With a staggering value of $260.7 billion in 2022, the Fintech as a Service (FaaS) market is making seismic shifts within the financial services industry. Here’s a head-turner: Global Market Insights forecasts its growth at a roaring CAGR of 14% from 2023 to 2032.

In an era where financial agility is not just desired but demanded, these numbers aren’t merely figures on paper but a testament indicating a revolution. It’s signalling a change where FaaS takes the lead, pushing traditional fintech to the sidelines. If you’re keen on understanding the impact of these changes, you’ve landed in the right space.

In this exploration, we’ll traverse through:

- Understanding Fintech-as-a-Service: Redefining the financial services market.

- Services of Fintech-as-a-Service Companies: Fintech company offerings that make the billion-dollar difference.

- Benefits for Financial Institutions: Efficiency, scalability, and rapid market entry.

- Real-world Examples: FaaS businesses and their successful partnerships.

- Fintech for Startups: Innovate financial technology solutions as a service without breaking the bank.

- Challenges and Solutions: Navigating the dark waters of security and regulations.

- Bridging Banking and Modern Expectations: The transformative nexus for traditional banks.

- The Future of Fintech-as-a-Service: Charting the course ahead.

Let’s decode what these billions truly represent.

P.S., If you’re hunting for a tailored solution that caters to the growing demands of the fintech services, Miquido’s advanced digital solutions might just be the answer.

What Is Fintech as a Service (FaaS)?

In its simplest terms, Fintech as a Service (FaaS) is financial technology offered as a service. Much like Software as a Service (SaaS), FaaS is all about offering financial products or services through software.

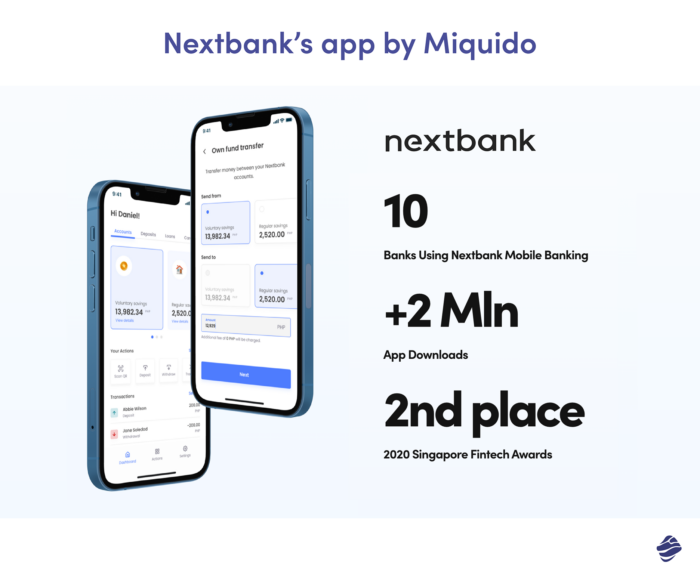

For example, our project with NextBank was an AI-based credit scoring engine – a prime example of FaaS in action, enabling precise identification of high-risk loans using cutting-edge technology.

Some other examples include:

- Digital Wallets: Think of services like Apple Pay or Google Wallet. They store users’ payment details and enable swift, contactless transactions, all managed via software.

- Peer-to-Peer (P2P) Lending Platforms: Websites or apps that connect borrowers directly to lenders, eliminating the traditional banking middleman. This streamlines the loan approval process and often results in better rates.

- Robo-Advisors: Automated platforms that provide financial planning or investment advice based on algorithms. They ask you a series of questions, crunch the numbers, and voilà – investment advice without human intervention.

- Payment Processing Services: Systems like Stripe or Square that allow businesses to accept payments online. They integrate with e-commerce platforms and handle transactions in real time.

- AI-driven Fraud Detection: Software that analyzes transaction patterns in real time to spot and flag suspicious activities. It’s like a watchdog, always on the lookout for financial mischief.

Traditional fintech models are like static DVDs, while FaaS is the evolving world of streaming, adapting to user needs. Old methods often entangle businesses in rigid infrastructures and regulations. However, FaaS provides a “plug-and-play” approach, enabling a smoother path to innovation and client service excellence.

Why Companies Love Fintech-as-a-Service

- Cost Savings: FaaS unifies all payment, financial management, and money movement services that modern enterprises require into a single and scalable worldwide API. This can lead to a 40% cost savings on initial tech expenditures when adopting FaaS models over traditional fintech solutions.

- Scalability: In the evolving fintech landscape, adaptability is vital. FaaS embodies this principle, offering a platform that allows businesses to adjust their operations in line with fluctuating demands. Whether it’s a startup experiencing a surge in growth or venturing into uncharted territories, Fintech-as-a-Service enables companies to soar.

- Faster Time-to-Market: According to McKinsey, companies that adopt cloud platforms can bring new capabilities to market more quickly, innovate more easily, and scale more efficiently, while also reducing technology risk. Fintech companies that have adopted cloud platforms report that they can bring new capabilities to market about 20 to 40 percent faster.

- Case in Point: A recent study by East & Partners underscores the appeal of Fintech as a service, revealing that a notable 46% of global businesses are adopting Fintech solutions mainly to cut down on operational costs. The shift towards efficiency and cost-saving is evident, with FaaS at the helm.

- Continuous Innovation: Partnering with FaaS providers ensures financial institutions access to the latest fintech advancements without hefty R&D investments, potentially saving them up to 30% in innovation-related costs.

In essence, the benefits of fintech services are vast, be it economic or efficiency gains, making it a strategic choice for modern and traditional financial institutions.

Want a piece of the pie that comes with integrating FaaS into your business? Miquido is the go-to partner for designing and implementing fintech solutions for forward-thinking businesses like yours. Reach out today.

What Kind of Products Are Most Common in Fintech As a Service Companies?

Diving into essentials, fintech companies now offer a wide range of FaaS solutions to enhance financial technology as a whole.

Payment Gateways

More than just transaction facilitators, these payment methods are the linchpins of the booming e-commerce sector. They spearhead digital payments, ensuring a frictionless experience, mirroring the ease of physical stores.

Platforms like Stripe or PayPal have revolutionized how businesses manage both international and local payments, making cross-border transactions feel local.

Banking as a Service (BaaS)

Banking as a service is banking reimagined. BaaS is the financial technology infrastructure that enables fintech companies to roll out banking services including deposits or transfers, without transforming into traditional banks.

Stripe, for example, offers BaaS APIs, blending them with versatile payment methods, and equipping FaaS businesses with products and services to design and deploy comprehensive embedded financial features.

Risk Management Solutions

Embracing AI’s prowess, these solutions forecast financial threats and recommend mitigation strategies. Giants like Mastercard deploy AI-infused fraud detection tech, fortifying the payment systems and staying a step ahead of credit and debit card fraud.

Automated Wealth Management

It’s like having a 24/7 financial advisor. These platforms use algorithms to craft personalized financial plans, often outperforming traditional payment methods in terms of returns. Betterment and Wealthfront use algorithms to create individualized financial plans, which frequently exceed traditional methods in terms of returns.

Lending Platforms

Gone are the days of endless waits for loan approvals. Modern lending platforms, complemented by money movement services, act as digital matchmakers, connecting borrowers with potential lenders swiftly. Peer-to-peer lending services have become particularly invaluable for enterprises seeking quick access to funds.

Examples of Companies That Have Successfully Integrated FinTech-as-a-Service

The transformation of traditional financial institutions, courtesy of fintech partnerships, is nothing short of remarkable. These alliances, once perceived as disruptive, now stand as a testament to the power of collaboration.

Banks offer fintechs their vast infrastructure, industry knowledge, and regulatory frameworks. In return, FinTech grants banks entry into new markets, accelerating their digital footprint and enhancing the customer experience. This collaboration ushers in enhanced efficiencies, data-driven decision-making, and broadened accessibility to banking services.

P.S., If you’re looking for a FinTech solution to transform how your business handles finances, contact us for a free consultation. We’ll discuss what’s holding you back, how to improve your processes, and the exact financial software needed to make that happen.

1. Tradeshit & HSBC

Tradeshift + HSBC

HSBC, a trailblazer in trade finance banking, joining forces with Tradeshift, the top-tier business commerce platform, leads to a groundbreaking shift.

Together, they supply services based on a comprehensive platform that assists businesses in handling working capital requirements and global supply chains proficiently.

These third-party solutions not only encourage companies to automate their processes for increased efficiency but also enhance global payment strategies and bolster risk management.

2. Citi & IntraFi

Citi and IntraFi

Citigroup’s partnership with IntraFi has introduced the Yankee Sweep—a service that allows corporate and institutional clients to direct their excess funds into U.S. branches of overseas banks.

Michael Berkowitz, North America’s head of liquidity management at Citi, highlights that customers accessing financial services aim for the best returns without sacrificing liquidity and are keen on smooth international payment methods.

Yankee Sweep meets these needs by enabling Citi’s clientele to accept global payments through a unified account.

Broadening the Horizon: Beyond Banks

The surge of FaaS isn’t restricted to the banking realm. With the introduction of FaaS payment processing systems, the broader startup and business ecosystem can access fintech services, empowering them to optimize their payment flow and fortify their finance strategies.

- Stripe & Shopify: Shopify’s ‘Balance’, empowered by Stripe Treasury, transcends a mere financial product. Integrated with third-party payment platforms and a robust payment flow, it stands as a merchant empowerment tool. Designed to ensure seamless local payments, it provides instant access to funds without burdensome fees. Leveraging Stripe’s cutting-edge architecture and APIs, Shopify has solidified its foothold in the e-commerce sphere, marking the registration of an impressive 100,000 U.S. small businesses in just four months post-launch.

- Adyen & Uber: Adyen’s symbiotic relationship with Uber isn’t limited to a standard partnership; it’s a testament to the capabilities of a leading fintech company in reshaping global payment systems. Processing payments across 80 countries, Adyen offers Uber an efficient and adaptive payment flow. This allows Uber to prioritize their core transactional demands, offering seamless interactions for millions of riders and drivers daily, without the complexities of juggling multiple local payments.

- Roofstock: Amidst a sea of real estate platforms, Roofstock emerges as a beacon, primarily due to its adept integration with fintech company tools. With a platform bolstered by algorithms predicting profitable acquisitions, innovative fractional ownership models, and advanced property management mechanisms, Roofstock has set new standards in democratizing real estate investments. Their booming valuation underscores their capability to harness fintech innovations effectively.

- Krea & Klarna: Krea’s strategic alliance with Klarna’s fintech branch, Klarna Kosma, is revolutionizing SME loans in Sweden. Integrating with national and international bodies through a digital interface, they’ve ensured that SMEs receive instantaneous loan verdicts, bypassing outdated bureaucratic roadblocks.

- Wish & Klarna: The collaborative force of Wish and Klarna is redrawing the boundaries of e-commerce financial adaptability. By amalgamating Klarna’s ‘Pay in 4’ solution, Wish guarantees its U.S. patrons a shopping experience like no other, where payments are effortlessly distributed, interest-free, over feasible installments.

The year 2023 marks significant alliances such as Visa joining forces with Fintech District and Santander teaming up with Salesforce. As startups and fintech companies pursue such dynamic collaborations, FaaS payment providers offer critical support.

Addressing The Challenges That Come With FaaS

Embracing fintech as a service companies does come with certain challenges. Issues related to data security, navigating the maze of regulatory and legal compliance, and apprehensions of becoming too reliant on a third party might give financial institutions pause. Nevertheless, by being forward-thinking and diligent, these hurdles can be managed.

Data Security

As the vast expanse of financial data makes its way into the digital sphere, ensuring its fortification becomes a must. Partnering with FaaS providers is a commendable step, but it’s essential that they not only align with international security benchmarks, including regulations set by the financial crimes enforcement network but also employ advanced encryption tools. Such proactive measures ensure that customers can confidently grant access to their data, resting assured of its safeguarded status.

Expert Suggestions:

- Regular Audits: Continuously audit your FaaS provider’s security protocols to ensure they’re up-to-date and rigorous.

- Two-Factor Authentication (2FA): Implement 2FA wherever possible, adding an extra layer of security during user access.

- End-to-End Encryption: Ensure that data, while in transit or at rest, is encrypted, making it inaccessible to unauthorized entities.

Regulatory Compliance

The evolving nature of fintech means regulatory landscapes shift frequently. Platforms that offer real-time regulatory updates can be invaluable. It’s not just about legal compliance but about staying ahead of the curve.

Recent studies indicate that keeping abreast of upcoming regulatory and legislative changes is the top strategic priority for a whopping 61% of companies’ compliance teams.

Expert Suggestions:

- Stay Proactive: Dedicate a team or utilize automated tools to monitor and respond to regulatory shifts.

- Collaborate with Experts: Engage regulatory consultants who can provide insights into global and regional compliance matters.

- Training Programs: Regularly update your team’s knowledge with compliance training sessions.

Vendor Lock-in

The anxiety over becoming too reliant on a singular fintech company is legitimate. Diversity is the solution here. Instead of solely leaning on one FaaS provider, ponder integrating offerings from diverse vendors, or opt for platforms that put a premium on interoperability and connections to local payment networks.

Expert Suggestions:

- Open Standards: Opt for platforms based on open standards, which ensure higher compatibility and easier transitions.

- Contract Clauses: Ensure contractual flexibility, allowing you to switch providers without hefty penalties or prolonged exit processes.

- Hybrid Approach: Use a combination of in-house and third-party solutions, ensuring you aren’t overly dependent on one vendor.

Scalability and Infrastructure Challenges

As your financial operations grow, your FaaS platform must scale with you. Prioritize platforms known for their scalability.

Expert Suggestions:

- Cloud Integration: Platforms like AWS and Google Cloud offer infrastructure services that can support the scalability of your fintech-as-a-service tools. Furthermore, leveraging Cloud Services offered by Miquido can amplify security and scalability, ensuring your FinTech solutions remain robust.

- Performance Metrics: Regularly monitor your platform’s performance metrics to detect and address scalability issues promptly.

- Forward Planning: Engage in forward capacity planning, estimating future demands and ensuring your platform can handle growth.

Bridging the Traditional-Modern Divide: The Role of Fintech-as-a-Service

In the rapidly evolving financial landscape, a chasm has emerged between the methodologies of traditional banking and the aspirations of the modern consumer. Fintech-as-a-Service (FaaS) stands at this crossroads, poised to bridge this gap.

The Shift in Consumer Expectations:

Today’s consumers, driven by the digital age, seek instant gratification, personalized experiences, and seamless digital interfaces. They’re no longer content with lengthy in-person banking processes or one-size-fits-all financial products. Instead, they demand intuitive digital banking solutions, instantaneous transactions, simple bank account management, and tailored financial advice.

Traditional Banking’s Dilemma:

While traditional banks hold trust, reliability, and an established customer base, they often grapple with outdated infrastructures, rigid operational protocols, and a slow pace of innovation. This makes adapting to the fast-paced digital transformation quite challenging.

Fintech-as-a-Service to the Rescue:

Here’s how FaaS plays a pivotal role in bridging the divide:

- Agility and Speed: FaaS platforms offer “plug-and-play” solutions, enabling banks to integrate modern financial tools quickly. This agility ensures that banks can roll out new features or services in response to market demands without undergoing a complete overhaul.

- Personalization at Scale: With the future of AI in fintech and machine learning capabilities embedded in many FaaS offerings, banks can now provide personalized financial advice, product recommendations, and customer experiences at a scale previously unattainable.

- Enhanced User Experience: FaaS solutions prioritize user-centric design, ensuring that banking apps and platforms align with contemporary digital user habits, from seamless onboarding to intuitive dashboard navigation allowing quick bank transfers and tracking credit and debit cards. This is something we always keep in mind when we do banking app development for clients.

- Cost-Effective Innovation: Instead of investing heavily in in-house R&D, banks can leverage FaaS to access the latest fintech innovations at a fraction of the cost, ensuring they remain competitive without straining their budgets.

- Collaborative Ecosystems: FaaS fosters a collaborative environment, where traditional banks can partner with fintech startups, tech giants, and even non-financial enterprises to offer a holistic range of services, from e-commerce integrations to IoT-based digital payments.

In essence, Fintech-as-a-Service acts as a catalyst, enabling traditional banking institutions to meet and exceed modern consumer expectations. By embracing FaaS, banks not only ensure their relevance in the digital age but also lay the foundation for a future where fintech is more accessible, efficient, and customer-centric than ever before.

Where is Fintech-as-a-Service Headed in the Future?

With an overwhelming 82% of traditional financial organizations preparing to collaborate with fintech companies within the next few years, the future of Fintech-as-a-Service is shining bright. Let’s embark on a journey through the advancements and transformations FaaS promises:

AI-Driven Innovations

The rise of Generative AI development is driving unparalleled productivity in the financial services industry. Beyond streamlining operations, AI creates avenues for deeply personalized payment processing solutions. For example, application programming interfaces (APIs) power automated chatbots in banking, enabling them to assist customers tirelessly.

Having been deeply rooted in the fintech landscape for over a decade, Miquido harnesses the power of AI, integrating it seamlessly into various financial services applications.

Complete Digitalization

Transitioning from cloud-native platforms to full-blown white-label digital solutions not only accelerates the digitalization of financial services but also underscores the importance of sustainable financing.

The latter extends beyond just a trendy term; it centers on environmentally conscious choices in finance. Furthermore, this combined approach fosters inclusivity, ensuring even the underserved demographics aren’t left behind in accessing fintech services for superior solutions.

Pro tip: For pioneers in fintech, orchestrating a seamless transition from cloud-based frameworks to entirely digital platforms is of the utmost importance. With Miquido’s prowess in Digital Transformation, businesses can ensure digital efficiency for tasks like cross-border payments.

Unified Financial Outreach

Recent statistics show that Omni-channel customer engagement strategies boast an impressive 89% customer retention rate. These strategies, augmented by FaaS offerings, enhance a financial brand’s visibility and appeal.

Whether a customer is accessing an e-wallet or another financial service, they are presented with a consistent and captivating journey. This diverse approach is not only essential for attracting new customers but also crucial for retaining existing ones.

This seamless experience is further enriched by the concept of Immersive Convergence. It aims to offer a comprehensive financial journey, ensuring that users can tap into a wide spectrum of fintech services all housed under one roof. Such inclusivity elevates user engagement and satisfaction, creating a holistic financial ecosystem for customers.

In-transit Data Safety

With the surge in the mobility of financial data, ensuring its safety during transit has become paramount. Privacy Computing addresses this concern, ensuring data security even while in circulation, and cultivating trust among users. Techniques such as Homomorphic Encryption are employed to reinforce these protective layers.

Complementing this focus on data safety, Dynamic Risk Governance models have emerged to strengthen digital security within financial operations. These models provide real-time risk assessments, allowing for proactive measures against potential threats.

In fact, several fintech firms are now leveraging predictive analytics to gauge and counteract risks even before they fully materialize, offering a dual layer of security and assurance for users.

Curious About FaaS for Your Business? Talk to Miquido.

Using technology as a service, especially in fintech is reshaping the financial landscape. As we’ve delved deep into Fintech-as-a-Service, it’s evident that this revolution isn’t merely about technology but about transforming user experiences and business agility.

- Key Takeaways:

- FaaS offers plug-and-play solutions for enhanced financial services.

- It provides cost efficiency, scalability, and rapid market entry for businesses.

- Collaborations like Stripe + Shopify exemplify the power of fintech partnerships.

- Security, scalability, and regulatory compliance remain key challenges.

- AI and Digitalization will lead the future innovations in fintech.

As the horizon of fintech broadens, businesses need allies who understand their unique challenges and can offer custom solutions. Miquido, with its suite of services from Digital Transformation to Cloud Services, is a trusted partner for Fintech app development services.