Just a few years ago, “blockchain” would ring the bell mainly for the handful of crypto-enthusiasts. Today, it is hard to find someone who has not heard about it. Companies outside the crypto niche are starting to embrace this technology due to its undeniable benefits. What does the popularisation of blockchain really mean for the financial industry? Are we already experiencing a revolution? In this article, we will try to capture the blockchain impact on the fintech industry (with a little detour for the other sectors).

What is blockchain?

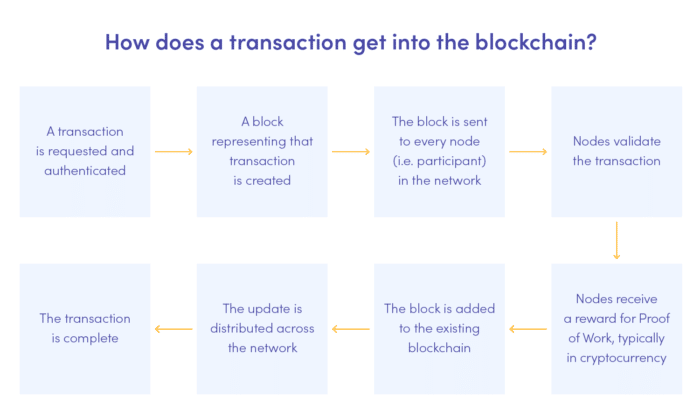

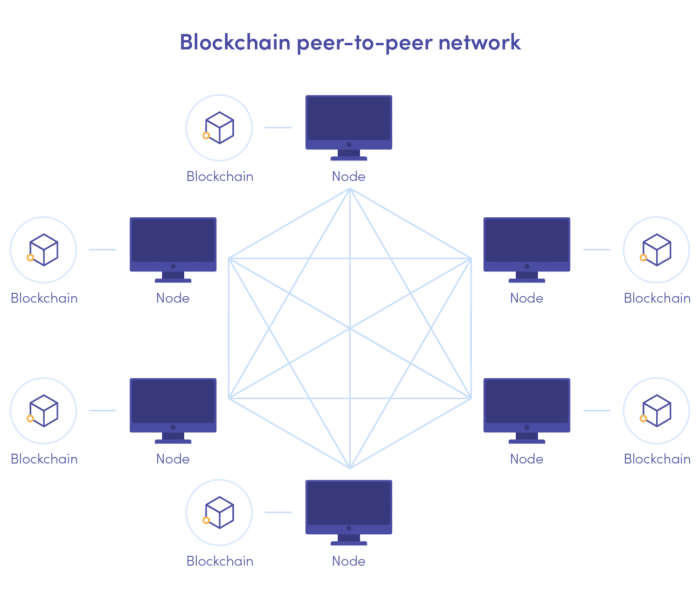

Let’s start from the basics. In a nutshell, a blockchain is a decentralised, distributed public ledger, an alternative to traditional databases. In blockchain’s case, the data is stored in chronologically connected blocks that cannot be modified or removed once added to the chain. It does not involve any central unit that would process and control the data. Such an architecture is the core of blockchain’s revolutionising potential and stands behind its popularity.

Blockchain, fintech and cryptocurrencies

The concept of blockchain dates back to the eighties, but until recently, no one has actually brought it into existence. We owe it to Satoshi Nakamoto, who made it the backbone of the bitcoin cryptocurrency, first released in 2009. Refined with the Proof-of-Work protocol, blockchain has enabled users to carry out financial transactions and earn on them without a central entity’s validation.

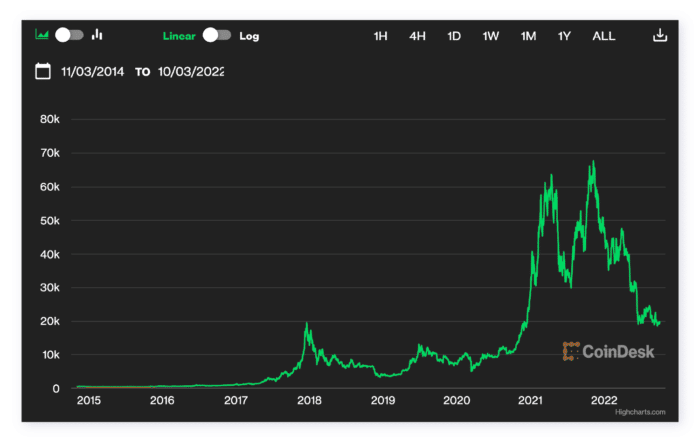

You probably know the rest of the story – starting as a small cryptocurrency, Bitcoin grew to the most powerful coin on the market in just ten years. While in 2010, one BTC would be worth 0.30 euro at its peak, in November 2021, its worth was already over 53 000 euros. Fun fact: the first Bitcoin transaction ever was a pizza order. The pizza’s cost was… 10 000 BTC. Do the counts!

In June 2022, the cryptocurrency started losing value after a continuous period of growth. It was caused by a mixture of factors, including the cautiousness towards crypto strengthened by the Terra LUNA crash. However, Bitcoin seems to be slowly coming back on track.

It is hard to talk about blockchain separately from the crypto scene. But to the point – let’s focus on the blockchain itself and its revolutionising potential for all the fintech niches.

Blockchain applications in fintech – examples

Considering the origins of blockchain, the fintech development industry was naturally the first to adopt this innovative technology to a greater extent. Fintech blockchain-based startups have been popping up like mushrooms, but it’s not just new businesses that decide to trust it. Even well-established fintech companies and organisations choose to implement it for a particular service or even fully migrate to it. What do they use blockchain for?

#1 International transfers

So far, one of the most embraced purposes for implementing blockchain by global companies and organisations is streamlining international transactions and transfers. The traditional way of processing these usually involves a few intermediaries. As a result, it takes much more time. With its decentralised and distributed structure, blockchain reduces the number of intermediaries to the necessary minimum. That means the transactions are:

- faster (data passes through fewer hands)

- cheaper (the intermediaries do not charge the fees)

- safer (cybercriminals cannot target any central entity)

#2 Security measures

The immutable character of the blocks makes it harder to get away with fraudulent activities as the records are impossible to erase. At the same time, the mechanism of adding blocks to the chain makes it easier to automate fraud detection effectively.

Instead of acting in reverse, financial companies and institutions can use blockchain to act in advance. The fraudulent transaction can be flagged in real time, preventing the user from adding the block to the chain. These qualities draw more and more companies that want to reduce the risk of fraud.

On the other hand, the anonymity of transactions may create room for abuse, for instance, money laundering. Fortunately, fintech startups are already creating tools for risk assessment and fraud detection designed specifically for the blockchain protocol. Elliptic can be an example.

Blockchain can also make peer-to-peer transactions more secure. In recent years, we have seen the growing popularity of p2p payment apps. The fact that they are fast and handy gained them a large fan base. However, they do not necessarily provide their users with maximum security.

Yes – the peer-to-peer payment model reduces the number of intermediaries, considering that there is just one processing unit between two users. However, even with encryption, the p2p agent that stores data in a centralised way is vulnerable to a data breach. If this exchange took place on the blockchain network, the risk would fall practically to zero.

#3 Trade Finance

In a traditional approach, every trade financing agreement requires numerous documents to be thoroughly verified. The settlement involves not only the buyer and seller but also their banks, insurance companies, and other parties. Each of them keeps track of the purchases in their own databases.

That makes all the processes less controllable and susceptible to negligence, not to mention that it creates perfect conditions for fraud to pass unnoticed. This situation doesn’t make trade financing flourish, but rather the opposite, as financial institutions, buyers and sellers fear risk.

Blockchain may change that, becoming the platform connecting the counterparties. Stored across the chain in chronological order, the registers are easy to track and verify at any given moment without reaching out to the individual databases and comparing them. Everyone has access to the same information. Full transparency! And with smart contracts, the transactions can be validated based on the established conditions, making the whole process fully automatic.

Will banks switch to blockchain?

Even though they remained sceptical for relatively long, banks today are slowly noticing that blockchain creates new opportunities for them, particularly in terms of security and compliance.

That shift is visible worldwide – many banking giants, including HSBC, JP Morgan, Citi Bank, and Goldman Sachs, are heavily investing in this technology. Local banks are following them, considering blockchain a promising tool for document authentication. Blockchain’s implementation solves the “durable medium” issue European banks have to deal with due to legislation. Using blockchain, they can share significant information among customers in a safe and fully transparent way without wasting paper and time.

When it comes to the processing of transactions, things are still a little different. Some banks take the initiative, since refusing to embrace blockchain technology could cost them customers. On the one hand, blockchain removes intermediaries, which means they give up their transaction fees, which are often high in the case of international transfers. On the other hand, their clients could otherwise migrate to more progressive platforms.

That applies particularly to the commercial users who process numerous import/export transactions every day. Whereas the change may not affect the wallet of the regular customers, the companies definitely notice the difference – and once they do, there is no way back to the traditional system.

Santander was the first to take a step further in terms of blockchain adoption, enabling its customers to actually transfer their money via a blockchain network. The service, Ripple-based One Pay FX, streamlines international money transfers, reducing the costs of the transactions and the time it takes for the money to arrive from one wallet to the other.

Blockchain applications – do they go beyond fintech?

Blockchain going outside the crypto bubble is already a big step forward. The cryptocurrency niche, however, is still a part of a fintech market. Does blockchain offer benefits to other industries as well? Of course – many sectors have been lately discovering the advantages of the distributed ledger.

Blockchain is being adopted in other industries mainly for the purpose of safe data processing and regulatory compliance. In the healthcare industry, blockchain serves mainly as a security upgrade. It allows hospitals, clinics, and other medical units to store and process records securely. Being kept in central databases, the data is more vulnerable to leaks. Considering its confidentiality, such events can have serious implications. With blockchain, the medical units are finally able to securely transfer the patient’s records between them.

The insurance industry, similarly to finance, is starting to employ blockchain extensively for regulatory compliance. Smart contracts combined with AI can streamline the claim processing, validating them automatically based on fulfilled conditions.

What is the future of blockchain in fintech?

Blockchain pumps new energy into the fintech world, promising transparency and increased safety for both companies and their customers. Even though the traditional transfers continue to dominate, that may change sooner than we expect. During the Blockchain Central Davos conference, Michael Mielbach claimed that in 5 years, SWIFT will no longer be in use (EU Blockchain trend report 2022). That’s quite a statement, but looking at the pace of blockchain’s adaptation, the Mastercard CEO may be right!

In the nearest future, we will likely see the banks diversify their spectrum of blockchain services and ultimately – turn into decentralised organisations. Changes are coming for the cryptocurrency market as well. You may remember we mentioned Bitcoin’s huge drop in value in 2022. There are many factors to blame, yet one of the most significant was the rise in energy prices. It is becoming increasingly difficult to dig the major cryptocurrencies, which makes the energy use of the mining systems even higher.

In the face of rising prices and the climate crisis, Proof of Work – the consensus mechanism used to add blocks to the cryptocurrency’s blockchain network – is no longer a relevant solution. It may soon be replaced by Proof of Stake, another mechanism that does not require computing-intensive operations and specialised equipment that gets outdated very fast. That proves that this technology moves with the times. Ethereum will soon migrate to PoS, and other platforms may follow its example.

Time will tell whether blockchain will entirely replace centralised databases. We’re happy to be witnessing that change!

Are you interested in testing blockchain’s potential on your own? Reach out to us to talk about the possible applications of decentralised networks for your business!