For nearly three years, we have all been witnessing rapid global changes in the social, political, and economic spheres. The pandemic, inflation, war in Ukraine, and the subsequent macroeconomic destabilization have affected how companies invest in developing digital products and support innovation. In a slowing global economy era, after a year of shocks related to cryptocurrency market crashes, supply chain shortages, and soaring inflation, companies watch every dollar they plan to spend on their product. For these reasons, we predict that Flutter apps will become one of the most influential trends in fintech software development in 2023. Why do we think that?

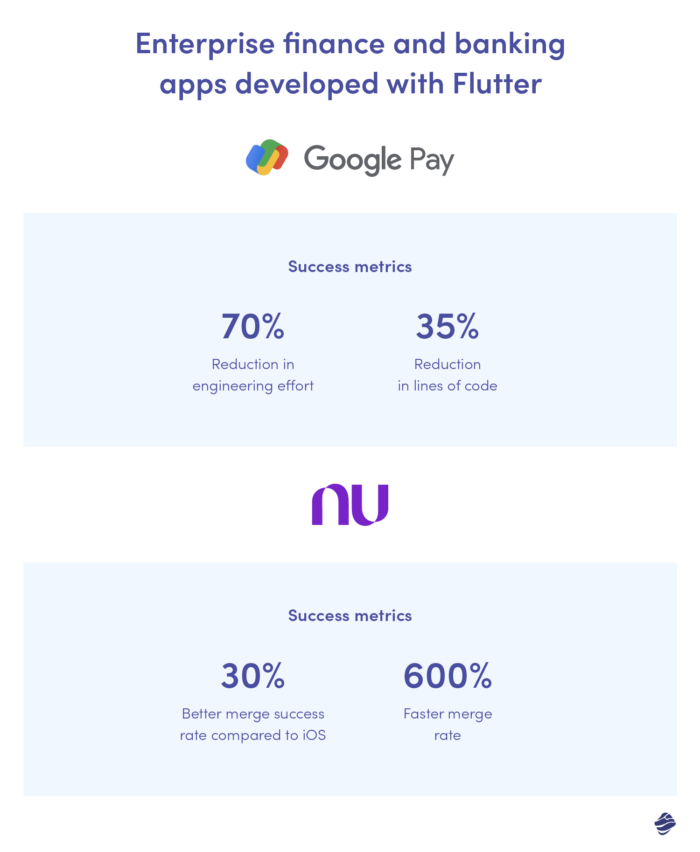

After developing a successful Flutter fintech app for an enterprise client from Asia, we are confident that Google’s SDK creates unprecedented opportunities to build comprehensive, feature-rich Flutter banking mobile apps. The experience of several fintech and banking companies, such as NuBank, Google Pay, Credit Agricole, ING Business, and Nextbank, confirms our beliefs.

On the verge of recession, many fintech and banking companies face the difficult decision of whether to scale, rebuild or launch a new digital product. Let’s discuss how Flutter app development can increase the chance of commercial success. We’ll start by outlining the macroeconomic and technological context critical for the fintech, finance and banking industry at the beginning of 2023.

Developing banking and fintech apps in 2023: a macroeconomic introduction

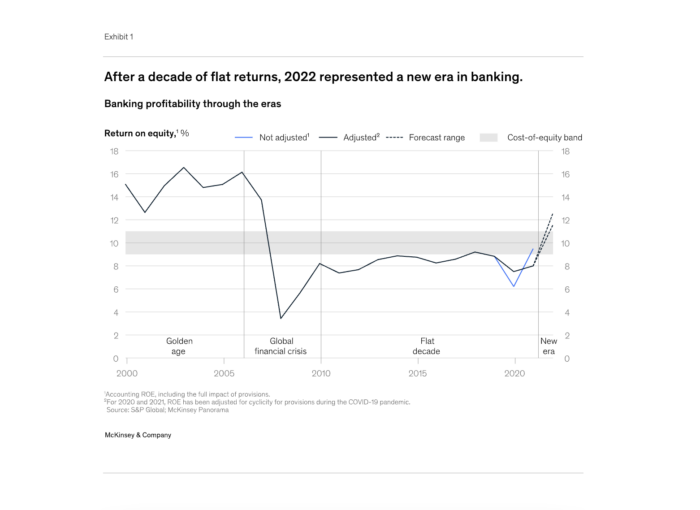

After the COVID pandemic, in 2022, the banking sector recorded unprecedented revenue growth. With capital markets and investment banking being the exception, all banking segments have seen improvements of up to 60% in revenue gains.

Bank profitability reached a 14-year high in 2022, with expected return on equity between 11.5 and 12.5 percent. Revenue globally grew by $345 billion. This growth was propelled by a sharp increase in net margins, as interest rates rose after languishing for years on their cyclical floors. For now, the banking system globally is sitting comfortably on Tier 1 capital ratios between 14 and 15 percent — the highest ever.

Despite a clear upward trend on a macro scale, delving into the specifics of the fintech and banking market, we can observe a considerable disproportion between the big players and the rest of the industry. As McKinsey points out in the report above, more than half the world’s banks in 2022 continue to have a return on equity that is below the cost of equity.

In other words, the fintech and banking industries are becoming increasingly heterogeneous. The growing differences between European, American, Asian, and South American markets force greater caution in planning a foreign expansion or choosing technological solutions.

A double challenge for the fintech and banking industries

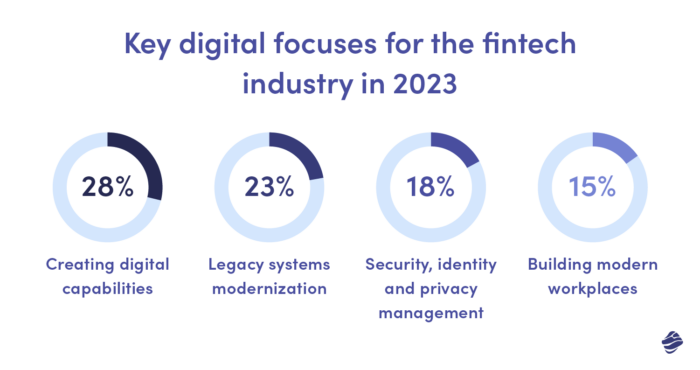

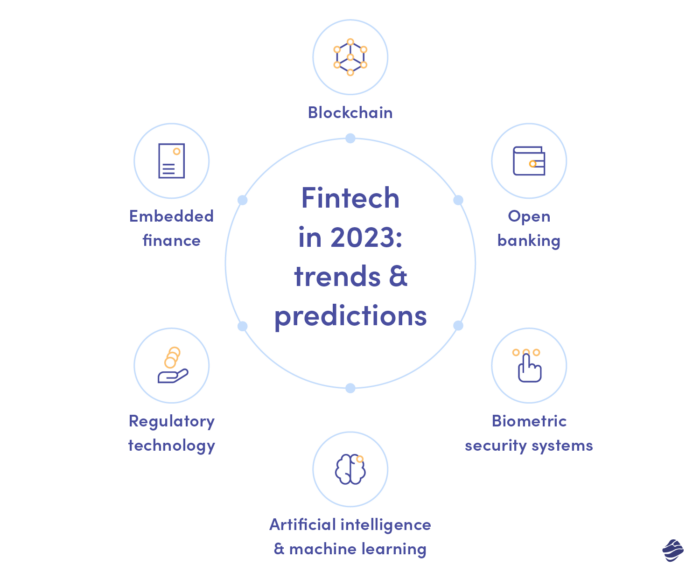

At the same time, while analyzing the predictions of fintech experts for the coming years, we can clearly notice a lot of optimism related to new technologies: AI, blockchain, NFT, AR, IoT, cloud computing, no code, and low code solutions. The financial industry is becoming increasingly competitive, resulting in more personalized, safer, and more intuitive digital products.

And here we come to the heart of the problem. The double fintech and banking challenge lies in strengthening the market position in an era of constant change while paving the way for future innovation. Why can Flutter financial apps become the game-changers in this context?

6 reasons why Flutter fintech apps will disrupt software development in 2023

Fortunately, with the latest technology advancements, companies can find the hard-to-find balance between pioneership and execution. In this context, Flutter is an excellent compromise between efficiency and quality. Let’s discuss the reasons why the cross-platform approach is worth a try, especially in the fintech, financial and banking industries. Read on to discover the 6 biggest advantages of Flutter fintech apps.

1. Flutter financial apps are cost-efficient

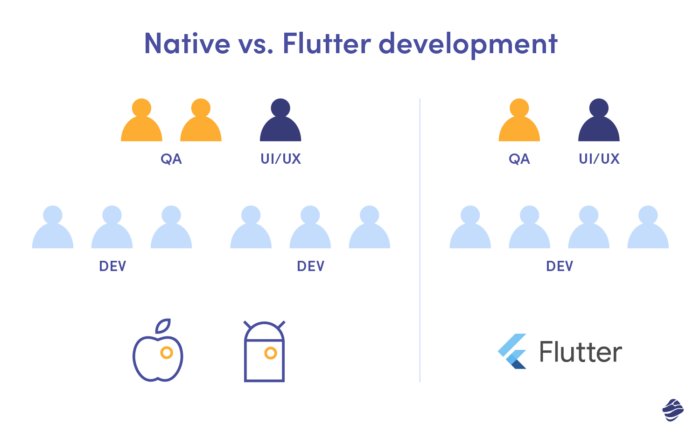

Facing the challenge of fintech app development, one of the fundamental decisions to be made is the choice between native and cross-platform approaches. Compared to native applications, cross-platform applications, especially those developed with Flutter, are more cost-efficient. But why are Flutter finance apps worth a try?

Let’s assume you chose a native approach for your new Android and iOS banking applications. You will need to hire two separate teams of developers specialized in programming languages of the given OS – Swift / Objective-C in iOS and Java / Kotlin in Android. If you want to scale the product with a web application, you will have to expand the team with the next set of experts.

Long story short, in the native approach, each device uses its own codebase – which requires employing several dedicated teams to build the application and then its maintenance. The native approach results in high fixed costs and reduces flexibility in releasing new functionalities or modules. Each new solution, improvement, or design must be built and implemented for each device from scratch.

Meanwhile, Flutter, as a cross-platform framework, enables the simultaneous development of fintech and banking apps for Android, iOS, desktop, web, and wearables. The shared codebase combined with extensive libraries of reusable components enables rapid Flutter app development by one team of developers.

How can Flutter reduce the development cost in banking & fintech applications?

Choosing the Flutter framework for the fintech or banking app development project, you can expect a significantly lower software development cost due to several optimizations on the way, such as:

- One development team instead of three – in the case of a Flutter fintech app, you only need to hire one Flutter development team instead of, e.g., three separate Android, iOS, and web development teams.

- Code reusability – the shared Flutter codebase means that developers can use up to 90% of the code between platforms. Based on our previous projects, the time needed to develop an application for another platform in Flutter usually does not exceed two weeks.

- Fast testing – thanks to the hot reload feature, Flutter developers can preview any changes in the frontend immediately after implementing the corrections in the code. Hot reload (or hot restart for Flutter Web) significantly improves the Flutter financial app testing process and slows down budget burndown.

- Fast minimum viable product (MVP) & proof of concept (PoC) development – Flutter allows creating an MVP or PoC in just 2-3 months. Full Flutter fintech app development process is approximately 30% cheaper than creating two native applications.

The efficiency of development in Flutter is the reason why two giants of the fintech industry, Google Play, and NuBank, chose Google’s framework. As you can see, Flutter is a perfect solution not only for startups but also for large corporations, where it brings million-dollar savings.

2. Flutter banking apps unlock future competitiveness

The paradigm shift from web 2.0 to web 3.0 is happening right before our eyes. Modern society is becoming more aware and digitized and relies on technology in many areas of daily life. The role of an effective, well-thought-out digital strategy in the banking and fintech sector is even more significant than in other sectors. In the face of enormous competition, customers expect highly personalized services.

Fintech and banking companies should constantly develop mobile and web applications based on securely collected and processed user data. At a time when customers can switch banking service providers quickly and seamlessly, every nuance, bug, or delay can result in an irreversible failure in the digital race.

Why is Flutter the key to the innovation of your digital product?

We have already discussed that Flutter allows fintech and banking institutions to quickly develop and test new features and modules for all devices simultaneously. But how does this relate to competitiveness and innovation?

Flutter developers can use extensive, frequently updated libraries and benefit from the support of a thriving Flutter community. Although native libraries still offer more solutions, the Flutter ecosystem is already mature enough that there should be a library for any common use case.

Secondly, Flutter is characterized by its outstanding speed in building user interfaces. Google’s SDK enables the smooth implementation of changes in the Flutter fintech app’s design and functionalities to meet users’ expectations. Plus, all of this can be done at a much faster pace than in the case of native solutions.

Need more evidence? In Flutter’s early days, many developers willing to explore cross-platform possibilities joined the UI challenge. Flutter developers searched for the most complex Dribbble shots and implemented them in Flutter. Projects that would take up to a month to implement in the native version were implemented in less than a week. All thanks to Flutter!

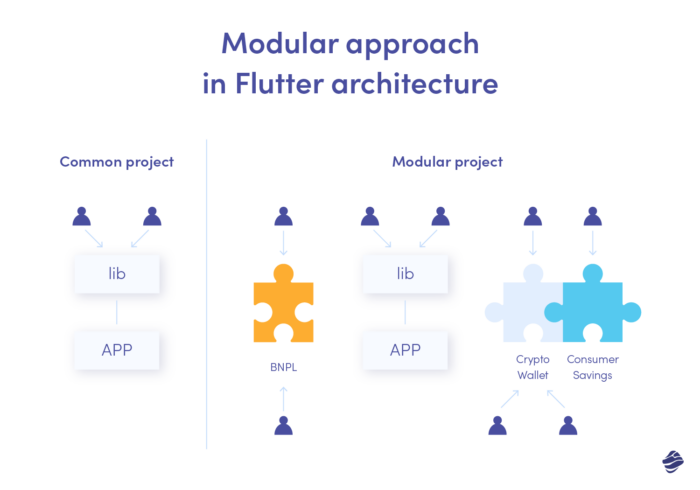

3. A multi-module approach in Flutter unlocks unprecedented scaling capabilities for finance applications

One of the most critical Flutter fintech app benefits for companies with already-existing native banking or fintech applications is the ability to implement a multi-module approach in the context of software architecture. The multi-module approach means Flutter allows developers are able to attach cross-platform modules to existing native applications. Thanks to this, fintech companies have the opportunity to quickly implement or test new functionalities such as:

- Cryptocurrencies

- Savings accounts

- Buy Now Pay Later

- Fast payments

- And many others!

The possibility of a modular approach to the software architecture in Flutter enables the simultaneous development of multiple new, innovative functions – especially in quickly scaling and developing projects. Thanks to the modular approach in Flutter, many teams can work on several different functionalities simultaneously. As a result, companies that decide to take advantage of Flutter banking apps can implement, test, and improve new functionalities long before their native OS-based competitors.

How does the multi-module approach in Flutter work in practice?

In a recent large project for a client from the banking industry, our team of cross-platform developers gradually implemented Flutter into native applications. Many cross-functional teams simultaneously worked on various modules related to the innovative application scaling plan. Flutter enabled us to create hybrid flows in which native and Flutter modules communicate with each other through the original native application.

What were the results of our work? Thanks to the multi-module approach, for end users (even those familiarized with the original native application), the Flutter fintech app’s screens turned out to be utterly indistinguishable from native ones. The revamped mobile application is characterized by lower failure rates and excellent performance. Not to mention that new modules are now used by millions of users of one of the largest banks in Asia.

4. Flutter provides flawless application performance

In fintech and banking apps, performance directly impacts customer engagement and user retention. With every second of delay and every underdeveloped application feature, the risk of losing customers is getting more and more serious. Hence, fast content load time and flawless product performance are critical in the fintech and banking industries.

Flutter fintech apps are characterized by fast, up to 60 frames per second (fps) performance. In the case of devices capable of 120Hz updates, it is even possible to unlock the 120 fps performance – equal to the metrics of native solutions.

Flutter is fast. It’s powered by the same hardware-accelerated Skia 2D graphics engine that underpins Chrome and Android. We architected Flutter to be able to support glitch-free, jank-free graphics at the native speed of your device. Flutter code is powered by the world-class Dart platform, which enables compilation to native 32-bit and 64-bit ARM code for iOS and Android.

Technical factors that affect the performance of Flutter fintech apps

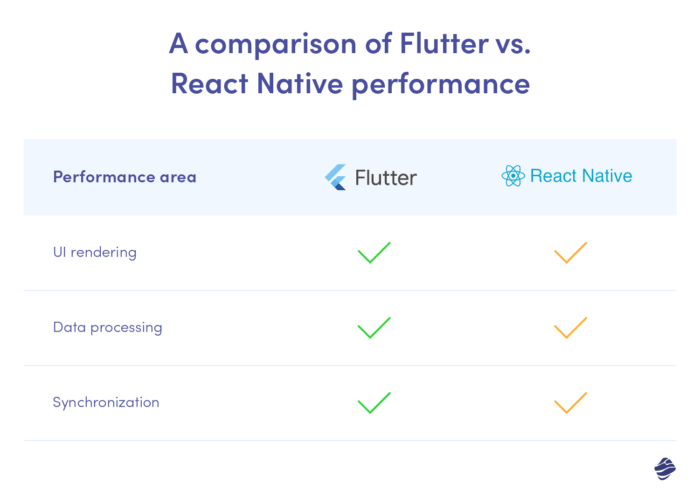

Compared to other cross-platform frameworks, such as React Native, Flutter seems the best solution in terms of app performance. Why? React Native always needs a bridge between JavaScript and native modules. In the case of Flutter, most components are already a part of the framework.

React Native handles gestures both through JavaScript and native solutions. The bridge between these two makes it less efficient. In the case of Flutter, it only happens on the native side. All Flutter finance app’s processes are fully native – and hence, much faster.

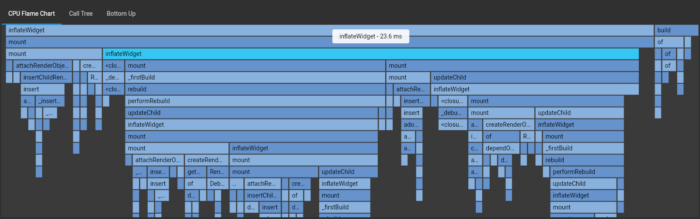

Last but not least, Flutter tools (DevTools) enable easy access to app’s performance. With the performance view, developers can learn about the app performance via:

- Flutter frames chart – to get the information about every frame

- Timeline events chart – to get the information about all events happening in the app

- CPU profiler – to receive information about the CPU use in an application.

Flutter, CPU Flame Chart

5. Flutter facilitates future maintenance

Releasing an application or its module to the public is just the beginning of the fintech or banking product journey. After a successful release, it is vital to maintain the application, react quickly to any errors in its functioning and observe user reactions. Fintech and banking applications need to be constantly developed – on the one hand, to ensure their flawless operation and, on the other, to stay ahead of the competition.

Effortless maintenance of Flutter-based fintech and banking apps is a vital cross-platform merit acknowledged and used by many. The creators of the ING Business application openly admit that easy app maintenance was one of the reasons behind the decision to use Flutter in their large-scale project.

How did Flutter optimize app maintenance in the ING Business?

ING Business was one of the first banking apps rewritten to Flutter in the SDK’s early beta days in 2020. The Flutter banking app developed by ING Business was a huge commercial success. In 2020, the application received the Global Finance award for the best mobile banking solution.

Let us remind you, however, that in 2020 Flutter was still a relatively new framework. Back then, the gradually introduced improvements were causing libraries to lose compatibility or code fragments to stop working. So why did ING decide to use Google’s framework even though it was still struggling with the problems of the beta version?

The creators of ING Business decided to choose this SDK due to:

- Cohesive UI for Android and iOS

- Reduced cost of application development

- Quick implementation of new functionalities

- And last but not least, simplified application maintenance process.

Before we started to rebuild the mobile app, we faced the dilemma of choosing the technology for the new version. (…) We went for Flutter and this decision allowed us to significantly accelerate development, create one coherent interface for the user and simplify production maintenance of the application.

One shared codebase in Flutter enables low-effort testing of new features and fixing bugs on all platforms at once. Thanks to hot reload (and hot restart for Flutter for the web), Google’s SDK enables fixing issues right at hand. Furthermore, the simple code structure allows developers to find bugs with ease. There is no doubt: Flutter is an advanced tool for optimizing the application development process at every stage – from MVPs and PoCs to maintenance.

6. Flutter fintech and banking apps are secure

In fintech and banking applications, the security of sensitive data and transactions is an absolute must. Fintech companies developing mobile applications must pay attention to several factors, such as:

- Identity management

- Data security

- Cybersecurity

- International and regional security requirements, such as KYC, GDPR, APPI, FCA, and many more.

In addition to taking care of the appropriate application functions and authentication methods, it is no less important to ensure the security of the code. In this aspect, Flutter also stands out when compared to native solutions. Why? Primarily thanks to the specifics of Flutter’s programming language, Dart.

Why are Flutter fintech apps by default more secure than native apps?

With native apps, hackers can use reverse engineering to restore the source code – even after the code obfuscation. In the case of Flutter, Dart is compiled directly into machine code – hence, reverse engineering tools are much more challenging to develop. While compared to native programming languages, such as Android’s Java, reverse engineering in Dart is a considerably unexplored topic. As a result, the Flutter code (and, consequently, any Flutter fintech app) is less subject to reverse engineering.

Code obfuscation is the process of modifying an app’s binary to make it harder for humans to understand. Obfuscation hides function and class names in your compiled Dart code, making it difficult for an attacker to reverse engineer your proprietary app.

Flutter enables using the platforms capacities to leverage app’s security

In addition to the technical, cross-platform-like properties of Flutter, Google’s framework allows fintech software developers to use the full spectrum of capabilities of native platforms. Cross-platform developers can use native APIs to secure the Flutter fintech app, e.g., with iOS Keychain services or Android KeyStore system. Apps made with Flutter can also use biometric authentication via Face ID, Touch ID, or a fingerprint scanner, as well as all the freshest library implementations of popular data encryption algorithms.

Why are Flutter fintech apps worth a try?

In an era of geopolitical and economic uncertainty, change is the only constant. In the fintech & banking industry, the rapidly shifting macroeconomic landscape forces an agile approach to team scaling, readiness for the dynamic development of promising new technologies, and a certain flexibility in terms of product growth.

Every year, fintech and banking companies are more aware of the solutions that enable risk-free and cost-efficient idea validation. Hence the growing popularity of low & no-code solutions, as well as the rise of cross-platform and Flutter-like frameworks in the case of mobile and web applications.

What are the most significant Flutter benefits? Flutter finance apps are a leap toward the digitized, seamless future of banking. Flutter allows the development of new digital banking features while also taking care of the balance between innovation, efficiency, and security. Companies using Flutter – from giants such as ING Business, Nubank, Google Pay, Credit Agricole or Nextbank, to smaller fintech startups (such as Fennel, Cheddar, Vosbor or Capital on Tap) – can achieve a smooth, native-like app experience with just one team of cross-platform experts. And in the era of uncertainty, such flexibility and efficiency is the deciding factor for which company will survive (or even benefit from) the times of crisis, and which will fall behind.