In the fast-paced world of business, 92.1% of companies have witnessed measurable gains from AI integration, marking a significant shift in how industries operate. Particularly in the investment sector, artificial intelligence has become a robust tool for reshaping strategies and outcomes.

Whether you’re looking to refine your portfolio or enhance your firm’s approach to the market, understanding AI’s role in investment is crucial.

In this article, we’ll explore:

- Smart investing strategy planning through AI

- AI’s radar for lucrative opportunities including risk and wealth management

- Venture capital’s AI transformation

- Bridging AI with traditional tactics

- The ethical maze of AI in finance

- Success stories and the AI roadmap

P.S., In the spirit of pioneering technology, Miquido understands the transformative power of AI in investment. With our full-service software development and AI integration, we’re helping businesses and investors leverage this powerful technology to unlock new potentials and drive growth.

Understanding the Role of AI in Investment

In the race for a competitive edge, Artificial Intelligence has transformed the investment sector, transforming the methodologies of opportunity identification, risk assessment, and decision-making.

With AI algorithms’ capability to analyze vast datasets and predict market trends with unprecedented accuracy, the investment landscape is experiencing a radical shift from traditional human intelligence to a more advanced, data-driven intelligence model.

This evolution is further enhanced by the use of predictive analytics in fintech, subtly complementing the broader application of AI in various financial sectors. This integration marks a significant stride in refining investment strategies and decision-making processes.

The adoption of AI in investment isn’t just about keeping up with the emerging technology; it’s about leveraging it to gain a significant advantage. AI democratizes access to sophisticated investment tools, automating complex tasks that were traditionally costly and time-consuming.

By reducing costs and enhancing efficiency, AI allows firms and individuals to navigate market complexities with newfound agility and insight. And that is precisely why companies look for an AI development company that can help them leverage the power of AI and get ahead of the competition.

How to Use AI in Investing: Key Use Cases

Understanding how to use AI in investing spans across all investment arenas, aiding in spotting emerging trends, decoding consumer behaviors, and facilitating more informed decisions. Its presence is undeniable in various markets, including equity, commodities, and real estate, where it’s reshaping the investment process. Additionally, the integration of AI in the fintech industry is a notable example, showcasing how technology is transforming financial services and investment strategies.

Here are some key use cases where AI is making a significant impact:

Predictive Analytics in Market Trends

Machine learning models excel at analyzing market data to forecast future trends. For example, A system might train AI models using years of stock performance data to predict how stocks will behave under similar future conditions.

By leveraging historical data, current market conditions, and complex algorithms, AI helps investors anticipate market movements and make proactive decisions. This not only maximizes potential returns but also minimizes risks associated with volatile markets.

Pro Tip: Leverage AI predictive models that factor in both global economic indicators and sector-specific news for a holistic view. If you’re seeking a partner to tailor these models to your specific needs, Miquido’s machine learning services can optimize your investment strategies with precision.

Risk Management and Assessment

Investing involves risk, even for the most experienced among us. AI, particularly machine learning and pattern recognition serves as invaluable tools to manage risk. It can swiftly identify potential risks in investment portfolios and suggest strategies to mitigate them.

For instance, AI can detect anomalies that may indicate a risk of fraud or a market downturn, allowing investors to react quickly. This predictive capability enables investors to maintain a healthier risk profile while pursuing their investment goals.

Pro Tip: Regularly update your AI models with the latest market data and risk factors to ensure they reflect current market realities. Use platforms like IBM’s Watson for advanced risk analysis.

Personalized Investment Advice

Generative AI business use cases and Natural Language Processing (NLP) extend AI’s bespoke capabilities to wealth management, tailoring investment plans to individual preferences and financial goals.

For instance, robo-advisors use AI to provide personalized advice and investment strategies based on the individual’s risk tolerance and financial goals. This ensures that strategies align with clients’ wealth growth, preservation, and succession planning.

Pro Tip: Continuously fine-tune your preferences in AI-driven platforms to get more accurate, personalized advice.

Automated Trading Systems

Algorithmic trading powered by AI is a cornerstone of AI in investment decision making, executing trades at optimal prices and times by analyzing market conditions and executing transactions in milliseconds. These systems remove emotional decision-making and human error from the trading process, leading to more efficient and profitable outcomes. This would aid high-frequency trading firms using AI to make thousands of trades per second, capitalizing on minute price differences.

Pro Tip: Boost trading efficiency by integrating AI trading systems with real-time data feeds. Leverage Miquido’s fintech app development expertise for robust, AI-powered trading apps.

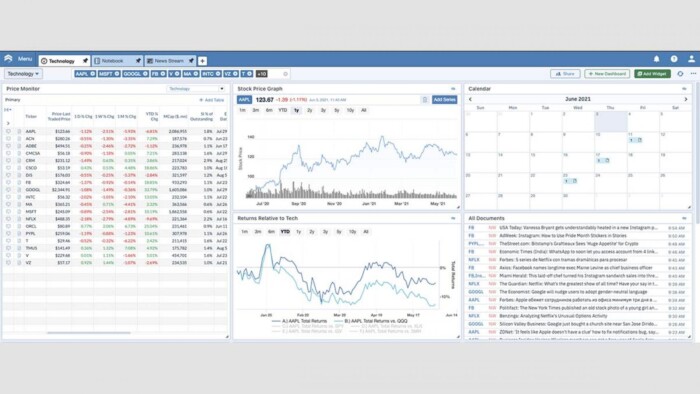

Due Diligence and Investment Research

AI accelerates the due diligence process, analyzing news articles, financial reports, and market data to give a comprehensive view of a potential investment’s health and prospects. This is especially enhanced by large language models capable of understanding and synthesizing complex documents. it’s particularly useful in sifting through large volumes of data to extract relevant insights, saving time and resources.

Pro Tip: Leverage AI-powered research tools like Sentieo or Kavout, which offer deep insights into market data and financial documents, helping investors make more informed decisions.

Wealth Management

In wealth management, AI plays a crucial role in creating sophisticated and highly customized investment portfolios. It considers various factors including risk tolerance, investment horizon, and personal values to manage and grow wealth effectively. AI-driven platforms provide wealth managers with deep insights into client profiles, enhancing the advisory process and delivering better client outcomes.

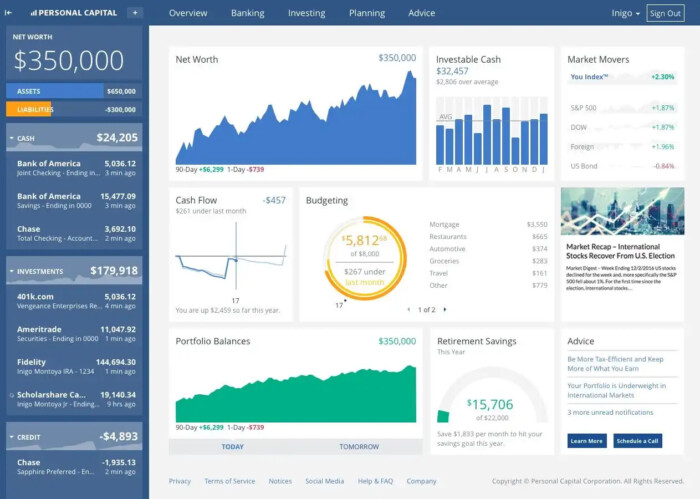

Pro Tip: Utilize AI-driven platforms like Personal Capital for a more holistic view of wealth management, integrating personal values and risk tolerance into the strategy.

How to Use AI in Investing: Enhancing Portfolio Management

In the ever-evolving world of investment, AI is proving to be a game-changer in portfolio management. By integrating AI, investors can automate and enhance the process of asset allocation, rebalancing, and responding to market dynamics. AI-driven systems analyze market trends, investor profiles, and economic indicators to optimize portfolios, ensuring they align with individual investment goals and risk tolerance.

AI algorithms can also predict asset performance with remarkable accuracy, enabling proactive adjustments. This dynamic approach contrasts with traditional, static strategies, ensuring portfolios are responsive to real-time market conditions.

Expert Tips:

- Leverage AI for Real-Time Portfolio Optimization: Utilize AI tools that offer continuous monitoring and rebalancing of portfolios to align with market changes and investment objectives.

- Personalize Investment Strategies: Implement AI systems that tailor asset allocation based on individual investor profiles, including risk tolerance, investment horizon, and financial goals.

- Data-Driven Decision Making: Ensure your AI tools integrate a wide range of data, including global economic trends and micro-level market data, for comprehensive investment analysis.

The Impact of AI on Venture Capital and Private Equity

AI is rapidly becoming a vital tool in financial markets, especially in the venture capital (VC) and private equity (PE) sectors, reshaping how investments are sourced, analyzed, and managed.

According to Gartner, Inc., by 2025, more than 75% of VC and early-stage investor executive reviews will be informed using artificial intelligence (AI) and data analytics.

Here is how artificial intelligence impacts these sectors:

- Streamlined Deal Sourcing: AI enhances deal sourcing by using sophisticated algorithms to evaluate a range of data points across markets. It’s the quality of insights on startup performance, market trends, and digital footprints that empower VCs and PEs to bet on the winners.

- Predictive Market Trends Analysis: With the ability to analyze historical data and current market conditions, AI’s predictive prowess offers foresight into market trends and investment outcomes, a game-changer for portfolio strategy.

- Real-Time Performance Monitoring: Post-investment, AI aids in monitoring and managing portfolios with real-time analytics and predictive insights. It’s about staying ahead of potential issues and optimizing opportunities for growth or divestment.

- Operational Efficiency and Growth: AI isn’t just a strategic advisor; it’s also an operational powerhouse. Automating routine tasks and providing deeper strategic insights, AI enables firms to focus on strategic growth and value creation, enhancing overall operational efficiency.

Top Companies Transforming Investments With AI

AI in investment banking is changing the way financial markets operate, from automating complex trading algorithms to enhancing risk management and customer service.

Here’s how prominent firms are leveraging to gain a competitive edge, drive innovation, and redefine the future of investment:

1. JPMorgan Chase & Co. (JPM)

As an investment management titan, JPMorgan Chase is not only leading the charge in investment strategy but also in AI in investment banking with its “IndexGPT” platform. Filed for trademark in May 2023, IndexGPT represents a significant leap in AI-driven investment management, resembling the popular large language models but specifically engineered for investment selection.

Trained on 100 trillion words’ worth of investment themes, stock prices, earnings reports, and analyst ratings, it’s designed to construct personalized investment portfolios, showcasing JPMorgan Chase’s commitment to innovation and customized client solutions in the AI-enhanced financial world.

2. Kavout

Kavout leverages machine learning and quantitative analysis to decipher vast sets of unstructured data, identifying real-time financial market patterns. Its notable offering, the K Score, is an AI-powered stock ranker that processes extensive data from sources like SEC filings and price patterns to assign a numerical rank to stocks, indicating their market performance potential.

3. Vanguard Group

Vanguard‘s CEO, Mortimer J. “Tim” Buckley, recognizes AI as a transformative force in asset and investment company management. At the Investment Company Institute Leadership Summit, Buckley highlighted the potential of generative AI to automate routine cognitive tasks. Vanguard is already implementing AI technology as a robo-advisor, utilizing the company’s ETFs to generate personalized retirement portfolios for clients.

4. Fidelity

Fidelity is reshaping its financial future with AI. With plans to significantly expand its tech team, Fidelity’s AI ventures include Saifr, an AI and machine-learning system designed to streamline compliance management—a critical advantage in the tightly regulated financial industry. Additionally, the Fidelity AMP digital advice platform, first launched in 2017, leverages AI and machine learning to analyze data and provide tailored investment recommendations.

5. Range

Catering specifically to millennials, Range combines traditional wealth management services with modern, DIY tools powered by machine learning. From investment and retirement planning to educational and estate strategies, it provides a comprehensive suite of services, all enhanced by the smart, adaptive insights of AI.

AI in Investment Banking: Revolutionizing Client Services

Investment banking is witnessing a transformation with the integration of AI in client services. AI technologies like machine learning, predictive analytics, and natural language processing are enabling banks to offer personalized, efficient, and innovative services to clients. From AI-driven chatbots providing instant customer support to predictive models offering tailored investment advice, AI is enhancing client interaction and satisfaction.

Furthermore, AI aids in analyzing client data to understand their needs better, enabling banks to offer customized solutions and advice. This personal touch, combined with the efficiency of AI, sets a new standard in client service in investment banking.

Expert Tips:

- Enhance Client Interaction: Use AI-powered chatbots and virtual assistants to provide timely and personalized client support.

- Predictive Client Analytics: Implement AI tools that analyze client data for insights, helping tailor services and advice to individual client needs.

- Continuous Improvement: Regularly update AI systems with the latest client interaction data to refine and enhance the customer service experience.

Integration of AI Tools with Traditional Investment Methods

The integration of AI tools with traditional investment methods is a major upgrade for the financial industry. This combination brings together the best of both worlds—combining the nuanced judgment of experienced investors with the analytical power of AI.

Balancing Human Insight with Machine Precision

While AI provides rapid data processing and predictive analytics, human insight remains critical for understanding market nuances and ethical considerations. Investment professionals use AI to handle data-heavy tasks, allowing them to focus on strategic decision-making and personal client interactions. This ensures a balanced approach, leveraging AI’s efficiency without losing the human touch essential to understanding market dynamics and investor behavior.

Refining Asset Allocation Models

Traditional asset allocation relies on historical data and standard deviation to gauge risk and return. AI enhances this by analyzing more variables, including real-time market data, global economic indicators, and social media trends. By processing this vast array of information, AI identifies patterns and correlations unseen by traditional models, leading to more dynamic and responsive asset allocation strategies that better reflect current market realities.

Enhancing Technical Analysis

Technical analysts study market price, volume, and sentiment indicators to forecast future market activity. AI transforms this practice by analyzing years of market data at an unprecedented scale and speed, uncovering insights and patterns beyond human capabilities. AI-driven technical analysis tools provide traders with a more nuanced understanding of market trends, leading to more informed and timely trading decisions.

Ethical and Legal Considerations of AI in Investment Decision Making

Integrating AI in investment decision-making is becoming increasingly crucial for businesses, as it brings with it a host of ethical and legal implications that are essential to consider in their investment strategies.

Transparency and Explainability

AI systems, especially those involving machine learning and deep learning, can be incredibly complex, leading to a “black box” scenario where decisions are made without clear understanding or traceability.

From an ethical standpoint, businesses need to strive for transparency in how AI tools make decisions and provide explanations for those decisions. Legally, this transparency is becoming a requirement in many jurisdictions, with regulations demanding clear explanations of algorithmic decisions, especially when they impact consumers or investors.

Data Privacy and Security

The use of AI in investment strategies often involves processing large volumes of sensitive data. Businesses must ensure that they are adhering to data protection laws, such as GDPR in Europe or various state laws in the U.S.

Ethically, firms must handle data responsibly, ensuring privacy and security to maintain trust and credibility. This includes using data ethically, securing it from breaches, and being transparent about data usage with all stakeholders.

Bias and Fairness

AI systems are only as unbiased as the data they are trained on and the designers who create them. Unintentional biases can lead to unfair outcomes or discrimination. From a business perspective, it’s essential to continuously monitor and update AI systems to ensure fairness and avoid discriminatory practices. This not only prevents legal repercussions but also maintains the firm’s reputation and trustworthiness.

Responsibility and Accountability

Determining liability for decisions made by AI can be challenging. Businesses must establish clear guidelines and accountability structures for AI-driven decisions. This includes determining who is responsible when AI makes a wrong decision or when an automated trading system malfunctions. Clear policies and robust oversight mechanisms are essential to address these accountability challenges.

Market Integrity and Stability

As AI becomes more prevalent in investment, there’s a potential impact on market integrity and stability. For instance, if many firms are using similar AI models, it could lead to market herding or amplify systemic risks. Regulators and businesses alike are concerned about these implications and are exploring ways to ensure that the use of AI supports market stability and promotes healthy competition.

As AI takes a more prominent role in investment decision-making, navigating the complex landscape of regulatory compliance becomes crucial. AI can play a pivotal role in ensuring that investment decisions are not only data-driven but also fully compliant with current regulations. From monitoring transactions for suspicious activities to ensuring adherence to international financial laws, AI is an invaluable asset in maintaining legal compliance.

AI systems can keep abreast of regulatory changes, automatically updating compliance protocols. This proactive approach ensures that investment decisions are both strategic and compliant, safeguarding firms against legal pitfalls.

Expert Tips:

- Automated Compliance Monitoring: Utilize AI for continuous monitoring of investment decisions and activities, ensuring adherence to regulatory standards. For example, a financial institution may employ an AI system that continuously scans all investment transactions. This system is designed to flag any trades or activities that deviate from established regulatory guidelines, such as unusual trading patterns or transactions that might indicate insider trading or market manipulation.

- Stay Updated on Regulatory Changes: Implement AI systems capable of adapting to new regulations and compliance requirements, ensuring your investment strategies remain legally sound. An investment firm may use an AI tool to track changes in financial regulations globally. Whenever a new regulation is enacted or an existing one is updated, the AI system automatically updates the firm’s compliance guidelines and alerts the relevant teams to review and adapt their strategies accordingly.

- Risk Management through AI: Use AI to identify potential compliance risks and vulnerabilities, enabling preemptive action to mitigate legal challenges. The AI may analyze various factors such as market volatility, company performance indicators, and geopolitical events. It then predicts potential compliance risks, like exposure to sanctions or industries with high regulatory scrutiny, allowing the company to take proactive steps to adjust its investment strategy and avoid compliance issues.

Staying Ahead in the AI-Driven Investment Landscape

As the investment world rapidly evolves with the advent of AI, businesses must adapt and incorporate AI in their strategies and operations, preparing for a future where AI is integral to financial strategies and operations (for a crash course on this, read our AI in Business 101 guide).

This shift emphasizes the need for a deep understanding of AI’s potential and its application in the dynamic landscape of investment and finance.

Here’s how companies can stay ahead in the increasingly AI-driven investment landscape:

1. Embrace Continuous Learning and Adaptation

The field of AI is constantly evolving, with new developments and technologies emerging regularly. Businesses need to foster a culture of continuous learning and stay updated with the latest AI trends, tools, and methodologies.

Encouraging teams to engage with ongoing education and training ensures that your business remains at the cutting edge of AI-driven investment, ready to utilize AI tools effectively.

Here are some ways:

- Online Learning Platforms: Utilize Coursera, Udemy, edX, and LinkedIn Learning for AI and data science courses.

- Conferences and Webinars: Attend AI-focused events like NeurIPS, ICML, and O’Reilly AI Conferences.

- In-House Training: Develop tailored training programs using resources from Pluralsight or DataCamp.

- Certification Programs: Encourage certifications from NVIDIA, IBM, or Google AI.

- Online Communities: Engage with forums like Stack Overflow and GitHub for AI discussions.

- Academic Collaborations: Partner with universities for workshops and research projects.

- Internal Knowledge Sharing: Hold regular sessions for team members to share AI insights.

- AI Journals and News: Subscribe to journals like the Journal of Artificial Intelligence Research for updates.

2. Invest in Robust AI Infrastructure and Talent

Building or enhancing your AI capabilities requires investment in both infrastructure and talent. Consider developing or partnering with AI platforms tailored to your specific business models and investment strategies. Hiring or collaborating with data scientists, AI specialists, and financial analysts who understand how to leverage AI in investment contexts can provide a significant competitive advantage.

3. Develop a Data-Driven Culture

Financial data is the lifeblood of AI. Cultivating a data-driven culture within your organization ensures that decision-making is grounded in data and analytics, maximizing the effectiveness of your AI investment strategies. Ensure that you have robust data collection, management, and analysis systems in place and that your team understands the importance of data in driving AI insights.

4. Implement Ethical AI Practices

As you integrate AI into your investment strategies, it’s crucial to consider the ethical implications of AI decision-making. This includes ensuring transparency, fairness, and accountability in AI systems and adhering to all regulatory requirements. Developing and following ethical guidelines for AI use will help maintain trust and credibility with clients and stakeholders, especially when handling artificial intelligence stocks.

5. Focus on Client-Centric Solutions

Ultimately, the goal of integrating AI into investment strategies is to provide better, more personalized services to clients. Keep your clients’ needs and experiences at the forefront of your AI initiatives, ensuring that investment objectives are met with precision and care. Regularly gather client feedback and use it to refine and improve your AI-driven services and solutions. This approach is particularly beneficial for fund managers who seek to optimize portfolios and deliver superior results.

Elevate Your Investment Game with Miquido

As we’ve navigated the twists and turns of AI in the investment landscape, you’ve gained insights that are both powerful and actionable. Remember, the journey into AI-driven investment is ongoing, and you’re now equipped with the knowledge to move forward confidently.

Key Takeaways:

- AI is transforming investment analytics and risk management.

- Personalized investment strategies are at your fingertips with AI.

- The future is bright and AI-driven for venture capital and private equity.

- Ethical considerations and continuous adaptation are key in AI integration.

In a world where staying ahead means embracing innovation, Miquido stands as your partner in navigating the AI-enhanced investment sector. With our expertise in cutting-edge technology and commitment to tailor-made solutions, we’re here to help your business tap into the full potential of AI, ensuring you’re not just keeping up but leading the way in the investment future.