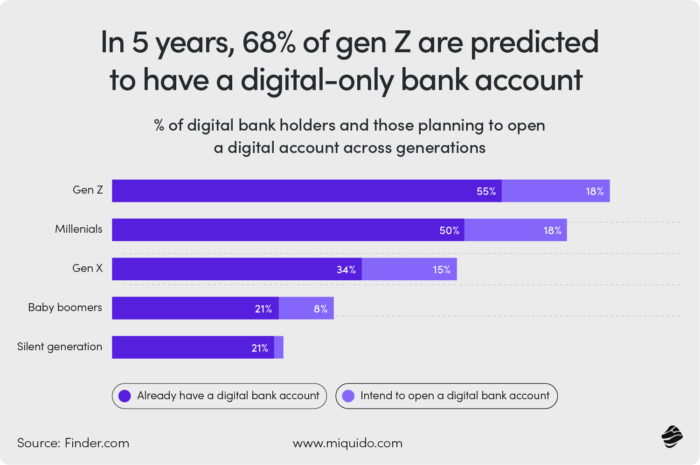

Driven by rapid technological advances and shifting consumer demands, many financial institutions are going mobile.

According to a 2023 Digital Banking Survey, 45% of Gen MZ (millennials and Gen Z) use digital banking exclusively. These customers no longer visit a bank branch to transfer funds, deposit checks, or view account balances. But just because mobile banking is now mainstream doesn’t mean customers stay with their banks.

Today’s customers are sophisticated and tech-savvy. Giving them a horrible mobile banking experience is pushing them to your competitors.

So, we gathered the best mobile banking app features to give you a foundation for banking application development.

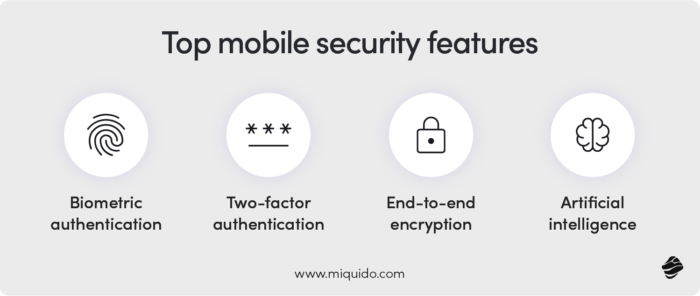

1. Security Features

We live in a digitally integrated world, which means that all our personally identifiable information is linked to various apps and services.

While convenient–customers don’t have to remember account information when transacting–it makes fraud detection difficult. It is easy for banks to detect and address security concerns at the server level but not so at the user or device level.

Here’s how to secure mobile banking app users from cyberattacks.

- Biometric authentication – uses unique biological traits like fingerprints, retina scans, and voice or facial recognition to verify user identity.

- Two-factor authentication – uses two or more independent factors (e.g., security questions or OTP codes) to verify user identity.

- End-to-end encryption – prevents third parties (hackers or service providers) from reading or modifying financial data.

Artificial intelligence (AI) is one of the trends in digital banking shaping how banks detect fraud. Thanks to machine learning, banks can detect fraudulent activity early. When the algorithm detects a change in usual patterns, it triggers an automated reaction, preventing further damage.

Machine learning is a more suitable fraud detection method than traditional rule-based programming, as it adapts to fraudsters’ changing strategies instead of having its logic manually rewritten.

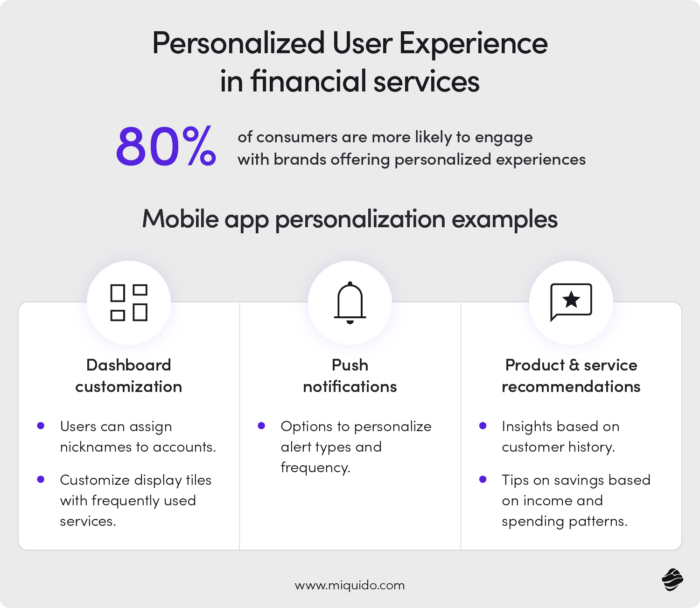

2. Personalized User Experience

Customer experience is a key differentiator when choosing financial services, and customers want tailored experiences. 80% of consumers are more likely to engage brands with personalized experiences.

Referring to customers by name in app messages is only a start. Every customer’s lifestyle and financial health is different. Successful mobile applications cater to their specific and evolving needs with customized services.

Mobile app personalization shows up in various ways.

- Dashboard customization: Financial institutions can let users assign their accounts nicknames or customize app display tiles with frequently used services.

- Push notifications: Customers should be able to customize the number and type of alerts they receive.

- Product and service recommendations: Financial institutions can provide personalized insights and products based on customer history, such as saving tips based on income and spending patterns.

The core technology driving financial personalization is AI. It analyzes large amounts of data, identifies patterns, and predicts customer needs, allowing banks to deliver highly relevant products and services to customers.

3. Seamless Money Transfers

One of the key benefits of banking apps is the secure, instant, and seamless transfer of funds between accounts and banks.

The mobile app banking features that facilitate the hassle-free movement of money include:

- Peer-to-peer payments

- QR code payments

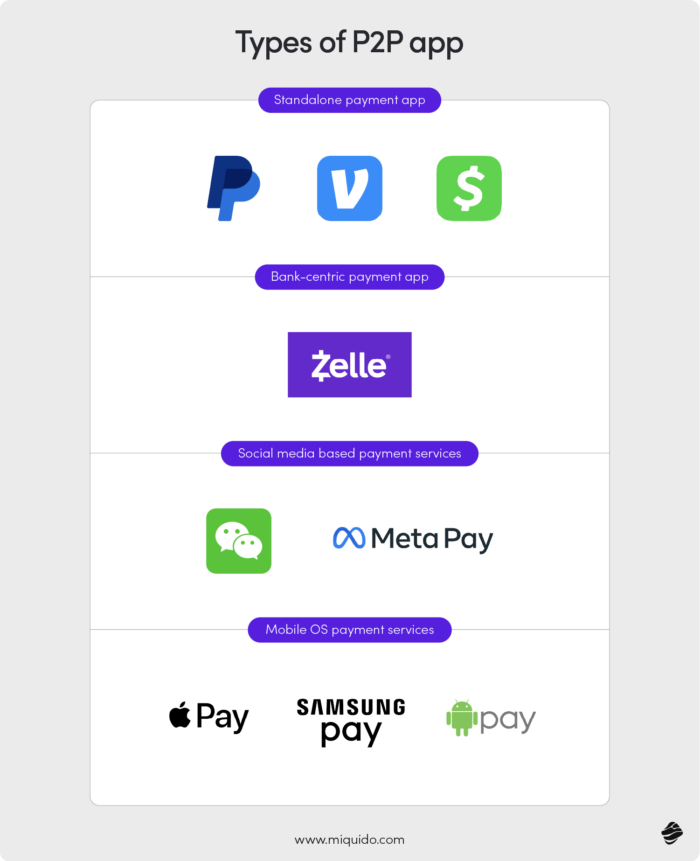

Peer-to-peer (P2P) payments refer to money transfers from one account to another. They are faster than traditional bank transfers and bypass delays associated with clearing.

Apple Pay, Google Pay, Zelle, and PayPal are popular third-party services. Customers link their bank accounts or credit cards to these digital wallets. Many banks also integrate Zelle for direct bank-to-bank transfers between users.

The bill-splitting functionality of P2P services makes it fast and simple to calculate shared bills. Users enter the final amount, and the app does the math, sending an automatic payment request to selected users.

Automatized payment requests are extraordinary not only because they exclude time-consuming calculations but also because they make splitting bills less awkward. It is easier to send a notification than to ask for money directly, and you will likely get it back faster this way.

QR codes enable cashless payments to vendors by scanning the user’s code on a barcode reader to make purchases.

The result is a quick, convenient, and secure money transfer. Users don’t need to share sensitive account information every time they transact.

4. Account Management

The purpose of using a banking app is to provide the entire banking experience on mobile devices, from account opening to closing and everything in between. The account management feature ensures access to banking services historically provided during branch visits.

Users should be able to view account balances, access account statements, set up recurring payments, create new accounts, and more through the app.

All these functionalities are possible when CORE banking is at the heart of the mobile banking app. CORE banking processes transactions in real time, giving users a current and comprehensive view of their financial status.

5. Budgeting and Expense Tracking

A list of the best mobile banking app features must include budgeting and expense tracking. These tools track spending, help set savings goals, and provide valuable financial insights.

Bank apps generate a lot of data on customers’ spending habits. They know how much customers make and what they spend their money on. That puts them in a position to offer guidance on how much to save monthly and where to cut expenses, turning these apps into automated advisors.

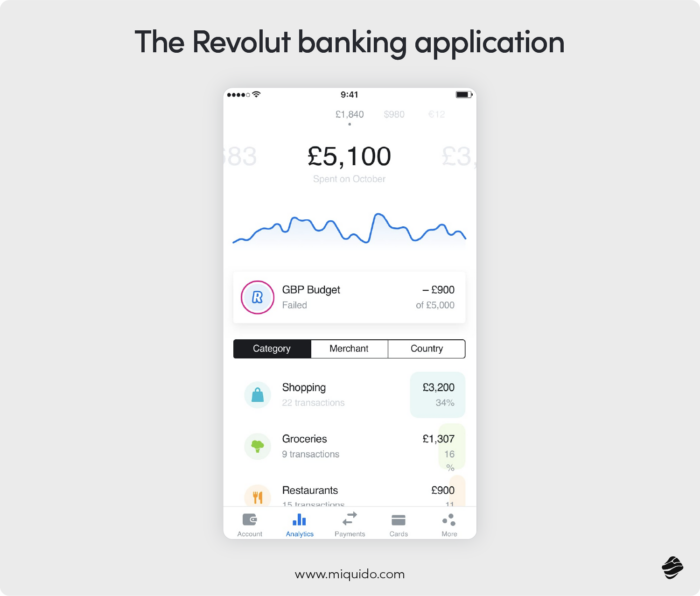

The most downloaded banking apps in Europe, like Revolut or Monzo, invest heavily in app development that enables users to:

- set different saving goals and diversify their spending limits

- intuitively understand their expenses through diagrams and comparative charts.

Aside from providing clients with an overview of their financial habits, some apps take a step further, delivering weekly insights on spending with a percentage comparison to previous weeks.

The Revolut app offers more than the typical sector breakdown (groceries/amusement/education, etc.), categorizing transactions by merchants, categories, and countries.

Third-party budgeting tools can also track and manage spending. However, these tools don’t record banking transactions like credit card payments or ATM withdrawals instantly, creating gaps in your budget.

6. Customer Support

Banking app users expect quick and easy access to customer support when they encounter issues or have questions.

Banking applications have a broad audience. Not everyone will know how to navigate the app. In addition, non-standard situations may arise that the FAQs don’t answer. That’s when mobile app support comes in.

The best mobile banking app features for customer support are in-app chats, virtual assistants, and direct call options.

- Chatbots

Chatbots are an excellent solution for banking applications, not only because the user can solve their problems at any time but also because they reduce the workload of bank employees.

In addition, the presence of natural language processing tools can significantly improve user satisfaction rates.

From checking an account balance to guiding users through more complex financial operations, these AI-powered chatbots provide personalized assistance at the user’s fingertips.

By embracing this cutting-edge technology, mobile banking app development services have redefined convenience, ease, and efficiency, ensuring a seamless and delightful user experience.

- Virtual assistants

Virtual assistants are similar to AI chatbots but more versatile. They act as personal helpers, leveraging big data, deep learning, and machine learning algorithms to provide conversational experiences. Think Siri, but for banking.

For example, Capital One bank has Eno, a natural language processor that understands how customers talk about their money, including emojis. Users can text “What’s my balance?” or send a money bag emoji to check their account balances.

- Direct call

Some user queries require human intervention. Furthermore, 76% of customers prefer traditional support via the phone.

An in-app direct call option makes switching to call center support seamless and gives users the omnichannel experience they want. Customer representatives are also empowered with real-time data, ensuring a swift resolution.

7. Mobile Check Deposits

One of the most sought-after banking app features is mobile check deposits. With this feature, customers can deposit paper checks into their accounts using a smartphone camera.

The advanced image capture and processing technology behind this feature ensures the accuracy and authenticity of the check.

The process typically follows these steps:

- Open the mobile banking app

- Select the ‘deposit’ option

- Enter the check deposit amount

- Take photos of the front and back of the check with the device camera

- Review deposit details

- Submit deposit

- Receive transaction confirmation

Depending on the institution’s clearing processing, the funds may become available in one to two business days.

Many banks restrict how much users can deposit remotely. They also require users to endorse the paper check by signing their name and writing ‘for mobile deposit only’ before photographing and submitting the deposit.

Still, customers love the convenience of this feature as it saves time and is available 24/7.

8. Investment and Saving Options

Historically, investing was limited to the wealthy few. High entry costs and complex processes prevented large segments of the banking population from engaging in financial markets.

That changed with the advent of custom fintech software development. The technology made investment options like bonds, mutual funds, and real estate accessible and affordable for the general public.

AI-driven investment features provide users with a low-cost way to build wealth. The algorithms eliminate the need for human advisors, and data analytics provide personalized investment advice based on financial goals and risk tolerance.

Mobile banking platforms should also offer automated saving schemes to help users create financial security. Banks like Varo turn change into savings by rounding up transactions and transferring the difference to users’ savings accounts.

9. Loan and Credit Services

Fintech didn’t just democratize investing. It also revolutionized access to credit. For years, complicated application processes, high creditworthiness requirements, and long wait times excluded individuals and businesses with lower income or short credit histories from obtaining loans.

The introduction of AI in fintech propelled banks to re-evaluate their loan verification strategies and include transaction history and purchasing behavior, allowing more people to access financing.

That means they are investing more than ever in machine learning-powered scoring engines, which help them identify high-risk loans based on an in-depth analysis of customer behavior patterns and other relevant factors.

We helped develop such a system for Nextbank.

The AI credit scoring system we contributed to made it to the 2019 Singapore FinTech Awards finals, paving the way for Nextbank to win 2nd place for best fintech startup in 2020.

Credit management isn’t limited to loans. Users should be able to manage their credit cards from the app. Usually, handling a lost or stolen card meant calling or visiting the bank. Not anymore. The card lock feature temporarily deactivates debit cards, preventing misuse. Users can unlock the card if they find it later.

10. Notifications and Alerts

These features are an absolute must-have in any good mobile banking app. Notifications and alerts guide intelligent money management with low-balance alerts or reminders about upcoming bills.

Notifications do two things:

- Facilitate effective communication by keeping users informed

- Facilitate fraud detection by alerting users of account activity.

Providing clear and timely messages is crucial to customers’ financial well-being. Vague language or delayed alerts negatively impact user satisfaction and sense of security.

However, you don’t want to overwhelm users with too many messages. Allowing customers to personalize the number and types of notifications they receive creates a better mobile banking experience.

11. Smart Subscription Management

As the subscription-based model has become dominant online, the average list of subscribed services has expanded radically—music and video streaming sites, food delivery, dating apps, video games, and accounting software—the list goes on. Access to these services renews automatically, incurring monthly expenses.

A subscription management feature tracks and manages various subscriptions directly from the banking app.

ING Belgium gives app users an overview of current and dormant subscriptions linked to their accounts. Customers can cancel or pause recurring payments, set renewal reminders, and remove payment information without contacting specific service providers.

12. Green Banking Features

Modern customers choose brands that align with their values. One of those values is environmental sustainability.

According to a PWC consumer intelligence survey, 76% of customers ditch companies that treat the environment poorly.

Consequently, many banks are trying to expand the way they aim their ESG (environmental, social, and governance) goals by helping their customers make a positive impact and incentivizing eco-friendly activities.

Green banking refers to financial activities, practices, and products that lower environmental risks. One such product is mobile banking applications.

By allowing customers to open accounts, transfer money, pay bills, and apply for loans online, they reduce paper waste and carbon emissions associated with visiting a physical branch.

Green banks also finance eco-friendly projects and invest in renewable energy markets.

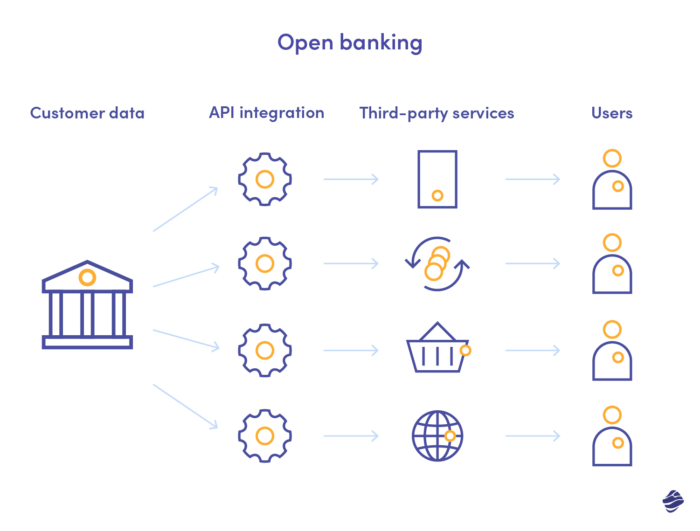

13. Open mobile banking app features

Having a few accounts across different banks is nothing unusual nowadays. Some people use them because they lead a nomadic lifestyle or share their life between countries, while others want to make the most out of what particular banks offer. However, the majority actually treat it as a preventive measure, having learned, often the hard way, what the lack of financial diversification may lead to in times of recession.

The concept of open banking, originating from the nineties in Germany, has evolved after the most recent financial crisis, which has shown us how dangerous low competitiveness can be for economic stability. Successfully implemented in the UK, it is now spreading globally as a way to boost competition and empower both companies and customers. Instant and seamless due to API integration, it enables banks to process and transfer user data easily if only the users themselves agree.

For those who have various bank accounts and lead businesses, open banking features are a perfect way to gain full visibility over their finances. If the financial institutions are affiliated, users can see all their accounts in one place without logging into other apps. On top of that, you may use smart analytics in an open banking mode to get deeper insights into your expenses and habits. Let’s not forget about the facilitated transfers – with open banking, their path is much shorter.

14. Crypto exchange & payment

The paths of crypto and conventional banking are starting to cross increasingly often. Banks have understood that such fusion is inevitable, as the number of crypto users is growing exponentially year by year. Crypto apps have been enabling customers to link their FIAT accounts to the crypto wallet for a long time, but now the banks are also taking the initiative. Not only does it provide their customers with more flexibility, but also empowers them to diversify their digital wallets and implement anti-inflation budget strategies.

You can use crypto banks, but the financial institutions that are traditional at their core are also starting to merge crypto and FIAT. Aside from introducing their own coins, they enable you to buy different coins directly through their app. Example? Chase Bank (JP Morgan) allows users to buy and sell crypto via Coinbase exchange, and with Revolut’s app, you can get yourself some Bitcoin. Other banks will likely join this trend soon.

With proper crypto banking apps, you will likely get more flexibility, though, as you can set up plans for the algorithm to automatically convert your FIAT reserves for particular coins and access successful banking app features designed specifically for crypto users.

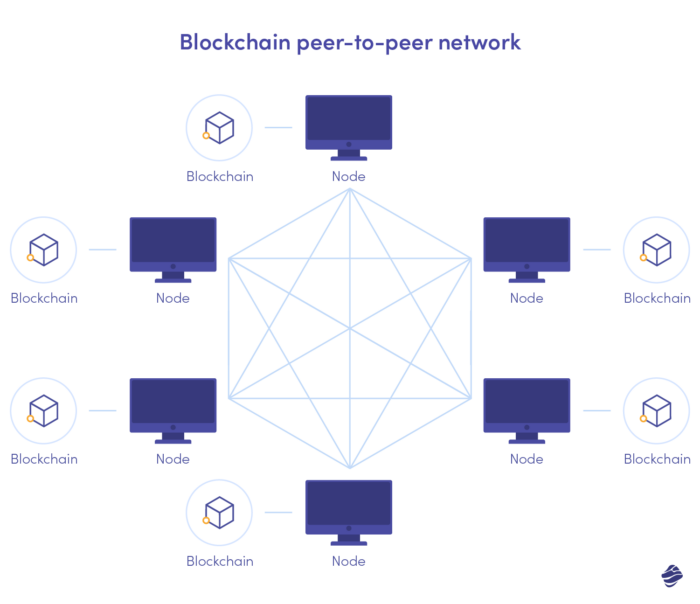

15. Secure blockchain transfers

Blockchain and cryptocurrencies are intertwined in theory and practice, but the use of blockchain technology in fintech application development can go far beyond that. Blockchain is a distributed ledger that stores information in a decentralised way. Held in immutable blocks connected with encrypted chains, the data is much more immune to security breaches and cyberattacks. There is no central entity for cybercriminals to attack – instead, they have to deal with a bunch of distributed nodes.

Result? The ledger is practically impossible to hack. Such an architecture also prevents fraud, as once written to the block, data cannot be changed or removed. No central units as intermediaries also mean that data travels faster between accounts.

Even without knowing much about the practical applications of blockchain, you probably can already think of its benefits for banks and financial institutions. As a sector that is particularly exposed to cyberattacks and for which these attacks cause the most serious implications, blockchain brings banks a promise of safer data processing. Now that the frequency of cyberattacks has increased significantly, such a solution is more needed than ever. It can also make open banking much more secure.

In Closing

Digital banking is the future of banking thanks to tech-savvy millennials and Gen Z customers. Consequently, banks and credit unions should expect to increase investment in mobile banking apps.

Basic mobile banking features like account balance and account-to-account transfer are the tip of the iceberg. The best banking apps offer innovative features driven by cutting-edge technology like AI. These include personalization, wealth management, and instant payments.

As a company with a strong fintech background, we stay on top of things when it comes to banking and keep our customers updated, too. If you are searching for a partner with expertise in this field, drop us a line.