Embedded finance is quietly reshaping how we use money, making financial services a built-in part of the platforms we already rely on. It’s a key driver of digital transformation, streamlining experiences and opening new doors for growth.

In this article, we spotlight 12 companies leading the way in 2025. Whether you’re building, scaling, or staying ahead of fintech trends, these are the ones to watch.

What is embedded finance?

Embedded finance is the integration of financial services into non-financial platforms, allowing users to access these services directly within their everyday activities. This approach enhances the customer experience by providing services like payment options, lending, insurance options, and banking without leaving the platform. Other popular embedded finance services are currency exchange, digital wallet, and investment options, which offer customers additional value. Embedded finance helps businesses create new revenue streams and boost customer loyalty.

The concept is transforming industries such as e-commerce, retail, healthcare, and logistics. By partnering with financial firms, companies can offer tailored financial products that meet customer needs precisely when required, improving satisfaction and engagement.

In essence, embedded finance is changing the financial landscape and insurance industry by making services more accessible and integrated into everyday platforms used by modern consumers. This shift is paving the way for new business models and opportunities.

Why embedded finance matters in today’s digital economy

Embedded finance has become mission-critical across virtually every sector, creating distinct value for different types of organizations:

For non-financial companies:

- enhanced customer experience through contextual financial services

- increased user engagement and retention with expanded service offerings

- new revenue streams beyond core business offerings

- example: Shopify evolved from an e-commerce platform to a comprehensive business system by embedding payments, loans, and banking services

For traditional financial institutions:

- opportunity to extend distribution beyond conventional channels

- risk of becoming “invisible utilities” if they don’t adapt

- ability to serve new customer segments through partnerships

- example: BBVA offers embedded finance infrastructure to corporate clients while building its own embedded experiences

Key criteria for evaluating embedded finance companies

With so many embedded finance providers now available, choosing the right one requires careful evaluation. Here are the essential factors to consider when selecting a partner for your business.

Technical infrastructure and integration capabilities

Top embedded finance companies go beyond offering a set of APIs—they give your developers the tools to build faster, smarter, and with fewer roadblocks. Leading platforms provide full-featured SDKs, real-time webhooks, and event-driven architectures that make syncing data seamless. The result? What used to take months to build can now be done in days.

Equally important is the developer experience. Top providers stand out by offering clear documentation, hands-on API explorers, and strong testing environments. Their code examples and responsive support teams help developers confidently move from idea to implementation. Seamlessly integrating financial services is essential for smooth collaboration.

Before fully committing to a solution, try running a small proof of concept. It’s the best way to see how well the tools fit your stack—and how quickly your team can start delivering value.

Regulatory compliance and security measures

Financial service providers must navigate complex regulations across different markets. The best partners handle critical compliance requirements like KYC (Know Your Customer) and AML (Anti-Money Laundering) automatically while giving you simple interfaces to manage these obligations.

When evaluating top embedded finance companies, check their regulatory coverage in your target markets. For global operations, ensure the provider supports region-specific requirements like PSD2 (Payment Services Directive 2) in Europe or FinCEN (Financial Crimes Enforcement Network) in the US.

Global reach and market support

As your business expands internationally, your embedded finance provider needs to keep pace. Few providers excel equally in all markets, so evaluate whether they support your current and planned regions, including local payment options and multi-currency capabilities.

While companies like Stripe and Adyen offer broad global coverage, they may have stronger capabilities in some regions than others. For example, Rapyd specializes in emerging markets across Latin America and Southeast Asia. Many businesses now use a hybrid approach—partnering with global providers for major markets while using specialized regional solutions for markets with unique payment ecosystems.

Customization options and flexibility

Different providers offer varying levels of customization—from completely standardized solutions to highly configurable platforms. Your business requirements should determine which approach is right for you.

When evaluating customization options, distinguish between simple configuration settings and true extensibility. Companies like Weavr offer modular approaches with pre-built components that can be combined to support different use cases while maintaining compliance. For businesses with unique requirements or those in heavily regulated industries, even the most flexible off-the-shelf solutions may not be enough. In these cases, partnering with specialized development firms like Miquido, a top embedded finance company, can provide the expertise needed to build custom embedded payment, lending services or insurance options tailored to your specific needs and increase customer engagement.

The leading global payment processing providers

The foundation of the embedded financial services ecosystem rests on sophisticated payment infrastructure providers who enable businesses to securely process transactions across borders, currency exchange, and purchase processes.

Stripe: comprehensive payment processing

Stripe has established itself as the gold standard for developer-friendly payment infrastructure, expanding far beyond its initial focus on online transactions. Its comprehensive approach to solving modern financial infrastructure challenges includes identity verification (Stripe Identity), fraud prevention (Radar), and banking services (Stripe Treasury) in partnership with institutions like Goldman Sachs.

Key advantages:

- industry-leading developer experience with extensive documentation and SDKs

- unified platform covering digital transactions, identity, fraud, banking, and business services

- support for 135+ currencies and diverse payment methods globally

- integrated comprehensive suite that eliminates the need for multiple provider integrations

- strategic banking partnerships enabling platforms like Shopify to offer embedded financial services

Adyen: unified commerce payment processing options

Adyen has become the preferred payment infrastructure provider for enterprise organizations seeking to unify payment options and streamline operations across channels and markets.

Key advantages:

- local acquiring in key global markets, reducing cross-border transaction fees and improving authorization rates

- unified business-to-business platform for managing all payment channels (online, mobile, and in-store)

- advanced AML tools leveraging machine learning to balance secure access and customer engagement

- enterprise-grade reliability trusted by global brands like Spotify, Uber, eBay, and Adobe

- specialized capabilities for organizations with both digital and physical retail operations to secure customer satisfaction

Checkout.com: business payment solutions

Checkout.com is a premium financial solutions provider for business customers with complex payment requirements. The London-based company has built its reputation on offering unparalleled flexibility and customization for large merchants, fintech companies, and marketplaces.

Key advantages:

- high-touch, consultative approach with dedicated engineering and account management teams

- direct access to all major card networks and local methods across 150+ currencies

- proprietary processing capabilities delivering industry-leading authorization rates

- specialized solutions for complex use cases like marketplace payments and subscription management

- trusted by sophisticated business customers, including Klarna, Revolut, and Sony

Core banking and financial infrastructure companies

Online transaction processors may have kicked off the embedded finance wave, but it’s core banking and infrastructure providers that make the real depth possible. They offer financial services like lending money, savings, or compliance that can be built seamlessly into non-financial products. Without them, embedded finance doesn’t scale.

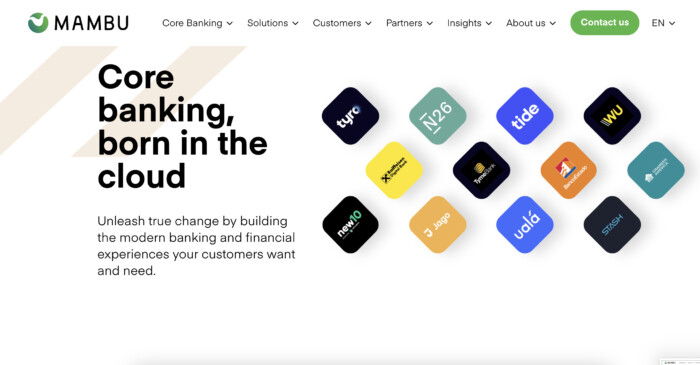

Mambu: cloud banking platform

Mambu is one of the top embedded finance companies, a pioneer of cloud-native core banking, providing the foundation for both digital banks and non-financial companies embedding banking capabilities into their offerings.

Key advantages:

- composable architecture allows companies to select only the needed features

- significantly faster implementation (3-6 months vs. years for traditional systems)

- proven scalability supporting both digital challengers (N26, OakNorth) and established institutions (Santander, ABN AMRO)

- cloud-native design offering superior operational flexibility and cost efficiency

- rich ecosystem of pre-integrated fintech companies, enhancing platform capabilities

Solaris: Banking-as-a-Service pioneer

Solaris, founded in 2016 in Berlin, has emerged as one of Europe’s leading Banking-as-a-Service platforms. It offers a unique combination of technical infrastructure and regulatory coverage.

Key advantages:

- full-spectrum banking solutions through modular APIs with underlying regulatory compliance

- European banking license, eliminating the need for partners to secure their own licenses

- comprehensive offering including accounts, payment automation, cards, lending, and crypto custody

- invisible infrastructure that preserves the partner’s brand relationship with end users

- strategic expansion beyond Germany into the UK, France, and Spain through acquisitions

Weavr: embedded finance operating system

Weavr simplifies integration through pre-configured financial plugins called “Plug-and-Play Finance,” specifically tailored to industry verticals and use cases.

Key advantages:

- industry-specific plugins combining multiple financial services in ready-to-embed packages

- dramatically reduced time-to-market compared to building with raw infrastructure

- “adaptive compliance” that automatically adjusts security requirements based on risk profiles

- particularly valuable for software companies without financial services expertise

- strong traction across diverse sectors, including HR, healthcare, education, and supply chain

Specialized embedded financial services

Beyond the major horizontal platforms, specialized top embedded finance companies address specific markets, industries, or financial services with deeper capabilities than broader platforms can offer.

Rapyd: global Fintech-as-a-Service

Rapyd combines embedded payments, disbursements, digital wallets, card issuing, and compliance services through a single API layer that connects to over 900 payment methods across more than 100 countries. Global companies, including Uber, IKEA, and Deliveroo, use Rapyd to simplify their financial operations worldwide.

Key advantages:

- access to 900+ payment methods through a single API integration

- specialized expertise in embedded finance in emerging markets across Latin America and Asia

- comprehensive capabilities covering both collecting payments and making disbursements

- unified solution for marketplaces and digital platforms needing multi-directional money movement

- significantly reduces complexity for businesses operating across multiple markets

OpenPayd: banking and payments for digital businesses

OpenPayd specializes in serving digital businesses operating in complex, fast-moving sectors that traditional banking institutions often consider high-risk. Founded in 2018 and based in London, the financial service provider combines banking and payment infrastructure through a single API, with particular expertise in serving online marketplaces, cryptocurrency businesses, and digital platforms across Europe, the UK, and North America.

Key advantages:

- tailored embedded finance solutions for high-risk digital businesses, including crypto exchanges

- virtual IBAN bank accounts, instant settlement, and FX capabilities through one platform

- support for 13 currencies with local payment rails across 20+ markets

- deep regulatory expertise for businesses at the intersection of traditional and digital finance

- notable partnerships with innovators like Wirex and Freelancer.com

Brankas: open finance for Southeast Asia

Brankas is a leading open finance platform specifically for Southeast Asia’s unique financial ecosystem. Founded in 2016 and headquartered in Singapore, the company offers APIs connecting to more than 100 banks and payment providers across Indonesia, the Philippines, Thailand, Vietnam, and Singapore—regions often underserved by global providers.

Key advantages:

- deep integration with regional payment systems like Indonesia’s QRIS, the Philippines’ InstaPay, and Thailand’s PromptPay

- specialized understanding of Southeast Asia’s diverse financial landscape

- comprehensive API suite for bank account opening, payments, data retrieval, and disbursements

- strong relationships with local regulators across multiple jurisdictions

- strategic partnerships with financial institutions like Standard Chartered and regional fintech companies like UangMe and Kredivo

Embedded lending platforms transforming business finance

Embedded lending platforms are revolutionizing how businesses access capital by integrating financing options directly into the software and platforms they already use.

Liberis: embedded business funding

Liberis pioneered the embedded business funding model, evolving from a direct small business lender into a platform that powers white-labelled financing solutions through partners like Klarna, Worldpay, and Sage. The UK-based company, founded in 2007, uses transaction data from these platforms to offer pre-approved financing offers tailored to each business’s capacity to repay.

Key advantages:

- revenue-based financing that automatically adjusts repayments based on daily sales

- minimal paperwork with fast credit approval and funding typically available within 24 hours

- creates revenue streams for platform partners while improving customer loyalty

- particularly effective for seasonal businesses and underserved sectors like restaurants and retail

- creates a “financing flywheel” that strengthens the entire business ecosystem

Froda: integrated business loans

Swedish fintech company Froda focuses specifically on embedded lending for business software providers. Founded in 2015, the company offers a “Lending-as-a-Service” infrastructure that enables accounting platforms, e-commerce systems, and business management software to provide seamlessly integrated financial services to their customers.

Key advantages:

- deep technical integration that pulls relevant financial data directly from host platforms

- one-click financing without requiring additional documentation from businesses

- frictionless access to lending options, invoice financing, and growth funding

- strong presence in Nordic markets with partners including Fortnox, Worldfavor, and Anyfin

- enables software companies to enhance platform stickiness while generating new revenue streams

The custom approach: Miquido — a top embedded finance company

Even top embedded finance providers that work well for standard requirements can’t really meet the expectations of organizations with complex needs that often require tailored solutions. Miquido specializes in custom embedded finance development, bridging the gap between fintech expertise and software engineering excellence.

Beyond off-the-shelf embedded finance: benefits of custom development

Custom embedded finance solutions give organizations with unique business models or strict regulatory needs a clear edge. Miquido focuses on building solutions that are tailored to fit, not just technically, but strategically. That means complete alignment with business goals and full control over both the user experience and the system architecture.

The results speak for themselves. For a European healthcare provider, Miquido built a secure payment platform that worked seamlessly with existing systems, supported local reimbursement rules, and stayed fully compliant with both financial and healthcare regulations. For a property management company, the company delivered a solution designed around industry-specific needs—handling tenant deposits, managing property-level expenses, and supporting multi-entity financial flows. It’s a smarter, more focused way to embed finance and meet customer expectations.

Key advantages of custom embedded financial solutions:

- complete alignment with specific business requirements and workflows

- seamless integration with existing legacy systems and databases

- full control over seamless user experience and brand presentation

- precise compliance with industry-specific regulatory frameworks

- opportunity to create unique features that deliver a competitive advantage

Trusted by fintech leaders and meeting customer expectations

At Miquido, we’ve partnered with forward-thinking companies to build fintech solutions that make financial services feel effortless, right where users need them most. Here are a few standout projects:

BNP Paribas – Mobile Banking App

We teamed up with BNP Paribas, one of Europe’s top financial institutions, to create a sleek, intuitive mobile banking app. The result? Over 1 million downloads and a 4.8-star rating on both Google Play and the App Store. Users love its clean design and powerful features—proof that good UX and strong functionality go hand in hand.

Nextbank – AI-Powered Credit Scoring

To help expand access to credit, we built an AI-based credit scoring system for Nextbank. With 97% prediction accuracy and over 500 million applications processed, it’s helping financial institutions make smarter, faster, and fairer lending decisions—especially for people traditionally underserved by the system.

Digital Bank – Personal Finance Platform

We created a personal finance and digital banking app that now supports over 50 million users globally. With more than 1 million positive reviews, the app shows how embedded finance can be both powerful and personal, giving users better control over their money, all in one place.

The near future of embedded finance

As embedded finance continues evolving rapidly, understanding emerging trends is crucial for making implementation decisions that will remain viable as the market matures.

Emerging trends to watch among embedded finance solutions

Two major technological forces are reshaping embedded finance in 2025:

Artificial Intelligence: AI is transforming embedded finance through improved risk assessment, personalized recommendations, and automated compliance:

- Stripe and Adyen are developing AI-powered fraud prevention systems that analyze billions of transactions to reduce losses while minimizing false positives

- Mambu and Weavr are building personalization engines that customize financial offers based on individual behaviour and profiles

- compliance monitoring is becoming increasingly automated, reducing both costs and regulatory risks

- Miquido has built from scratch AI Kickstarter — a fast, secure, and reliable framework designed to build LLM-powered products perfectly tailored to your business needs

Decentralized Finance: DeFi concepts are gradually entering mainstream embedded finance:

- Solaris has integrated cryptocurrency custody into its Banking-as-a-Service platform

- hybrid models combining DeFi’s programmability with traditional finance’s regulatory compliance are emerging

- Blockchain-based primitives are creating new possibilities for embedded lending, insurance options, and investment products

Selecting the right provider for your business needs

Finding the right embedded finance solution requires a structured approach:

- Start with business outcomes: Define your desired customer experience and business goals, then identify the technical capabilities needed to deliver them.

- Consider hybrid strategies: Many organizations find that no single provider meets all their needs, leading to multi-provider approaches combining specialized capabilities.

- Balance build vs. buy decisions: The most successful implementations often combine:

- off-the-shelf components for standard features (faster time-to-market)

- custom development for differentiating capabilities (competitive advantage)

As embedded finance continues to blur the boundaries between financial and non-financial products, organizations that thoughtfully select the right partners and maintain focus on offering customers real value will create transformative experiences that drive sustainable business growth.

![[header] 10 embedded finance examples](https://www.miquido.com/wp-content/uploads/2025/03/header-10-embedded-finance-examples-432x288.jpg)