In a Deloitte survey, 92% of FSI (financial services industry) firm respondents foresee digital transformation disrupting the financial industry. What’s interesting, though, is that only 46% of financial service firms are actually preparing for it.

That means if you can act fast and seek the right guidance, you can still be a part of the first movers and gain a competitive advantage. This advantage could translate to higher net margins and revenue.

If you’re ready for this bold move, software is an essential denominator to note. It is the foundation upon which you’ll build your digital services. This could be novel customer-facing solutions like mobile apps or backend digital solutions like financial data analysis tools.

With that in mind, today’s article will cover everything you need to understand financial services software development and how to integrate it into your digital transformation strategy.

Common challenges in financial services software development

Before embarking on financial software development, here are some potential roadblocks you should prepare for:

1. Data and security breaches from technical vulnerabilities

The number-one responsibility of any financial institution is safeguarding customer assets and data. Unfortunately, cybercriminals keep devising new ways to ensure fintech firms don’t fulfill this duty. They employ malicious strategies like phishing and malware smuggling to find vulnerabilities to exploit in your software.

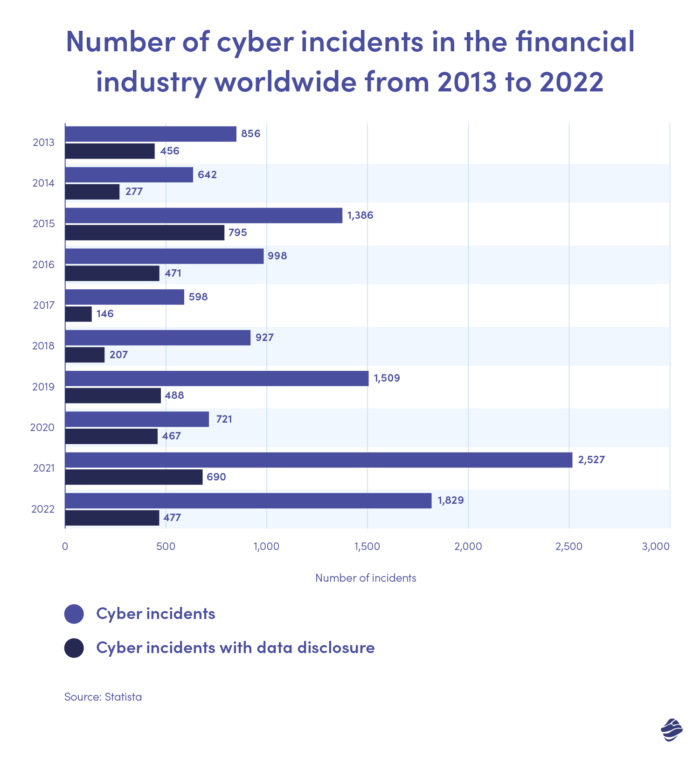

In 2022 alone, these tactics succeeded 1,829 times.

That’s a concerning number, despite the reduction compared to the previous year. Such breaches result in financial losses, regulatory penalties, and reputational damage.

2. Business logic attacks

Sometimes, bad actors don’t exploit technical vulnerabilities but target the underlying logic and workflow of your financial software. Essentially, they manipulate the legitimate functionality to achieve their malicious intent.

A common example is an account takeover (ATO), where attackers exploit weaknesses in password reset procedures. By answering security questions or providing stolen personal information, they could gain unauthorized access to users’ financial accounts

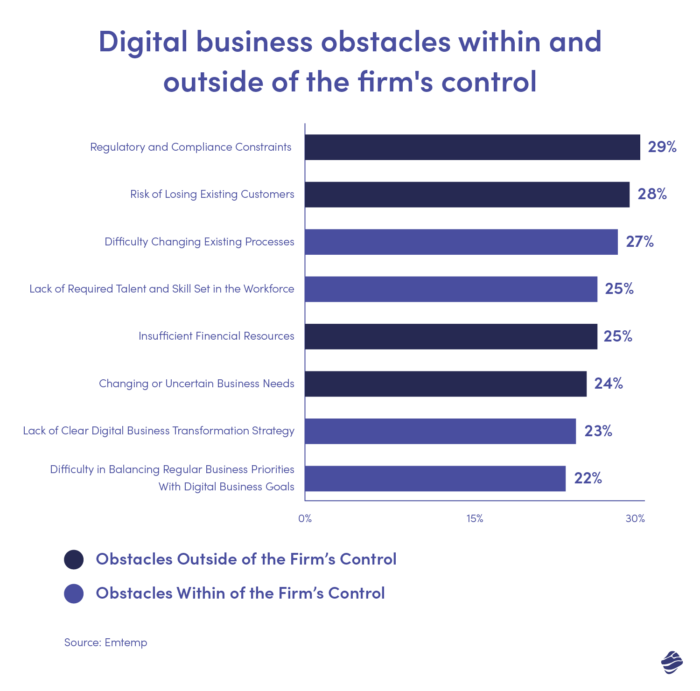

3. Regulatory compliance

The regulatory framework for fintech firms can be quite complex. New data protection rules keep popping up constantly, and they keep getting more stringent. This makes it challenging to stay up-to-date during and after financial software development. In fact, this is the biggest hurdle financial firms often encounter.

The potential penalties for noncompliance can be severe as well. For instance, failing to comply with GDPR could result in fines as high as €20 million or 4% of annual revenue.

4. UX design

Financial software involves numerous complex features, catering to diverse user needs. Striking the right balance between this level of complexity and usability is often a challenge in the banking app development process.

The issue may become even more pronounced when creating mobile versions, where space is limited, yet you must offer comprehensive features.

5. Risk management

The financial services software development process involves various stages, spanning from design to testing. Each of these phases demands specific management expertise.

Given the number of people involved, each with different roles, certain risks are unavoidable. A typical example is financial risk, which could lead to budget overruns.

These risks can become serious challenges if not handled correctly.

Fortunately, there are solutions to these challenges – you need a solid development team by your side.

How a trusted software development partner can help

An excellent financial software development service team often includes experts with extensive experience in addressing the challenges mentioned earlier.

For starters, a development partner keeps up with various financial regulations, ensuring your software complies with current and emerging requirements. They can even automate compliance checks to minimize the risk of noncompliance down the road.

Take Nextbank, a cloud banking service, for example. They needed multi-platform, feature-rich banking software meeting the strict OWASP Application Security Verification Standard. We partnered with the institution to create the app while ensuring the highest data protection, privacy, and security standards.

The same idea applies to security. Financial services software development teams involve cybersecurity experts experienced in handling various security challenges. So they know how to best handle and avoid breaches.

For NextBank, we provided comprehensive security services, including:

- Thorough pen testing,

- Cybersecurity audits,

- Multi-factor authentication,

- Cutting-edge data encryption.

You can read this case study to see more innovative solutions we provided for Nextbank.

Risk management also becomes more straightforward with a software partner. No risk is new to any development process; chances are the software development team has faced such or similar risks in the past. So, you can take advantage of their past experiences to prepare for and mitigate risks to ensure your project runs smoothly.

With these challenges addressed expertly, your company’s growth in the financial software and mobile banking app market becomes a much smoother journey.

How to pick a financial services software development partner

When selecting a partner for your financial services software development, it’s crucial to find a balance between these three key factors:

- Innovation

- Compliance expertise

- Security

With innovation, look for a partner that brings fresh ideas and creative problem-solving to the table. You want a team that can challenge the status quo and provide a unique perspective to differentiate your software from the market.

Therefore, always request case studies to assess their ability to push boundaries. It’s also not out of place to reach out to their past clients to confirm the kinds of innovations they bring.

Secondly, ensure the partner has deep knowledge of fintech regulatory compliance requirements. You can, for instance, ask to see their compliance documentation and reporting process.

Finally, prioritize security. Your ideal financial services software development partner should be able to present relevant security certifications like CISSP or CISM to show their commitment to security best practices.

You can also ask for details about their security protocols, including encryption methods, access controls, vulnerability assessments, and incident response strategies. A trustworthy development agency wouldn’t mind walking you through their security strategy.

Trends in financial software development

To keep your financial software up-to-date with the latest technologies, here are some financial industry trends you can consider implementing:

1. Blockchain

Blockchain technology has been around for a while. ReportLinker projects the fintech blockchain market will reach $21.6 billion by 2028, with a CAGR of 41%. That presents a big opportunity you don’t want to overlook.

Blockchain is particularly valuable in fintech app development because it addresses longstanding issues like centralization, slow cross-border transactions, and a lack of trust.

This technology uses consensus algorithms to make cross-border transactions faster and more cost-effective.

Also, blockchain uses a tamper-proof, distributed ledger system where every transaction is visible and verifiable by anyone. This transparency instills trust in financial transactions.

2. Artificial intelligence (AI) and machine learning

The future of AI in the fintech industry looks very promising.

GitNux reported that 54% of major financial companies already use AI for both customer-facing and backend solutions.

For customer-facing solutions, AI can cover a wide range of applications, from credit scoring to providing personalized cash flow predictions.

On the backend, financial institutions also use AI for fraud detection. Machine learning models excel at identifying unusual patterns in user behavior and transactions. This feature makes detecting and responding to fraudulent activities easier than traditional rule-based systems.

3. Cloud computing

You deal with vast amounts of customer data as a digital financial service. Managing this data efficiently is nearly impossible through traditional means.

Shifting your data to a cloud-based server is logical, as it can handle your data more effectively. That’s why 98% of financial companies are following this trend.

Moreover, cloud-based financial software is highly scalable. You can always scale up or down based on your current needs. This flexibility ensures you’re not paying for unused space or services.

4. Embedded finance

Financial service consumers have a growing appetite for frictionless digital experiences. No wonder embedded finance is a growing trend today and is expected to grow at a CAGR of 32.2% from 2023 to 2030.

Embedded finance involves integrating your financial software into non-financial applications or websites. This means users can access your financial services without leaving the platform they’re currently using.

For example, major retailers like Amazon and Shopify have incorporated Buy Now, Pay Later (BNPL) services like Affirm and Klarna. Customers can choose these options and get financing during checkout without leaving the platform.

5. RegTech (Regulatory Technology)

RegTech uses advanced software solutions to help organizations automate and efficiently manage regulatory compliance. But beyond automating compliance, this trend is crucial in combating money laundering and terrorist financing. It achieves this in two ways.

Firstly, by automating compliance checks, it ensures financial institutions adhere to anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. Additionally, it monitors transactions to detect suspicious activities or patterns so you can address the risky behavior promptly.

How fintech companies have succeeded with their software

Now, let’s look at five successful fintech companies to draw some inspiration as you approach your financial software development journey.

1. Nextbank

Nextbank is a forward-thinking financial company providing cloud-based banking services to banks in Southeast Asia. Their white-label solution has empowered over 35 Asian financial institutions to create custom retail and corporate banking apps.

Nextbank’s success story hinges heavily on its commitment to customer experience. They offer financial institutions the ability to seamlessly integrate features like online payments, money transfers, loans, and business intelligence dashboards into their workflows.

The company also pays maximum attention to compliance by considering the OWASP Application Security Verification Standards in its processes. With such attention to security, it’s only natural for businesses to entrust Nextbank with their data.

2. SBAB

SBAB is a Swedish bank specializing in mortgages and house financing. The company found success by simplifying the mortgage application process through software. They introduced an intuitive online platform that allows customers to compare rates, submit applications, and receive advice on various mortgage loans.

SBAB’s software streamlines the traditionally complex mortgage process, reducing paperwork and expediting approvals. This was well-received by customers seeking transparency and convenience in home financing.

3. BNP Paribas

BNP Paribas is another global bank that embraced digital transformation to stay competitive. For example, their GOMobile application enables customers to access mobile banking app features like transaction history, charts, and various financial services seamlessly within the app.

Also, the app integrates GOTravel features, allowing users to purchase travel insurance conveniently. Essentially, their software innovations positioned them as a leader in the rapidly evolving banking industry.

4. Adyen

Adyen is a Dutch financial service provider that has achieved massive success by simplifying cross-border payments for businesses.

Their software integrates with e-commerce platforms, enabling merchants to accept customer payments worldwide. They also offer real-time currency conversion, fraud prevention, and detailed transaction insights.

5. Chime

Chime, a US-based neobank, disrupted traditional banking with its mobile-first, fee-free banking experience. Their software allows users to open accounts in minutes, receive early direct deposits, and save through round-up features.

Chime’s software product also provides budgeting tools and real-time transaction alerts to promote financial responsibility. This approach resonates with a younger, tech-savvy audience, contributing to Chime’s rapid growth.

Thriving through digital transformation

Digital transformation is more than just a buzzword; many financial companies record higher revenue and margins from this bold step.

Furthermore, you must keep up with the trends in mobile banking and financial software development to meet the changing customer needs.

But, partnering with a reputable financial software development company is essential in this journey. They make navigating challenges like security, data privacy, logic attacks, risk management, compliance, and UX design easier.

If you’re ready for the digital leap, team up with us for top-notch finance software development. Together, we’ll navigate the complexities and ensure your competitive edge.

![[header] [ad] building a financial mobile app – an introduction](https://www.miquido.com/wp-content/uploads/2025/02/header-ad-building-a-financial-mobile-app-–-an-introduction-432x288.jpg)