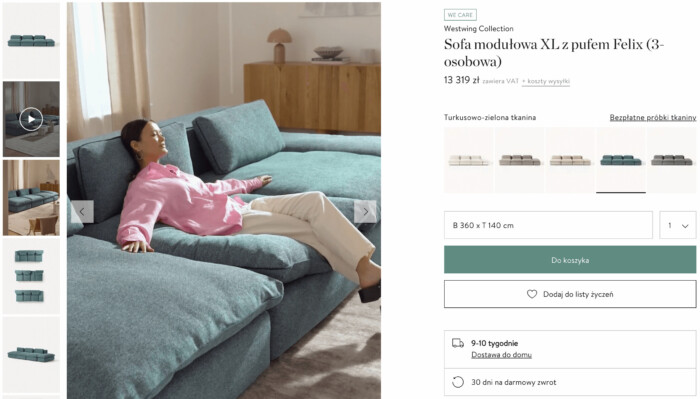

The number of online stores and mobile apps has also increased. Many leading companies, from Wayfair to IKEA and Hammonds, offer eCommerce mobile applications for their employees and customers, which improve customer service and shorten order processing times. Increasingly popular stores like Westwing and Sklum are entirely abandoning physical stores, opting exclusively for an online strategy. These web and mobile commerce statistics showcase the e-commerce furniture trends and outline the current industry landscape.

What is furniture eCommerce?

Furniture e-commerce refers to the online shopping and selling of furniture through digital platforms, where customers can browse, select, and purchase furniture online without visiting physical stores. It encompasses various business models, including direct-to-consumer sales, online marketplaces, and furniture retailers offering both online sales and in-store options, often with features like virtual showrooms and augmented reality tools to visualize furniture in home spaces.

Furniture eCommerce worldwide: statistics and facts

According to Statista's data, the global furniture e-commerce market is expected to generate around $28.15 billion in revenue by 2024 and grow at a compound annual growth rate (CAGR) of 5.0% from 2024 to 2031.

In 2024, the global furniture e-commerce market is set for significant growth, with varying regional performances and shifting consumer behaviour trends shaping its trajectory. In 2024, North America is expected to generate $11.26 billion in furniture e-commerce revenue, making up over 40% of the global market share. The Asia Pacific region is anticipated to reach approximately $6.48 billion, driven by increasing internet connectivity and urbanization and boasting a strong CAGR of 7.0%. And Europe’s forecasted revenue stands at $8.45 billion. Latin America, the Middle East, and Africa are expected to generate $1.41 billion and $563 million.

Demographic shifts and their implications

The furniture e-commerce industry is poised for significant changes due to demographic shifts. According to the United Nations, the population will increasingly consist of individuals aged 25 to 64. This age group is particularly important for furniture sales as they typically have higher disposable incomes and are more likely to be setting up their own homes or apartments. This demographic drives the demand for online furniture purchases, making it a prime target for e-commerce furniture businesses. As these consumers are tech-savvy and value convenience, they are more inclined to purchase furniture online, further boosting the growth of the furniture e-commerce market.

User preferences: how are they shaping the furniture eCommerce market?

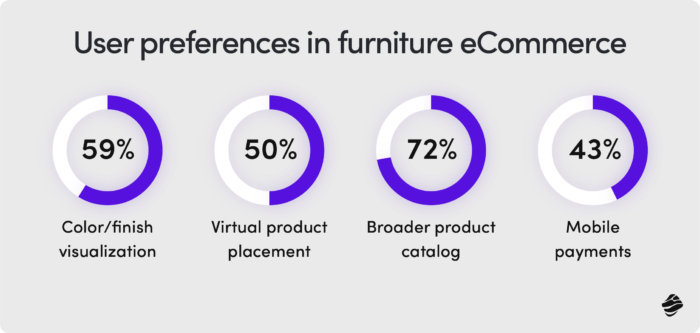

Similarly to the clothing industry, furniture eCommerce is increasingly embracing mobile devices. As many as 46% of online shoppers prefer smartphones for purchasing furniture and accessories, while only 25% prefer laptops. Additionally, 43% prefer to pay through mobile applications. Given these preferences, it’s no surprise that investments in mobile commerce technology are becoming crucial for furniture businesses.

59% of respondents would like the ability to visualize colour or finish when purchasing furniture. Virtual product placement in a space is also becoming a highly desired feature. Personalization is valued as well, especially in the face of expanding online furniture catalogues and image recognition. Online shoppers want apps to help them find furniture and accessories that match their tastes, similar to those seen in either online or offline spaces. That gives a rise to image-search based and advanced recommendation eCommerce app features.

IKEA's impact on furniture eCommerce evolution

A major driving force in the evolution of eCommerce in recent decades has been the well-known Swedish giant, IKEA. As the largest furniture retailer in the world, it controlled about 10.8% of the global furniture market in 2023. Its unique model of selling self-assembled furniture has found many followers and redefined the market. Creative marketing and branding approaches also distinguish IKEA in the furniture industry (take, for example, their "sleepfluencers" campaign or their efforts to promote the employment of migrants).

In the context of eCommerce, however, IKEA’s radical steps in innovating its online store are key. The company was one of the first to embrace global online sales, developing its store since 2000. By 2023, 25% of its sales came from eCommerce platforms. IKEA pioneered the adoption of AI and augmented reality, which we will explore further in this article.

3D Commerce, AI and Augmented Reality (AR) in furniture eCommerce

3D commerce and augmented reality solutions address the last of the challenges mentioned above, allowing furniture shoppers to visualize furniture in their own space. This enables them to test whether the size and format of the purchased furniture will fit their interior.

This can reduce the number of mistaken purchases and, consequently, returns. It can also reduce the number of abandoned carts, as such AR features remove a major shopping barrier. The user can feel confident in their decision, leading them to complete the transaction.

How 3D Commerce enhance conversion

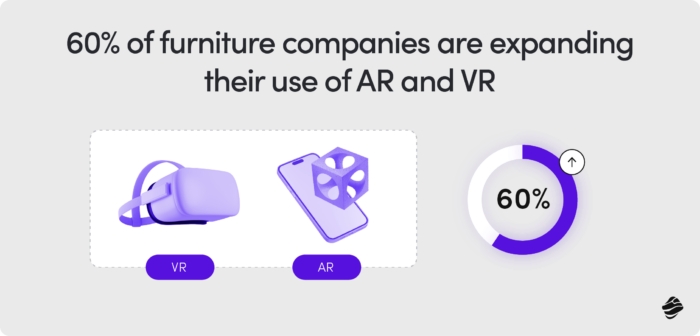

Users appreciate the ability to check how a potential purchase will match their decor. Considering all this, it’s no wonder that forward thinking furniture businesses are expanding their use of AR and VR (at the moment, nearly 60%). Meanwhile, 3D tools allow users to modify and view products from every angle. Together, they enhance decision-making by offering a realistic preview of the final product.

These tools also enable the visualization of product customization, enabled by an increasing amount of brands. Thanks to them customers can see how their choice of materials, textures, and colours will impact the final product design, allowing them to make informed decisions and create a more tailored and satisfying shopping experience.

3D commerce for product customization and configuration

With the advent of 3D commerce and augmented reality, customers can now visualize and personalize their furniture in real-time. This trend is gaining traction, with 71% of consumers willing to pay a premium for customized products. Furniture e-commerce platforms can leverage 3D product configurators to offer a personalized shopping experience, allowing customers to tailor products to their specific preferences. This not only enhances customer satisfaction but also increases the likelihood of purchase, making it a crucial strategy for furniture e-commerce businesses.

Computer vision and AR in furniture eCommerce

Have you ever passed by a place, like a café or a store, and spotted the furniture of your dreams? This is a great sales opportunity, and soon it may be used by most furniture eCommerce companies.

Through computer vision, users can scan an image in real-time via smartphone and find similar models in the store, immediately paired with aesthetically similar products. Computer vision is pivotal in enhancing product search, visual search capabilities, and inventory management within furniture eCommerce worldwide.

IKEA, Oak Furniture Land, and Wayfair are pioneers in this area. Their integrated AR functionalities allow users to view products in 360° and 3D in real rooms. Westwing is a great example of how to use the potential of Generative AI tools for better product presentation. Its instruction videos reflect the color variant of the product, even though the rest remains the same.

What's more, thanks to AR, customers can visualize furniture in their own homes through their smartphones or tablets, providing a true-to-life representation of how items will look and fit in real spaces. This interactive experience significantly reduces uncertainty in online purchases, helping to decrease return rates and boost customer confidence.

AI Technologies in furniture eCommerce

AI is also a key foundation for an increasing number of furniture eCommerce businesses. About 42% of companies use AI to adjust images in real time, and 52% use AI tools for recognizing, classifying, and tagging images.

Most AI applications in the furniture industry are related to personalization. Thanks to advanced algorithms, users receive recommendations tailored to their shopping preferences and current needs, increasing purchase likelihood.

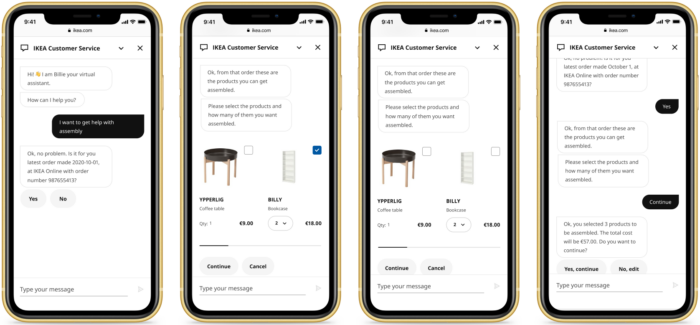

Recommendations paired with the viewed product can increase cart value, especially if they are also tailored to the user’s aesthetic preferences. Let’s not forget about AI-powered chatbots in eCommerce, which are now used by a large part of the furniture eCommerce industry worldwide, from IKEA to Wayfair and Ashley Furniture.

Furniture eCommerce AI success stories

IKEA uses AI to power its chatbot but also relies on it for inventory management, customer service, and design. Its team is also planning to explore the possibilities of the AI Builder tool for sentiment analysis, to automatically detect positive, negative, neutral, or mixed sentiments in social media, customer reviews, or any textual data from customer opinions. They are also considering using Microsoft Power Virtual Agents to provide their staff with an additional channel of communication with customers.

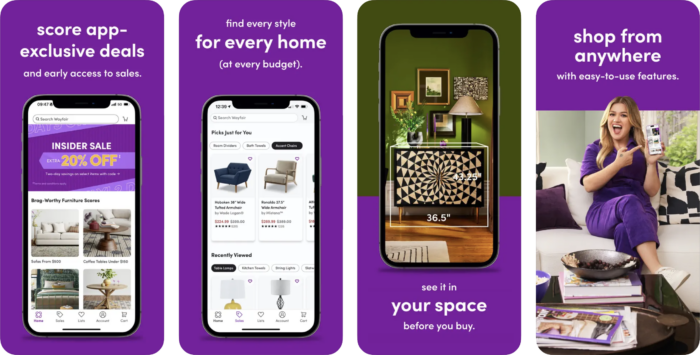

Wayfair is an excellent example of how AI can contribute to a company’s growth. The company saw a sharp increase in mobile activity immediately after introducing new features to its app in 2015. Features such as limited-time offer notifications, order notifications, and personalization translated into revenue and cart value. In the third quarter of 2015, 35% of all orders were placed from mobile devices.

Another example Furniture Village, has achieved significant success through the use of artificial intelligence, directly improving customer service and sales efficiency. The app, designed by Red Ant, allows consultants to gain insights into customers' online activity, enabling more personalized and effective service. As a result, the company has built customer trust and increased satisfaction with the shopping experience.

This solution delivered a return on investment within just six months, covering only 50% of the product range. Additionally, automation reduced transaction completion time from 20-30 minutes to just five minutes. AI-powered delivery notifications also keep customers informed at every stage of the process, from schedule confirmations to accurate ETA estimates.

Why are AI-driven recommendations so important in furniture eCommerce?

Because of the nature of furniture shopping, accurate recommendations can be highly profitable, while missed opportunities can result in lost sales, which occur less frequently compared to other sectors like clothing or cosmetics. Furniture purchases are often tied to significant home renovations, meaning users may buy more and look for matching products. On the other hand, these purchases are less impulsive, so random recommendations are less effective.

Seamless checkout experience and omnichannel integration as one of top eCommerce furniture trends

A seamless checkout experience and omnichannel integration are essential for the success of furniture e-commerce businesses. With an average cart abandonment rate of 73.26%, it’s crucial to streamline the checkout process to minimize friction for customers. Implementing features like guest checkout, one-click payments, and simplified form fields can significantly reduce cart abandonment rates. Additionally, omnichannel integration ensures a consistent experience across all touchpoints, aligning messaging, branding, and customer interactions. This approach not only enhances customer satisfaction but also helps retain an average of 89% of customers, making it a key strategy for furniture e-commerce success.

Conversational furniture eCommerce: the role of chatbots and AI assistants

Statistics show that chatbots have already helped eCommerce companies drive transactions worth $122 billion by 2023, with 35% of consumers having used chatbots for purchases. In furniture retail, chatbots are especially beneficial in guiding customers through the often complex decision-making process, such as selecting the right dimensions, materials, or styles, which is crucial for furniture stores transitioning to online platforms.

AI-powered assistants can recommend products based on past purchases or preferences, while conversational AI helps maintain a smooth, human-like interaction, enhancing engagement and satisfaction in both online stores and physical stores.

Chatbots generate more profit in furniture businesses than in other niches due to the industry's inherently repetitive nature. Furniture purchases often involve common queries about assembly instructions, setup, product dimensions, or missing parts. By efficiently handling these inquiries, chatbots reduce the burden on human support teams, minimize wait times, and increase customer satisfaction.

For example, a chatbot can resolve a missing part issue without manual intervention, speeding up the resolution process and improving the post-purchase experience—key benefits for both online and physical furniture stores. Successful implementations can be seen in furniture businesses like Wayfair, Crate & Barrel, and Skum.

Smart furniture and IoT integration

Smart furniture and IoT integration are emerging as significant trends in the furniture e-commerce industry. Combining state-of-the-art technology with conventional design, smart furniture enhances comfort, productivity, and lifestyle. IoT integration allows furniture to connect with other devices, providing a seamless and enhanced user experience. This trend is expected to grow, with the global modular furnishing market projected to reach $58.6 billion by 2027. Furniture e-commerce businesses can capitalize on this trend by offering smart furniture options, appealing to tech-savvy consumers looking for innovative and functional home solutions.

The importance of recommerce (second-hand furniture market) and eco-friendly practices in furniture eCommerce trends

As environmental awareness grows, the second-hand furniture market is expanding significantly. This trend not only applies to clothing but also to furniture. The rising popularity of vintage furniture has led to the emergence of many popular furniture re-commerce platforms today.

AptDeco, Chairish, and Sotheby’s Home are examples of platforms where users can sell and buy second-hand furniture instead of searching through generic marketplaces. These e-commerce platforms also protect user interests by offering fulfilment and delivery services. They can ensure eco-friendly packaging and filling.

Examples of recommerce in furniture eCommerce platforms

Once again, the IKEA. The company has launched various furniture buyback and resale programs, allowing customers to return used furniture, which the company then refurbishes and resells. This recommerce initiative aligns with their commitment to sustainability and circular economy practices.

Chairish and Kayio, though primarily recommerce platforms, often collaborate with mainstream online retailers for listings and reach. Chairish, for example, caters to both direct consumers and larger design-focused platforms, helping streamline the recommerce of luxury and vintage furniture.

These partnerships are part of growing furniture eCommerce trends where recommerce platforms align with furniture eCommerce companies to expand their audience and improve visibility. Additionally, tech-savvy furniture businesses are taking advantage of digital innovations to enhance the customer experience, from personalized recommendations to seamless payment options.

Ecofriendly practices in furniture eCommerce

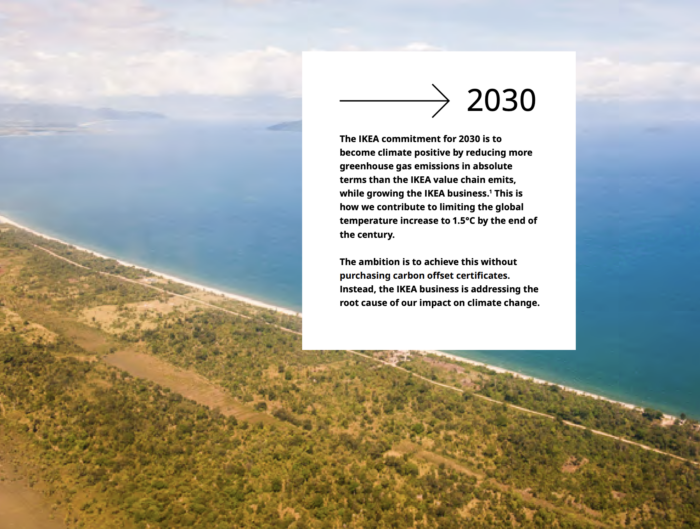

Sustainability is becoming an increasingly important aspect to consumers, especially when buying furniture online. This trend is evident in the global market, where a big part of the furniture business is turning to more sustainable materials or acquiring them from ethical sources.

Transparency has become a norm in online stores, with origin certificates becoming an integral part of product cards, contributing to overall commerce revenue. Social media platforms also play a role in this shift, as consumers demand eco-conscious choices and expect businesses to prioritize sustainability in their offerings.

A significant change in material usage can be seen across the industry, with companies moving toward sustainable alternatives. For example, IKEA has transformed its sourcing practices, committing to using 100% sustainably sourced wood by 2030. In 2019, they reported that over 60% of the wood they used was already from renewable or recycled sources, showcasing their dedication to environmental responsibility. This transformation is setting an example for other tech-savvy furniture businesses to follow and highlights the importance of eco-conscious practices in maintaining customer loyalty and driving future commerce revenue.

Furniture eCommerce challenges

Due to its specific nature, selling furniture online involves very particular challenges that are highlighted in furniture eCommerce. The most important is, of course, the size of the items being sold. Even when fully disassembled, furniture can still pose a challenge in terms of transportation.

The size and weight of the transported parts create challenges for delivery providers. This often involves additional costs and solutions that shorten the supply chain (see IKEA’s pick-up points). It also affects the handling of returns and complaints.

Transporting furniture parts is also challenging due to the materials used. Glass or ceramic elements, in particular, must be carefully secured, which becomes the responsibility of fulfillment. Thoughtful filling and packing of irregularly shaped packages are additional logistical challenges, as well as added costs. Empty runs in transportation increase costs, and for items with unusual dimensions, it is more difficult to fully utilize the available space.

Cart abandonment is a significant issue for the furniture e-commerce industry, often linked to complicated checkout processes. For instance, retailers in the e-commerce furniture industry face higher cart abandonment rates due to multi-step transaction methods. Therefore, cart abandonment during the payment process impacts both sales and customer retention in the online furniture shopping experience.

This issue can be addressed by streamlining the checkout procedure. In 2022, furniture prices increased by 16.8% compared to 2021, putting the ecommerce furniture industry at risk of declining sales. Implementing a "buy now, pay later" service could help mitigate this trend.

The last key issue affecting furniture eCommerce is the frequency of returns. This is especially visible in cities, where shrinking spaces make it difficult for buyers to successfully arrange their interiors. It’s easy to buy a piece of furniture that doesn’t fit, which then requires a return.

Conclusion with expert insights and best practices

Industry experts emphasize the importance of investing in dedicated to eCommerce development services and technology to enhance the customer experience. Recognizing the value of human interaction and leveraging technology to streamline processes can significantly elevate the customer journey. Focusing on customer experience, responding to high customer expectations, and utilizing social media as a new shopping channel. By embracing these trends and best practices, furniture e-commerce businesses can stay ahead of the curve and achieve success in the competitive market.

![[header] 29 top ecommerce app features you need to know](https://www.miquido.com/wp-content/uploads/2024/02/header-29-top-ecommerce-app-features-you-need-to-know-432x288.jpg)